- United States

- /

- Oil and Gas

- /

- NYSE:SUN

What Sunoco (SUN)'s Credit Agreement Amendments and Debt Exchange Mean for Shareholders

Reviewed by Sasha Jovanovic

- On October 3, 2025, Sunoco LP amended its primary credit agreement and launched private exchange offers to eligible holders of Parkland Corporation's Canadian and U.S. dollar notes, issuing new Sunoco notes with substantially identical terms while seeking consents to eliminate most restrictive covenants from the original indentures.

- This coordinated move aims to optimize Sunoco's capital structure and enhance financial flexibility by aligning subsidiary guarantees and updating key debt terms impacting both the company and noteholders.

- We'll examine how Sunoco's debt exchange and covenant changes could affect its investment narrative and capital allocation outlook.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Sunoco Investment Narrative Recap

To be a Sunoco shareholder today, you have to believe in the company's ability to capture value through scale in a fragmented fuel distribution market, while managing near-term integration and leverage risks from ongoing acquisitions like Parkland. The recent amendment to Sunoco’s credit agreement and note exchange appears unlikely to materially shift the most important short-term catalyst, successful integration of new assets, or meaningfully impact the largest current risk, which remains elevated leverage and integration complexity.

The Parkland acquisition announcement on September 4, 2025, stands out as especially relevant given its direct ties to the recent note exchange and credit adjustments. The success of this acquisition, and Sunoco’s ability to realize expected accretion while managing rising debt, is closely intertwined with the changes the company just made to its capital structure and debt covenants.

By contrast, investors should also be aware that a delayed integration of Parkland or a failure to achieve planned cost synergies could...

Read the full narrative on Sunoco (it's free!)

Sunoco's outlook anticipates $26.7 billion in revenue and $1.6 billion in earnings by 2028. This scenario is based on a projected 7.4% annual revenue growth and an earnings increase of $1.3 billion from the current $279 million.

Uncover how Sunoco's forecasts yield a $64.71 fair value, a 29% upside to its current price.

Exploring Other Perspectives

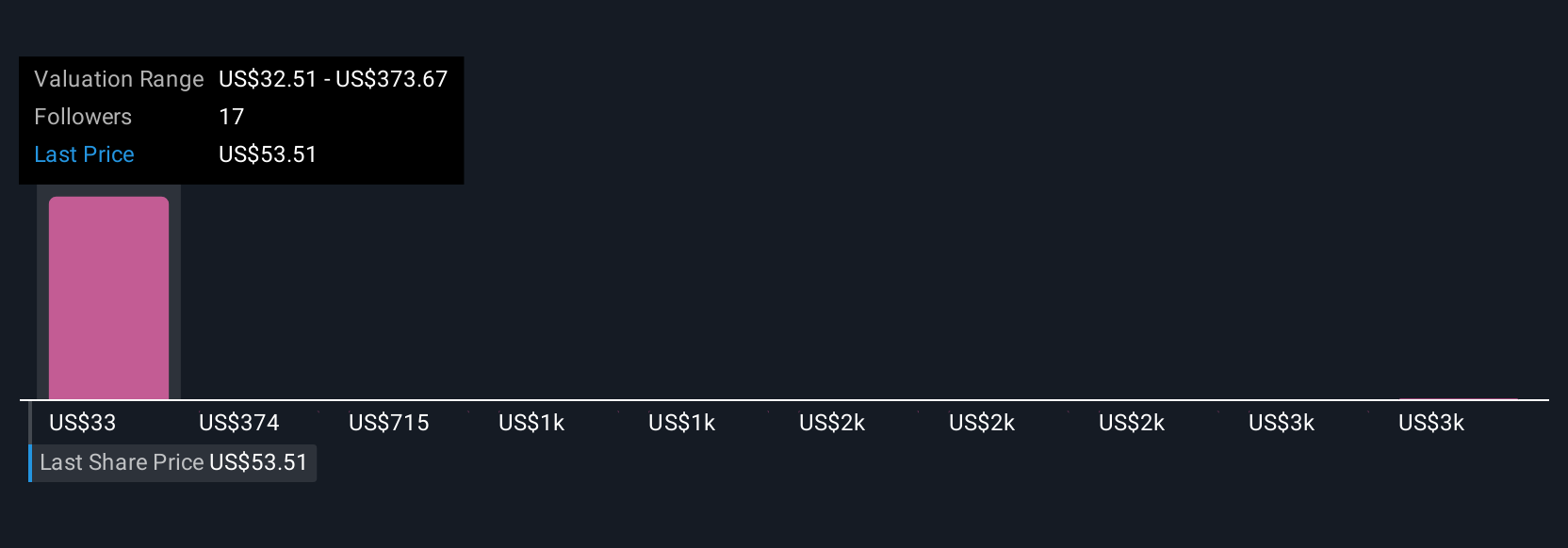

Five retail investors in the Simply Wall St Community produced fair value estimates for Sunoco ranging from US$32.51 to US$3,444.12. While their valuations are widely dispersed, attention should turn to how Sunoco’s rising leverage and debt management efforts might affect future performance and capital allocation decisions, make sure you check out a range of these perspectives for a fuller picture.

Explore 5 other fair value estimates on Sunoco - why the stock might be a potential multi-bagger!

Build Your Own Sunoco Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sunoco research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Sunoco research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sunoco's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SUN

Sunoco

Engages in the energy infrastructure and distribution of motor fuels in the United States.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives