- United States

- /

- Energy Services

- /

- NYSE:USAC

What USA Compression Partners (USAC)'s $750 Million Debt Refinancing Means for Shareholders

Reviewed by Sasha Jovanovic

- On September 24, 2025, USA Compression Partners, LP and its subsidiary completed a US$750 million senior notes offering, issuing new 6.250% senior unsecured notes due 2033 with proceeds used to redeem existing 6.875% senior notes due 2027 and manage borrowings under its credit agreement.

- This refinancing event lowers interest costs and signals a shift toward optimizing the company’s capital structure and financial flexibility as USA Compression manages long-term obligations in a changing midstream market.

- We'll explore how this debt refinancing, which reduces future interest expenses, influences USA Compression’s investment narrative and operational outlook.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

USA Compression Partners Investment Narrative Recap

Owning USA Compression Partners often comes down to a belief in the durability of natural gas infrastructure demand and the company’s ability to manage debt while supporting distributions. The recent US$750 million refinancing lowers near-term interest costs but does not meaningfully impact the key short-term catalyst: high contract renewal rates and utilization driven by robust natural gas demand. However, the company’s biggest risk, high leverage and limited financial flexibility due to a distribution-focused policy, remains largely unchanged after this event.

Among recent developments, the extension of the credit facility to August 2030 stands out as most relevant. This amendment, alongside the new senior notes, gives USA Compression more runway to manage its long-term obligations and maintain operational stability, directly tying into the need for financial headroom as they pursue large customer contracts and respond to sector shifts.

By contrast, investors should keep in mind the heightened risks associated with high debt levels and dividend obligations if cash flows ever come under pressure...

Read the full narrative on USA Compression Partners (it's free!)

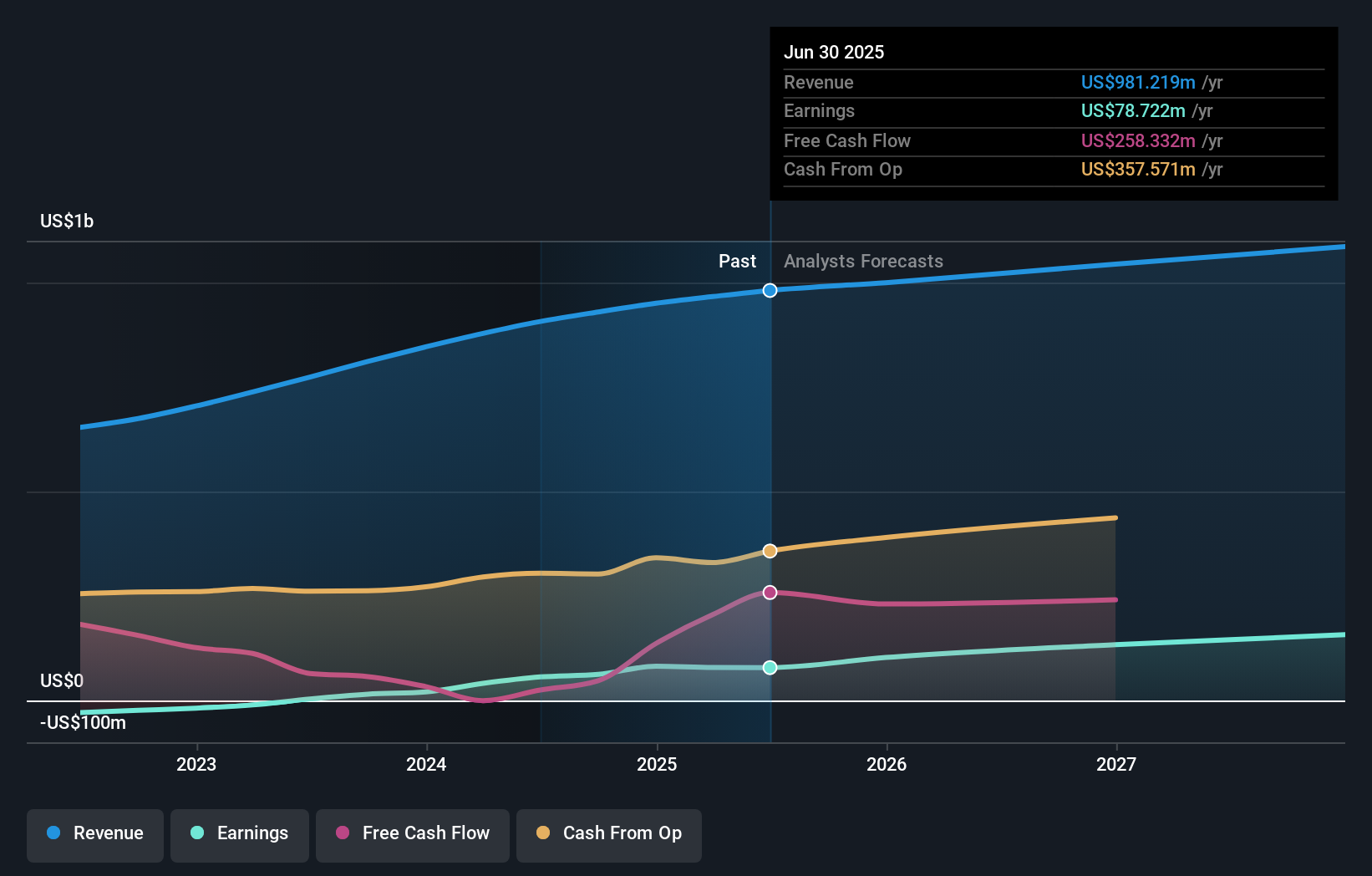

USA Compression Partners' forecast sees revenue reaching $1.1 billion and earnings hitting $185.2 million by 2028. This outlook relies on a 4.2% annual revenue growth rate and a $106.5 million increase in earnings from the current $78.7 million level.

Uncover how USA Compression Partners' forecasts yield a $26.50 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair values for USA Compression between US$15.01 and US$26.50 across 3 analyses before the recent refinancing. Given that high leverage still underscores much of the outlook, you will find a wide range of expectations on future performance.

Explore 3 other fair value estimates on USA Compression Partners - why the stock might be worth 37% less than the current price!

Build Your Own USA Compression Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your USA Compression Partners research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free USA Compression Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate USA Compression Partners' overall financial health at a glance.

No Opportunity In USA Compression Partners?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USAC

USA Compression Partners

Provides natural gas compression services in the United States.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives