- United States

- /

- Energy Services

- /

- NYSE:SEI

Solaris Energy Infrastructure (NYSE:SEI): Exploring Valuation After a Standout Year for the Stock

Reviewed by Kshitija Bhandaru

See our latest analysis for Solaris Energy Infrastructure.

Solaris Energy Infrastructure’s momentum has been hard to ignore, with a strong total shareholder return of 2.45% over the past year. This signals that investors are warming to its growth story and perhaps reassessing its longer-term prospects. This upward trend suggests the market is increasingly optimistic about the company’s ability to deliver on future opportunities.

If Solaris’s sharp run has you thinking about what else is out there, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

But with Solaris shares rallying so strongly, investors now face the big question: are they picking up a bargain, or is the market already factoring in every ounce of future growth potential?

Most Popular Narrative: 4% Overvalued

With Solaris Energy Infrastructure's fair value pegged at $45.11 according to the leading narrative, the last close of $46.75 puts shares just above consensus long-term expectations, drawing a line between recent momentum and the analyst outlook.

Ongoing vertical integration and technology investments, including proprietary SCR emissions systems, remote monitoring (Solaris Pulse), and expanded in-house balance of plant solutions, are positioning Solaris to capture greater share of customer wallet and widen its addressable market, supporting higher long-term revenue growth and operating leverage.

Want to know what powers this verdict? The backbone of the narrative relies on rapid expansion, margin transformation, and ambitious profit forecasts. Discover the bold financial leaps that led analysts to this price target. The exact blueprint that puts Solaris in the market spotlight might surprise you.

Result: Fair Value of $45.11 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing softness in oil prices and occasional surges in Power Solutions revenue could challenge Solaris’s growth story if momentum slows.

Find out about the key risks to this Solaris Energy Infrastructure narrative.

Another View: DCF Model Points to Deep Value

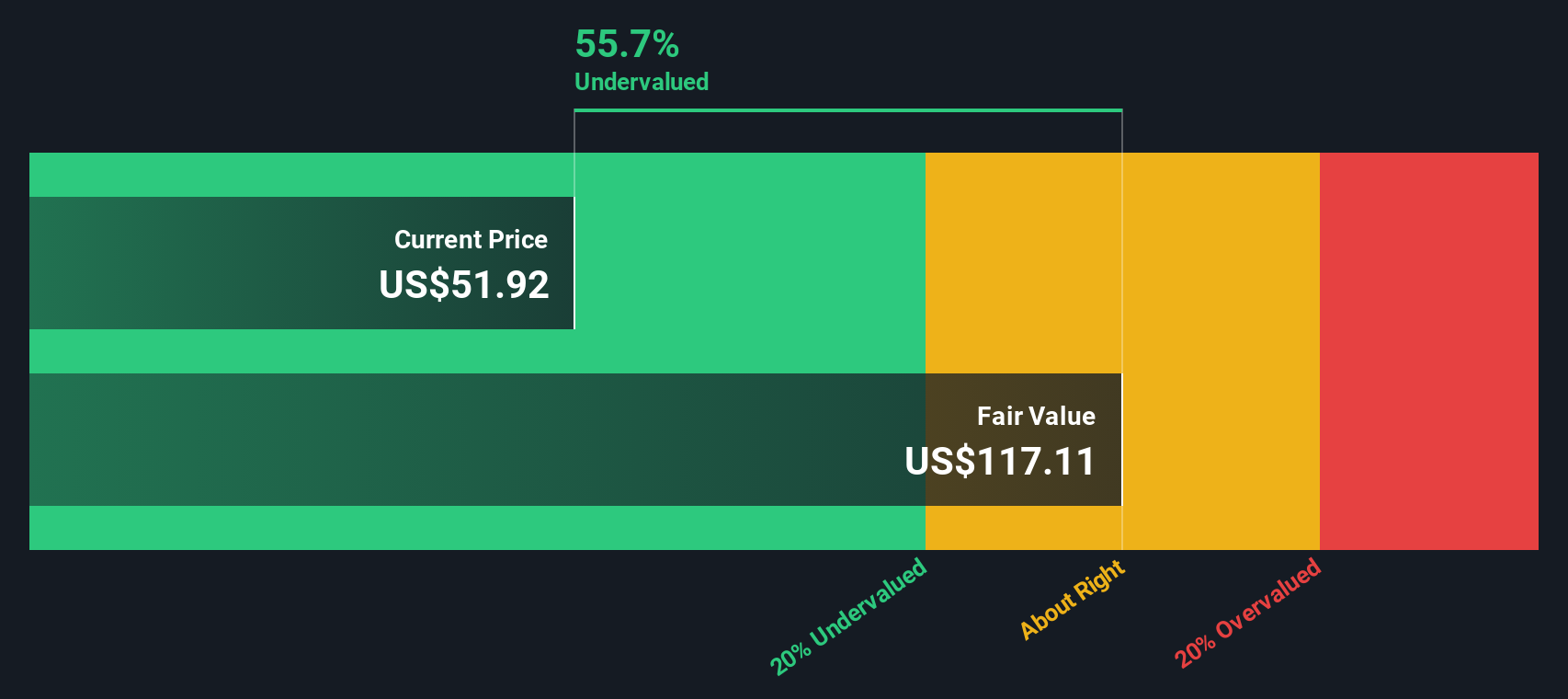

While the narrative valuation sees Solaris as overvalued, our DCF model offers a different take. It estimates fair value at $122.05 per share. This suggests the stock is actually trading well below what its future cash flows could justify. Could the market be underestimating Solaris’s long-term earnings power?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Solaris Energy Infrastructure for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Solaris Energy Infrastructure Narrative

If you want to dig into the numbers your way or form your own conclusions, building a personalized Solaris story only takes a few minutes. Do it your way

A great starting point for your Solaris Energy Infrastructure research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Step ahead of the crowd and spot tomorrow’s winners before everyone else. The best opportunities rarely wait—so put your watchlist to work right now.

- Access regular income potential and solid fundamentals by checking out these 19 dividend stocks with yields > 3% yielding over 3%, which may help strengthen your portfolio's returns.

- Be at the forefront of medical innovation and find companies reshaping healthcare by browsing these 32 healthcare AI stocks already transforming patient outcomes.

- Tap into fresh growth stories by tracking these 894 undervalued stocks based on cash flows that are trading below their true worth, which could offer strong upside if the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SEI

Solaris Energy Infrastructure

Provides mobile and scalable equipment-based solutions for use in distributed power generation and management of raw materials used in the completion of oil and natural gas wells in the United States.

Exceptional growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives