- United States

- /

- Oil and Gas

- /

- NYSE:VLO

Valero Energy's (VLO) Dividend Declaration Might Change The Case For Investing In VLO

Reviewed by Simply Wall St

- On July 17, 2025, Valero Energy's Board of Directors declared a quarterly cash dividend of US$1.13 per share, payable on September 2, 2025 to shareholders of record at the close of business on July 31, 2025.

- This regular dividend affirmation highlights Valero's ongoing commitment to stable shareholder returns even as analysts upgrade their earnings outlook and see its valuation as attractive among peers.

- With this continued dividend stability, we'll explore how renewed earnings optimism is shaping Valero's investment narrative.

Valero Energy Investment Narrative Recap

To be a Valero Energy shareholder today, you need to believe in the company's ability to deliver consistent returns through market cycles while effectively managing cost and regulatory pressures, especially in renewables. The latest dividend confirmation upholds Valero’s record for shareholder payouts but does not materially alter the key short-term catalyst, upcoming Q2 2025 earnings, nor the main risk, which remains regulatory and impairment uncertainty tied to its West Coast exposure.

Among recent company news, Valero's ongoing share buybacks, including nearly 1.9 million shares repurchased for US$242.46 million through March 2025, stand out. This complements its commitment to distributions and adds a layer of support to earnings metrics as the market awaits Q2 results, while also intersecting with catalysts such as expectations for improved refining margins and long-term balance sheet strength.

However, investors should keep in mind that despite dividend consistency, regulatory challenges on the West Coast could still represent ...

Read the full narrative on Valero Energy (it's free!)

Valero Energy is projected to generate $120.0 billion in revenue and $3.7 billion in earnings by 2028. This outlook assumes a 0.6% annual revenue decline and a $2.8 billion earnings increase from current earnings of $924.0 million.

Uncover how Valero Energy's forecasts yield a $154.47 fair value, a 5% upside to its current price.

Exploring Other Perspectives

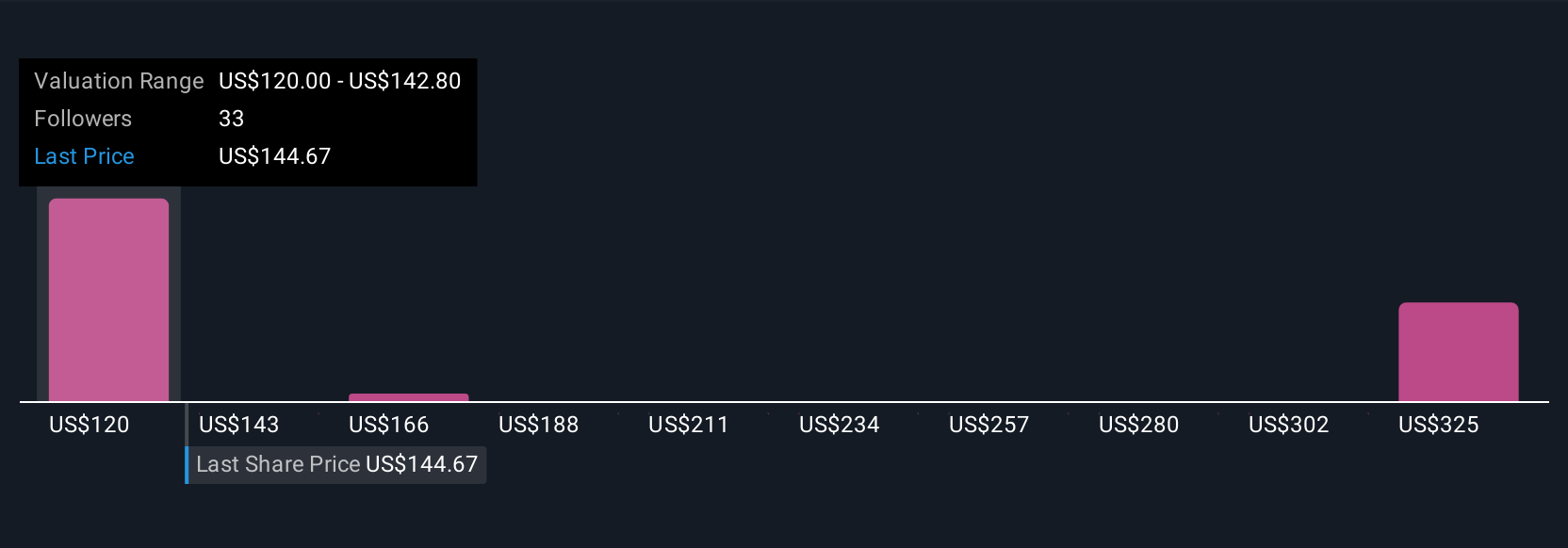

Five community members on Simply Wall St estimated Valero's fair value with targets spanning US$115.01 to US$349.12 per share. While optimism around near-term earnings growth is prevalent, your view on regulatory risks may shape your own outlook, encouraging you to consider multiple viewpoints.

Build Your Own Valero Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valero Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Valero Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valero Energy's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 25 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLO

Valero Energy

Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives