- United States

- /

- Oil and Gas

- /

- NYSE:SM

The total return for SM Energy (NYSE:SM) investors has risen faster than earnings growth over the last five years

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But on a lighter note, a good company can see its share price rise well over 100%. For example, the SM Energy Company (NYSE:SM) share price has soared 262% in the last half decade. Most would be very happy with that. Then again, the 9.1% share price decline hasn't been so fun for shareholders.

Although SM Energy has shed US$149m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

See our latest analysis for SM Energy

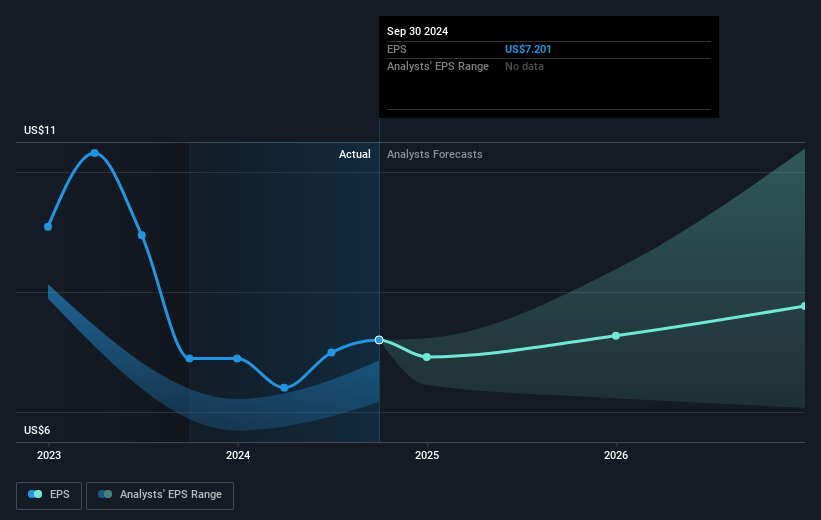

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the five years of share price growth, SM Energy moved from a loss to profitability. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that SM Energy has improved its bottom line over the last three years, but what does the future have in store? This free interactive report on SM Energy's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of SM Energy, it has a TSR of 282% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

SM Energy shareholders are up 4.5% for the year (even including dividends). But that was short of the market average. On the bright side, the longer term returns (running at about 31% a year, over half a decade) look better. Maybe the share price is just taking a breather while the business executes on its growth strategy. If you would like to research SM Energy in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

We will like SM Energy better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SM

SM Energy

An independent energy company, engages in the acquisition, exploration, development, and production of oil, gas, and natural gas liquids in the state of Texas.

Very undervalued with excellent balance sheet and pays a dividend.