- United States

- /

- Oil and Gas

- /

- NYSE:VLO

Valero Energy (VLO): Reassessing Valuation After a Sharp Pullback Following a Multi‑Year Run

Reviewed by Simply Wall St

Valero Energy (VLO) has quietly given back some gains over the past month, even though its longer term track record and solid profitability trends still stand out compared with many refining peers.

See our latest analysis for Valero Energy.

That recent pullback, including a 1 month share price return of minus 10.42 percent and a 7 day share price return of minus 7.13 percent to about 162.82 dollars, comes after a strong run, with a year to date share price return above 30 percent and a 5 year total shareholder return above 250 percent. This suggests near term momentum is cooling even as the longer term story remains intact.

If Valero’s swingy moves have you rethinking concentration in a single name, this could be a good moment to explore fast growing stocks with high insider ownership as potential fresh ideas.

With shares trading below analyst targets and a sizable estimated intrinsic discount, yet following a substantial multiyear run, investors face a dilemma: is Valero undervalued today, or is the market already factoring in future growth?

Most Popular Narrative: 12.4% Undervalued

Compared with the last close at 162.82 dollars, the most followed narrative points to a fair value near 185.78 dollars, framing Valero as modestly mispriced.

The analysts have a consensus price target of $158.333 for Valero Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $181.0, and the most bearish reporting a price target of just $133.0.

Want to see how flat revenues, rising margins, and shrinking share count still add up to a higher value than today’s price? The narrative spells it out.

Result: Fair Value of $185.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside view could quickly change if West Coast asset impairments mount or regulatory shifts further squeeze margins in the renewable diesel segment.

Find out about the key risks to this Valero Energy narrative.

Another Angle On Valuation

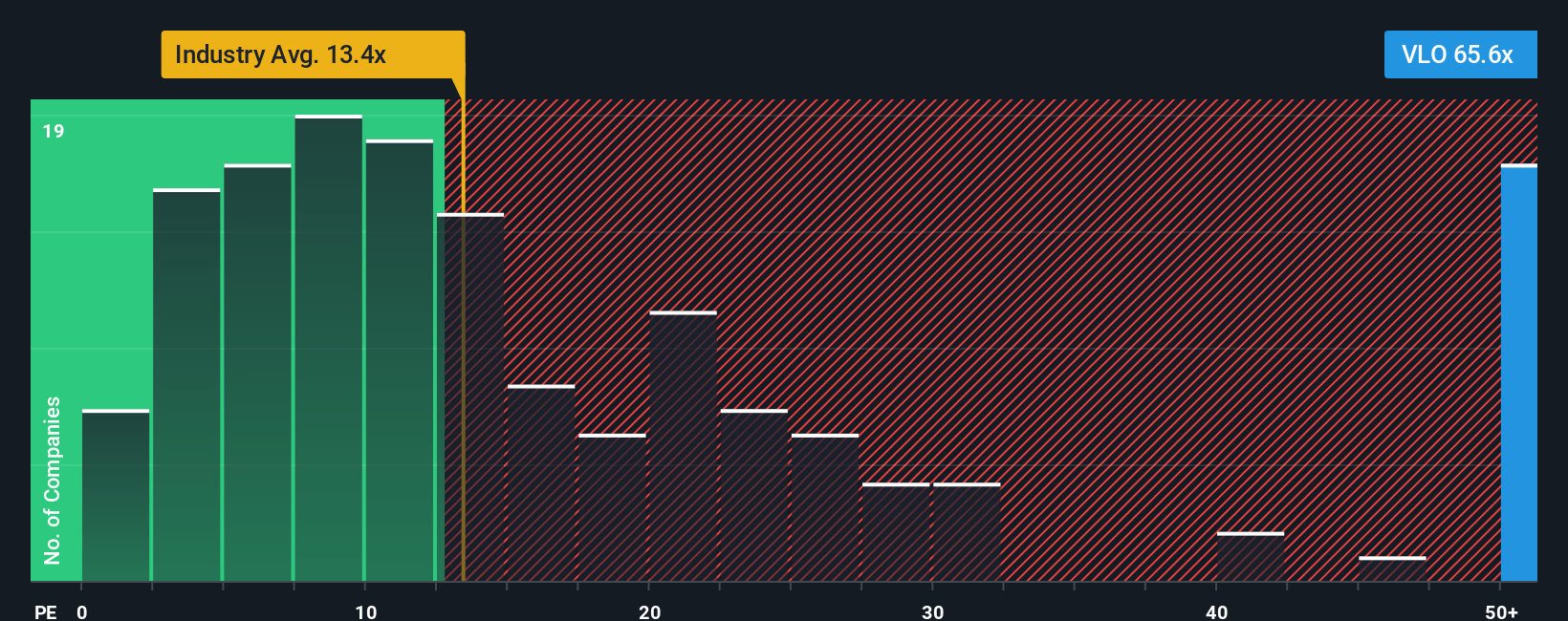

On traditional price to earnings, Valero looks anything but cheap, trading at about 33.3 times earnings versus 13.2 times for the US Oil and Gas industry and 25.2 times peers, and even above its 23.2 times fair ratio. Is the market overpaying for near term earnings power?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Valero Energy Narrative

If you see Valero differently or simply want to dig into the numbers yourself, you can build a personal narrative in minutes: Do it your way.

A great starting point for your Valero Energy research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop with a single refinery story when you can scan the whole market for fresh opportunities tailored to your strategy and risk appetite.

- Capture potential mispricing by targeting companies trading below intrinsic value with these 915 undervalued stocks based on cash flows, where solid cash flows meet skeptical market sentiment.

- Capitalize on the next wave of innovation by zeroing in on these 25 AI penny stocks that could benefit most as artificial intelligence reshapes entire industries.

- Lock in income opportunities by reviewing these 13 dividend stocks with yields > 3% that combine robust yields with financial profiles built to support reliable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLO

Valero Energy

Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)