- United States

- /

- Oil and Gas

- /

- NYSE:RRC

The Bull Case for Range Resources (RRC) Could Change Following $4 Billion Credit Facility Announcement

Reviewed by Sasha Jovanovic

- On October 2, 2025, Range Resources Corporation announced it entered into an amended and restated revolving credit agreement, establishing a senior secured credit facility with an aggregate maximum principal amount of US$4.0 billion and a maturity date of October 2, 2030.

- The agreement provides Range with enhanced financial flexibility, potential for lower financing costs upon reaching investment grade, and a stronger covenant structure, supporting its access to liquidity and risk management.

- We'll examine how Range Resources' expanded borrowing base and improved credit terms could influence the company's investment outlook and growth strategy.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Range Resources Investment Narrative Recap

To be a shareholder in Range Resources, you need to believe that Appalachian natural gas demand will grow steadily and that Range's operational scale and efficiency will translate into strong free cash flow and competitive margins. The recent US$4.0 billion credit facility should strengthen Range’s financial flexibility, but does not change the most important catalyst, expanding regional demand from AI data centers, or the biggest near-term risk, which remains regulatory and market access uncertainty in Appalachia.

Of the recent company announcements, the upcoming Q3 2025 earnings release stands out as most relevant in providing a near-term signal on whether the improved capital structure and enhanced liquidity are translating to earnings stability, especially as Range prepares for possible production increases in Q4. The impact of production growth and enhanced liquidity will matter most if supportive demand drivers remain intact.

In contrast, investors should be alert to how regulatory and infrastructure risks could still disrupt Range’s access to markets and revenue growth should...

Read the full narrative on Range Resources (it's free!)

Range Resources' outlook anticipates $4.1 billion in revenue and $804.1 million in earnings by 2028. This is based on expected annual revenue growth of 13.7% and an increase in earnings of $325.4 million from the current $478.7 million.

Uncover how Range Resources' forecasts yield a $42.62 fair value, a 17% upside to its current price.

Exploring Other Perspectives

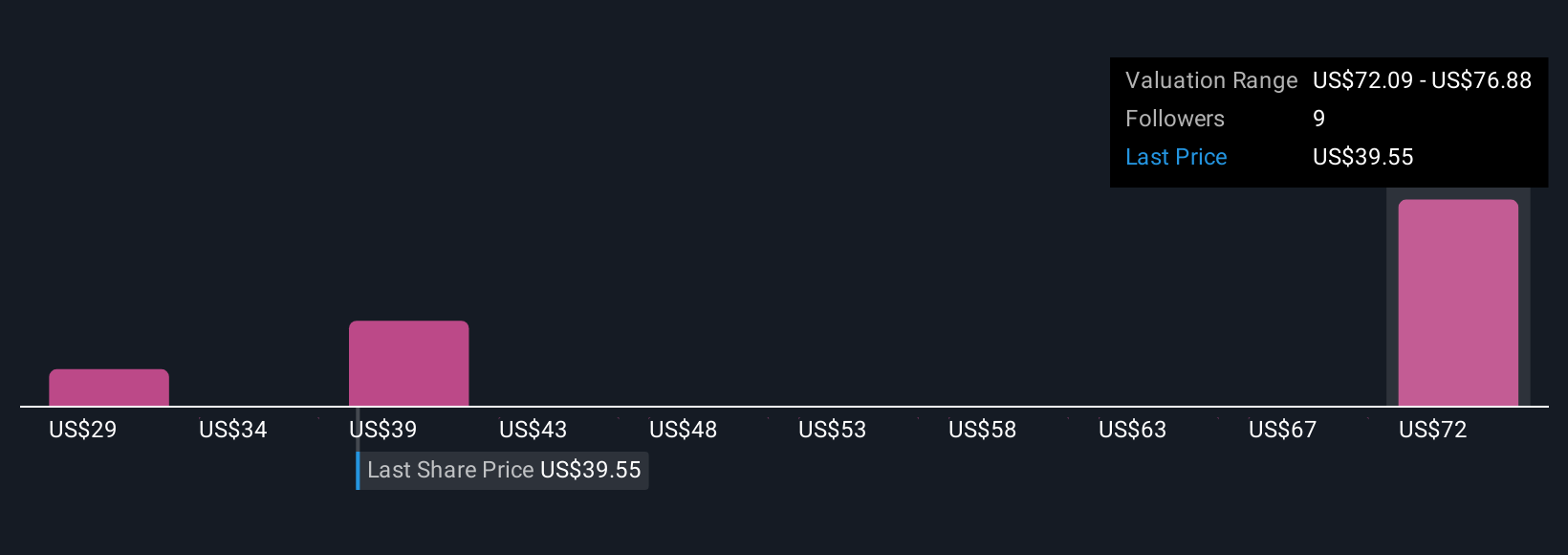

Five private investors in the Simply Wall St Community pegged Range Resources’ fair value anywhere from US$29 to almost US$76.88 per share. With regulatory risks looming and community views diverging widely, you’ll want to weigh several perspectives on Range’s growth and risk profile.

Explore 5 other fair value estimates on Range Resources - why the stock might be worth 20% less than the current price!

Build Your Own Range Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Range Resources research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Range Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Range Resources' overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RRC

Range Resources

Operates as an independent natural gas, natural gas liquids (NGLs), and oil company in the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives