- United States

- /

- Semiconductors

- /

- NasdaqGS:HIMX

Himax Technologies And 2 Other Undiscovered Gems In The United States

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it boasts a remarkable 25% increase over the past year with earnings projected to grow by 15% annually in the coming years. In such a dynamic environment, identifying stocks with strong growth potential and solid fundamentals can lead investors to uncover hidden opportunities like Himax Technologies and other lesser-known companies that may offer significant value.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Eagle Financial Services | 170.75% | 12.30% | 1.92% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Franklin Financial Services | 173.21% | 5.55% | -1.86% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.11% | -35.88% | ★★★★★☆ |

| FRMO | 0.08% | 38.78% | 45.85% | ★★★★★☆ |

| Pure Cycle | 5.15% | -2.61% | -6.23% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Himax Technologies (NasdaqGS:HIMX)

Simply Wall St Value Rating: ★★★★★☆

Overview: Himax Technologies, Inc. is a fabless semiconductor company specializing in display imaging processing technologies across various regions, including China, Taiwan, the Philippines, Korea, Japan, Europe, and the United States; it has a market cap of $1.26 billion.

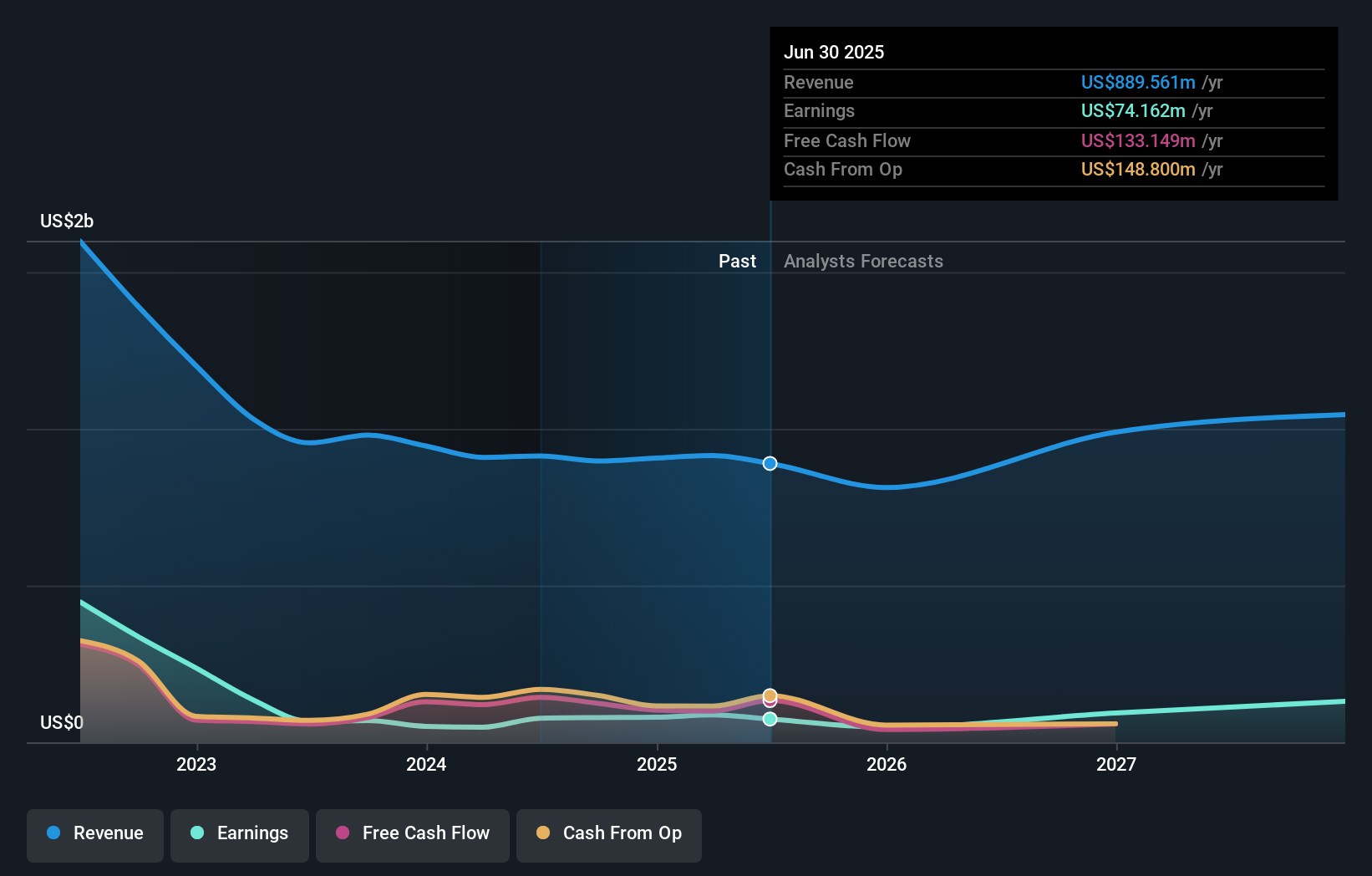

Operations: Himax generates revenue primarily from the sale of display imaging processing technologies. The company's net profit margin has shown variability, reflecting changes in cost structures and market conditions.

Himax Technologies, a fabless semiconductor firm, is making waves in the display imaging processing sector with its innovative automotive and OLED technologies. Despite a volatile share price recently, Himax's earnings grew 13.7% last year—surpassing the semiconductor industry's -3.4%. The company's net debt to equity ratio stands at a satisfactory 38.2%, while its P/E ratio of 18.3x is competitive against the US market average of 18.7x. With strategic collaborations and advancements like WiseEye AI technology, Himax seems poised for growth, though it faces challenges from macroeconomic pressures and industry competition.

MetroCity Bankshares (NasdaqGS:MCBS)

Simply Wall St Value Rating: ★★★★★★

Overview: MetroCity Bankshares, Inc. is a bank holding company for Metro City Bank, offering a range of banking products and services in the United States, with a market capitalization of approximately $791.37 million.

Operations: MetroCity Bankshares generates revenue primarily through its community banking segment, which amounts to $135.57 million.

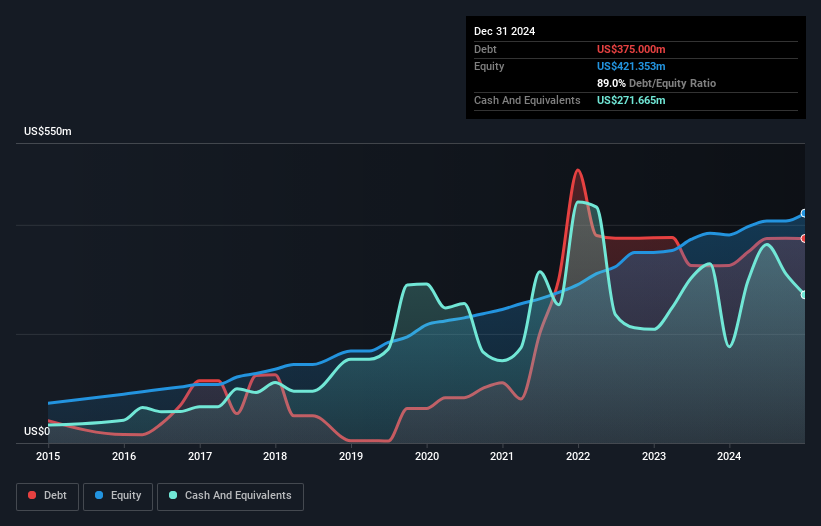

MetroCity Bankshares, a financial entity with total assets of US$3.6 billion and equity of US$407.2 million, shows promise in the banking sector. With earnings growth at 18.2%, it outpaces the industry average significantly. The bank's funding structure is robust, relying primarily on customer deposits which account for 86% of its liabilities, reducing risk compared to external borrowing. Total loans stand at US$3.1 billion against deposits of US$2.7 billion, while maintaining a net interest margin of 3.1%. Additionally, MetroCity has set aside an adequate allowance for bad loans at 0.5% of total loans, indicating prudent management practices amidst recent insider selling activities and dividend declarations offering US$0.23 per share payable in February 2025.

Teekay (NYSE:TK)

Simply Wall St Value Rating: ★★★★★★

Overview: Teekay Corporation Ltd. is involved in crude oil and marine transportation services globally, with a market capitalization of $679.62 million.

Operations: Teekay generates revenue primarily from its Teekay Tankers segment, which contributes $1.19 billion, and its Marine Services segment under Teekay Parent, which adds $111.50 million.

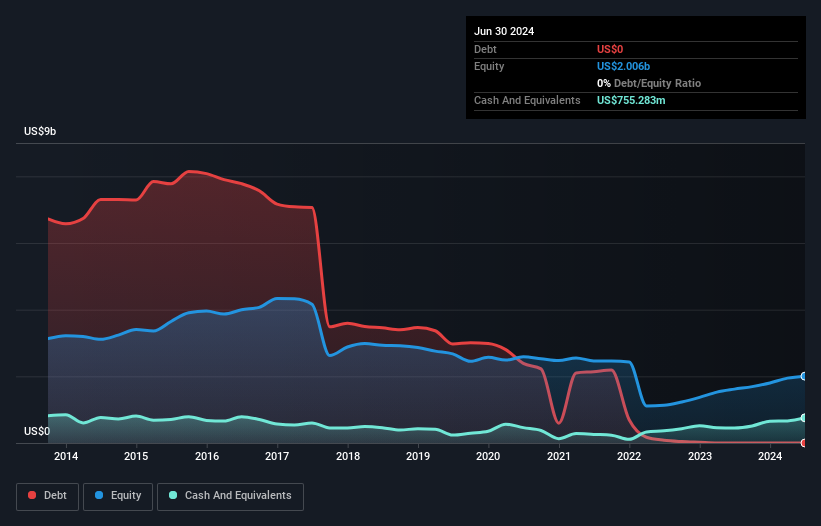

Teekay, a player in the oil and gas sector, is currently trading at a significant discount of 91.8% below its estimated fair value. Despite experiencing negative earnings growth of 6.8% over the past year, it outperformed the industry average decline of 14.6%. The company has managed to eliminate its debt entirely from five years ago when it had a debt-to-equity ratio of 122.8%, showcasing financial discipline and stability. Recent strategic board changes aim to streamline operations, while share repurchases totaling $25 million highlight confidence in its future prospects amidst ongoing market challenges.

- Take a closer look at Teekay's potential here in our health report.

Explore historical data to track Teekay's performance over time in our Past section.

Where To Now?

- Reveal the 249 hidden gems among our US Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Himax Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HIMX

Himax Technologies

A fabless semiconductor company, provides display imaging processing technologies in China, Taiwan, the Philippines, Korea, Japan, Europe, and the United States.

Solid track record with excellent balance sheet.