- United States

- /

- Oil and Gas

- /

- NYSE:VLO

Valero Energy (VLO): Evaluating Valuation After Strong 3-Month Share Price Performance

Reviewed by Kshitija Bhandaru

See our latest analysis for Valero Energy.

While Valero Energy’s share price dipped fractionally in the past week, it has maintained strong momentum, reflecting renewed optimism about future earnings and sector demand. Over the past year, the company’s total shareholder return has outpaced many peers, underscoring both its resilience and growth potential in a shifting energy landscape.

If Valero’s run has inspired confidence, now is a smart time to broaden your search and discover fast growing stocks with high insider ownership

But with Valero trading near its all-time highs, investors are left to wonder if the recent surge leaves room for further upside or if the market has already accounted for all of the company’s growth prospects.

Most Popular Narrative: 4.7% Undervalued

Valero Energy’s most widely followed narrative sees a fair value of $169 per share, which is slightly above its last close at $160.98. This view positions the stock as modestly undervalued, with valuation supported by upbeat future earnings forecasts and operating improvements just ahead.

The SEC unit optimization project at St. Charles, expected to start up in 2026, is projected to increase the yield of high-value products, potentially boosting future revenues and earnings. Anticipated tight product supply and demand balances, with low product inventories, are expected to support refining fundamentals during the driving season, possibly enhancing refining margins and revenues.

Want to know the backbone of this valuation? The story rests on projected profit margins and a future earnings multiple higher than today’s sector average. Bold calls are hiding in the numbers. But which metric truly drives the upside? Find out what’s fueling analyst conviction in the full narrative.

Result: Fair Value of $169 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unforeseen regulatory changes or operational setbacks in Valero’s renewable segment could quickly challenge the current optimism about its future growth trajectory.

Find out about the key risks to this Valero Energy narrative.

Another View: What Does the SWS DCF Model Say?

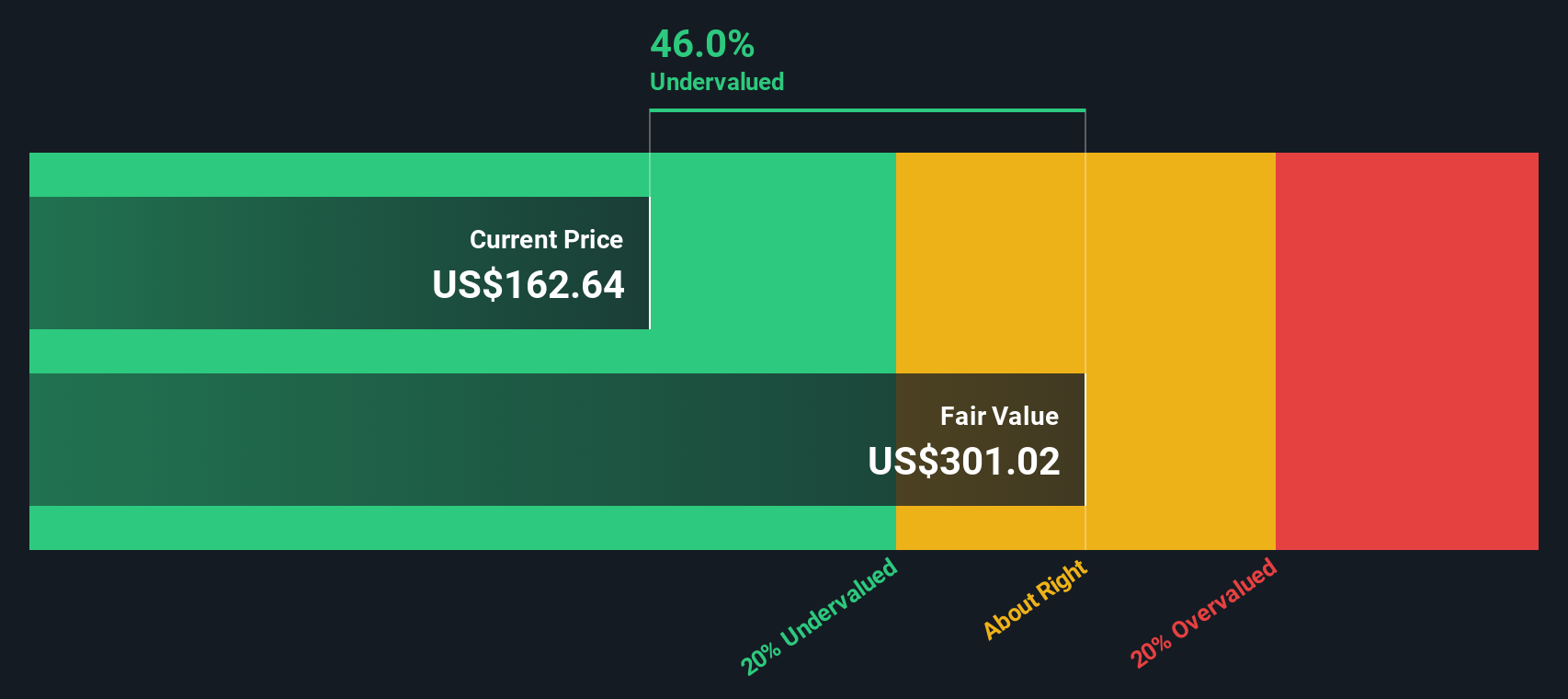

While analyst price targets suggest Valero is fairly valued, our DCF model presents a strikingly different picture. It values the company at $275.10 per share, meaning Valero could be trading at a steep discount of over 40%. Could the market be missing the true long-term potential here, or are the risks being underestimated?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Valero Energy Narrative

If you see things differently or want to run your own numbers, it takes just a few minutes to craft your personal thesis and perspective. Do it your way

A great starting point for your Valero Energy research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunities pass you by. There are standout stocks across the market waiting for the right investor. Use these handpicked ideas as your springboard to something bigger.

- Unlock untapped potential when you check out these 877 undervalued stocks based on cash flows offering substantial value hidden in plain sight.

- Position yourself ahead of breakthroughs by following these 33 healthcare AI stocks revolutionizing patient care with the latest in medical technology.

- Pounce on high-yield returns by exploring these 18 dividend stocks with yields > 3% delivering strong income alongside capital growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLO

Valero Energy

Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives