- United States

- /

- Oil and Gas

- /

- NYSE:TXO

3 Top Undervalued Small Caps With Insider Action In US Markets

Reviewed by Simply Wall St

The United States market has experienced a robust performance, climbing 3.0% in the last seven days and rising 25% over the past year, with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying stocks that are perceived as undervalued with notable insider activity can offer intriguing opportunities for investors seeking potential growth.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Array Technologies | NA | 1.1x | 49.68% | ★★★★★☆ |

| OptimizeRx | NA | 1.1x | 44.43% | ★★★★★☆ |

| Quanex Building Products | 33.3x | 0.9x | 38.18% | ★★★★☆☆ |

| First United | 13.0x | 2.9x | 47.07% | ★★★★☆☆ |

| Franklin Financial Services | 10.4x | 2.1x | 33.55% | ★★★★☆☆ |

| McEwen Mining | 4.2x | 2.2x | 44.55% | ★★★★☆☆ |

| Innovex International | 9.2x | 2.1x | 47.38% | ★★★★☆☆ |

| ProPetro Holding | NA | 0.7x | 12.63% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -76.88% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -72.20% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

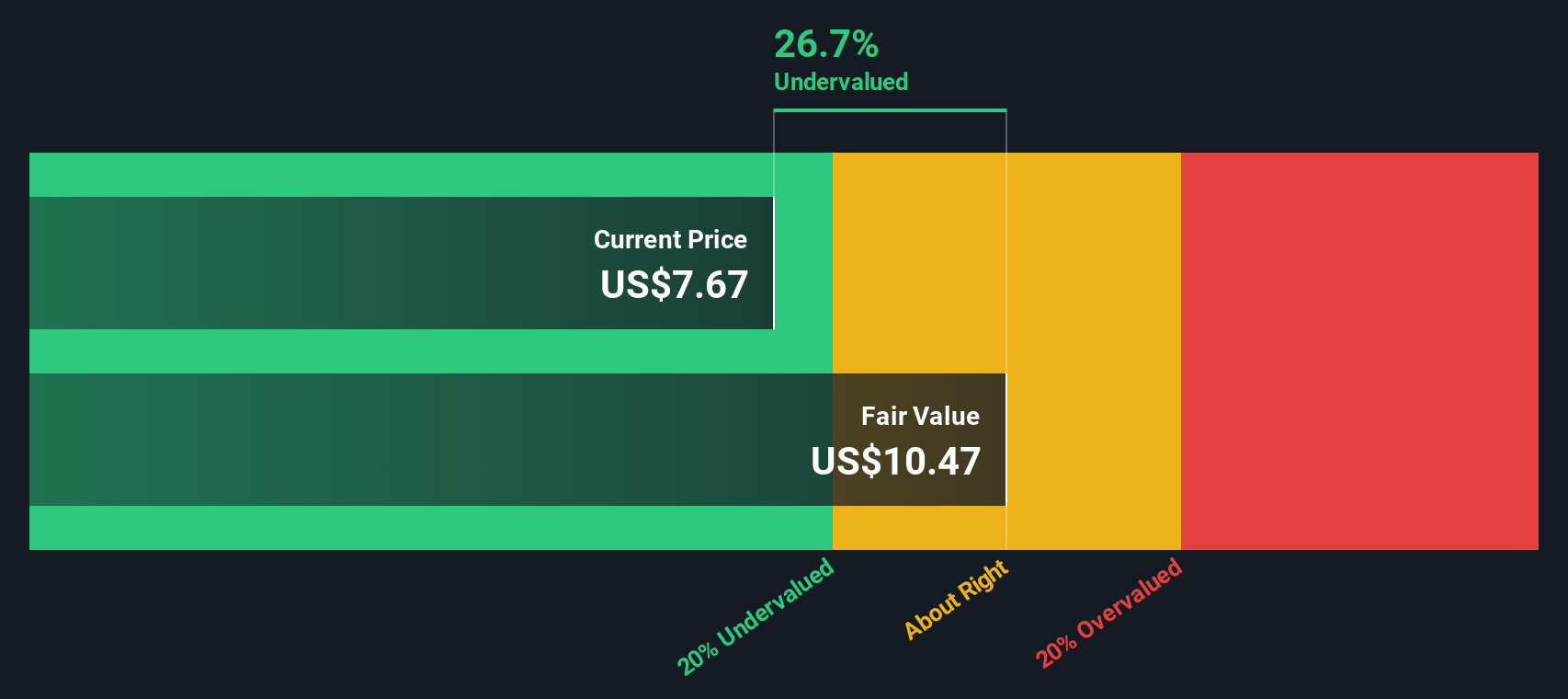

Array Technologies (NasdaqGM:ARRY)

Simply Wall St Value Rating: ★★★★★☆

Overview: Array Technologies specializes in manufacturing solar tracking systems and solutions, with a market capitalization of approximately $2.35 billion.

Operations: Array Technologies generates revenue primarily from Array Legacy Operations and STI Operations. The company's gross profit margin has shown variability, reaching up to 30.50% in recent periods.

PE: -7.1x

Array Technologies, a smaller company in the renewable energy sector, has seen significant changes recently. New leadership with Darin Green as chief revenue officer and H. Keith Jennings as CFO aims to drive growth and strategic financial management. Despite reporting a net loss of US$141 million for Q3 2024, insider confidence is evident through share purchases over recent months. Revenue guidance for 2024 is set between US$900 million and US$920 million, highlighting challenges but also potential opportunities in the market.

- Click here to discover the nuances of Array Technologies with our detailed analytical valuation report.

Explore historical data to track Array Technologies' performance over time in our Past section.

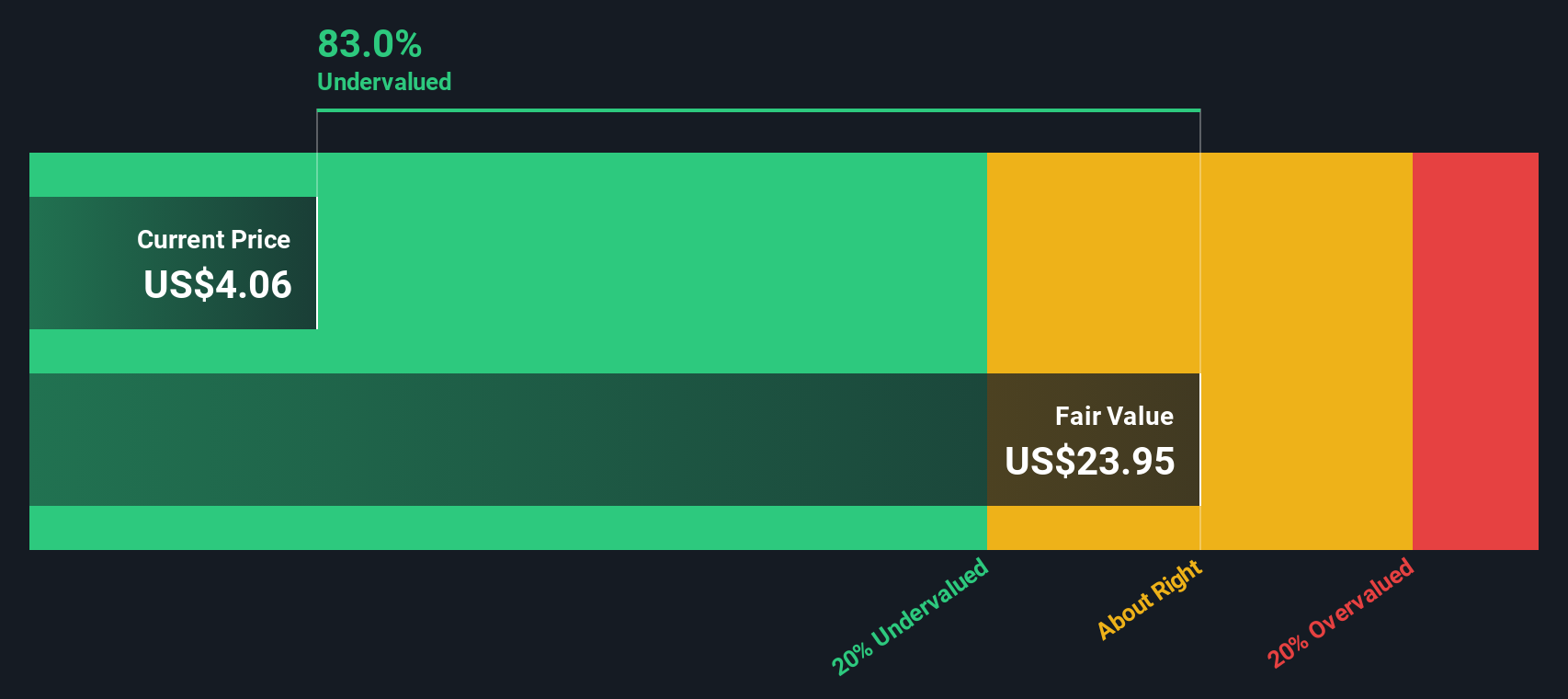

Borr Drilling (NYSE:BORR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Borr Drilling is an offshore drilling contractor that provides services to the oil and gas industry, with a market cap of approximately $1.06 billion.

Operations: Borr Drilling generates revenue primarily from dayrates, with recent figures reaching $968.1 million. The company has experienced a notable improvement in its gross profit margin, increasing to 55.56% by the end of September 2024. Operating expenses and non-operating expenses have been significant cost components, with general and administrative expenses recorded at $58.5 million for the same period.

PE: 9.9x

Borr Drilling, a player in the offshore drilling industry, has been navigating challenges and opportunities. Recent earnings showed a jump to US$9.7 million from US$0.3 million year-over-year for Q3 2024, reflecting improved financial performance with revenues reaching US$241.6 million. Insider confidence is evident as they recently increased their holdings, suggesting belief in future prospects despite operational halts in Mexico until March 2025 and a delisting from Oslo Stock Exchange by year-end 2024. A new contract in West Africa adds US$58 million to its backlog, providing potential revenue growth amid funding risks due to reliance on external borrowing without customer deposits.

- Delve into the full analysis valuation report here for a deeper understanding of Borr Drilling.

Examine Borr Drilling's past performance report to understand how it has performed in the past.

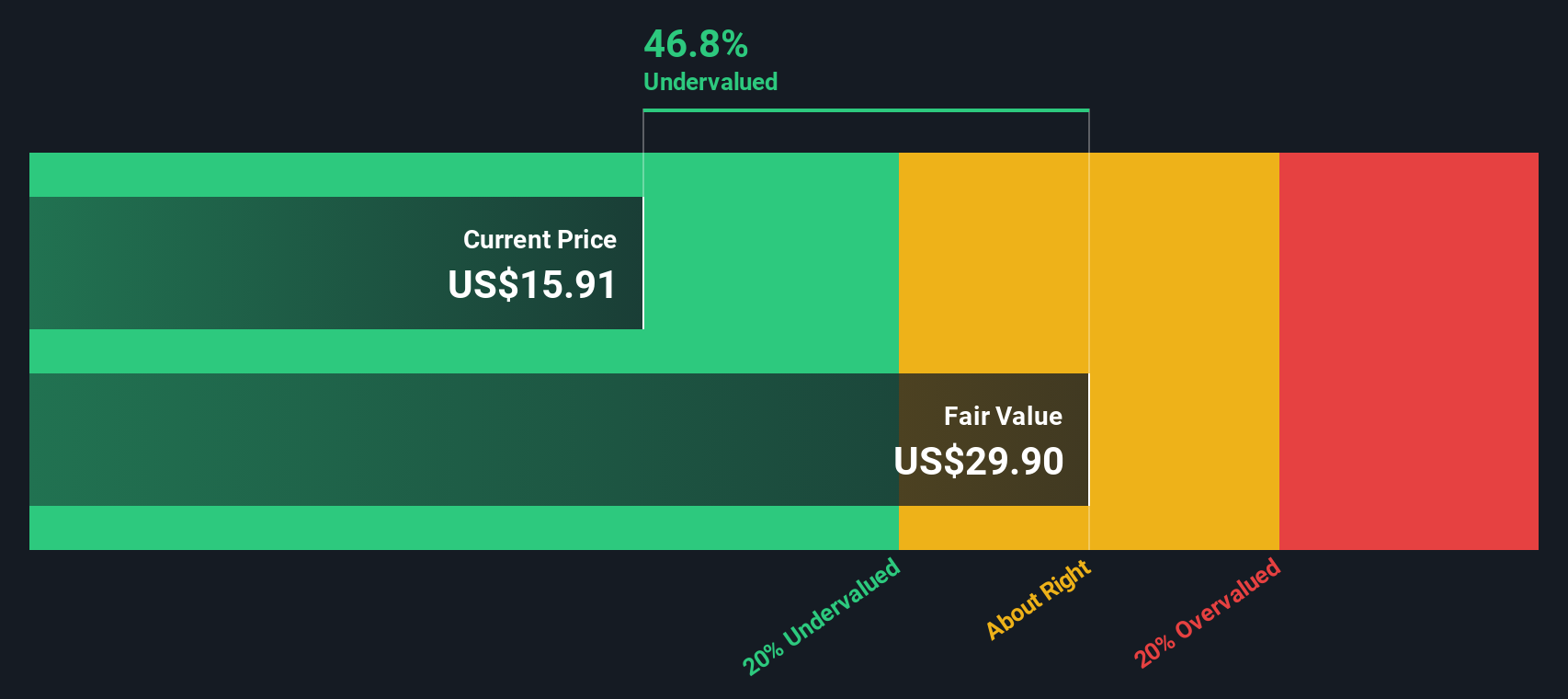

TXO Partners (NYSE:TXO)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: TXO Partners is engaged in the exploration and production of oil, natural gas, and natural gas liquids with a market cap of $1.25 billion.

Operations: The company's revenue primarily comes from the exploration and production of oil, natural gas, and natural gas liquids. Over recent periods, the gross profit margin has fluctuated, with a notable decrease to 49.78% as of September 2024. Operating expenses have consistently been a significant portion of costs, impacting net income results across various quarters.

PE: -4.4x

TXO Partners, a smaller company in the U.S. market, has shown insider confidence with Executive Vice President and Director Keith Hutton purchasing 878,000 shares valued at US$17.56 million over the past year, indicating a 28% increase in their holdings. Despite recent challenges with declining revenue and net income for Q3 and nine months ending September 2024 compared to previous periods, TXO's leadership changes might signal strategic shifts. The company declared a quarterly distribution of US$0.58 per unit for Q3 2024 amid these developments.

- Unlock comprehensive insights into our analysis of TXO Partners stock in this valuation report.

Evaluate TXO Partners' historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Embark on your investment journey to our 45 Undervalued US Small Caps With Insider Buying selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TXO Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TXO

TXO Partners

An oil and natural gas company, focuses on the acquisition, development, optimization, and exploitation of conventional oil, natural gas, and natural gas liquid reserves in North America.

Fair value with moderate growth potential.