- United States

- /

- Energy Services

- /

- NYSE:WHD

Reassessing Cactus (WHD) Valuation After Credit Facility Amendment and Baker Hughes Pressure Control Deal Plans

Reviewed by Simply Wall St

Cactus (NYSE:WHD) just amended its ABL credit facility, adding a $100 million delayed draw term loan tied to a potential Baker Hughes Pressure Control acquisition, a material move that reshapes both its balance sheet flexibility and growth narrative.

See our latest analysis for Cactus.

The amended facility and potential Baker Hughes Pressure Control deal arrive as Cactus posts a seven-day share price return of 8.4 percent but a year-to-date share price return of negative 22.9 percent. The five-year total shareholder return remains a strong 76.9 percent, suggesting long-term value creation even as near-term momentum is only now starting to rebuild.

If you are reassessing energy names after this move, it could also be worth exploring aerospace and defense stocks as another pocket of the market where capital investment and contract visibility can shape future returns.

With earnings still growing, a sizable intrinsic value gap and fresh firepower for acquisitions, does Cactus quietly offer upside that the market is overlooking, or are investors already pricing in the next leg of growth?

Most Popular Narrative: 5.6% Undervalued

With Cactus last closing at $45.90 versus a narrative fair value of $48.63, the valuation case leans modestly positive and hinges on specific growth and margin assumptions.

The acquisition of a majority interest in Baker Hughes' Surface Pressure Control business will significantly expand Cactus' geographic footprint and customer base into the Middle East, an area poised for long term energy infrastructure investment and supply security, this is likely to drive sustained revenue growth and higher earnings resiliency.

Want to see what powers that confidence in future revenue and earnings? The narrative quietly leans on ambitious growth, margin durability and a richer future earnings multiple.

Result: Fair Value of $48.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in U.S. land activity and integration challenges around Baker Hughes Surface Pressure Control could derail both the growth ramp and the margin story.

Find out about the key risks to this Cactus narrative.

Another Angle on Value

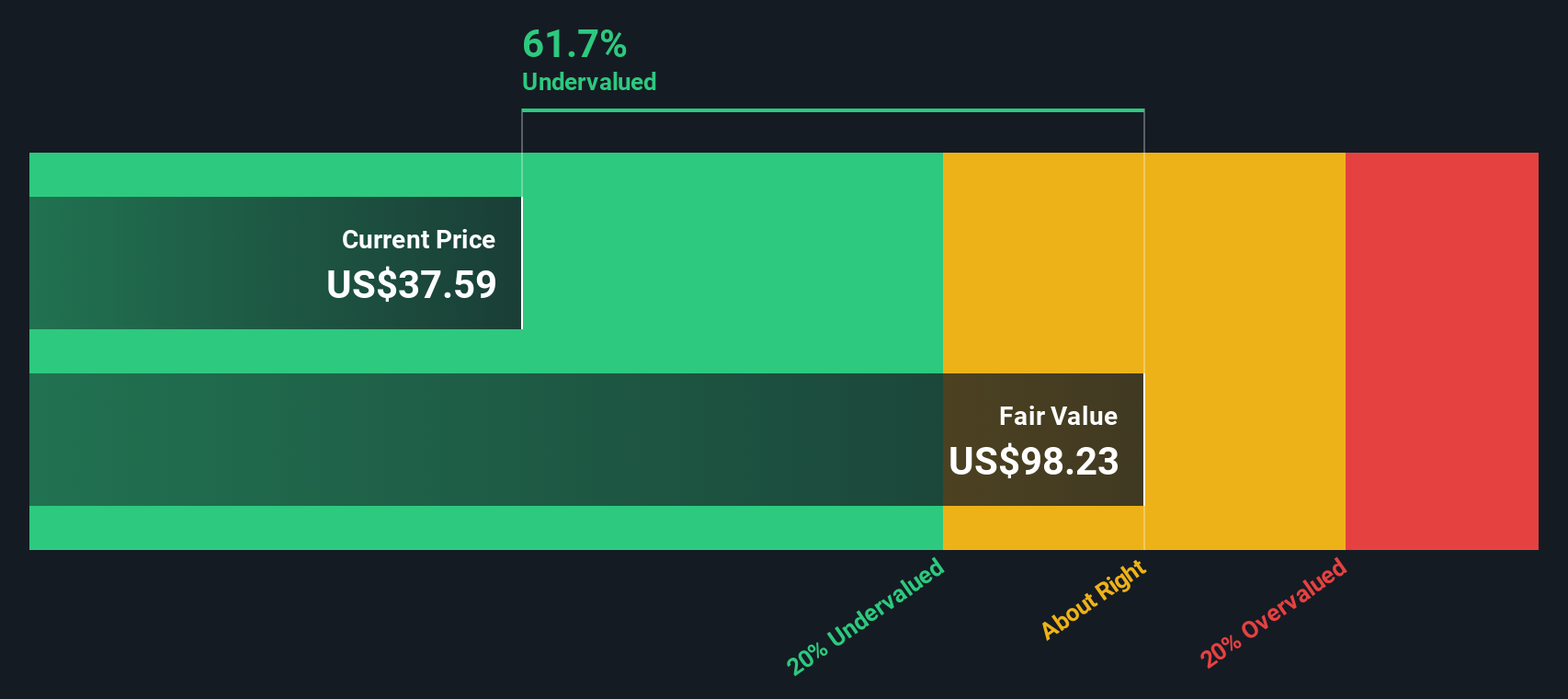

While the narrative fair value suggests only a modest 5.6 percent upside, our DCF model paints a much bolder picture. It puts fair value closer to $80.26 per share and implies that Cactus trades at roughly a 43 percent discount. Is the market underestimating cash flows or overestimating execution risk?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Cactus Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in under three minutes: Do it your way.

A great starting point for your Cactus research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you can explore your next potential opportunity by using the Simply Wall St Screener to spot trends and potentially mispriced assets across the market.

- Target early stage companies with robust balance sheets using these 3571 penny stocks with strong financials.

- Explore companies involved in automation and data by scanning these 25 AI penny stocks.

- Filter for companies trading below intrinsic value through these 920 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WHD

Cactus

Designs, manufactures, sells, and rents engineered pressure control and spoolable pipe technologies in the United States, Australia, Canada, the Middle East, and internationally.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026