- United States

- /

- Oil and Gas

- /

- NYSE:REX

REX American Resources (REX) Q2 Margin Squeeze Reinforces Bearish Profitability Narratives

Reviewed by Simply Wall St

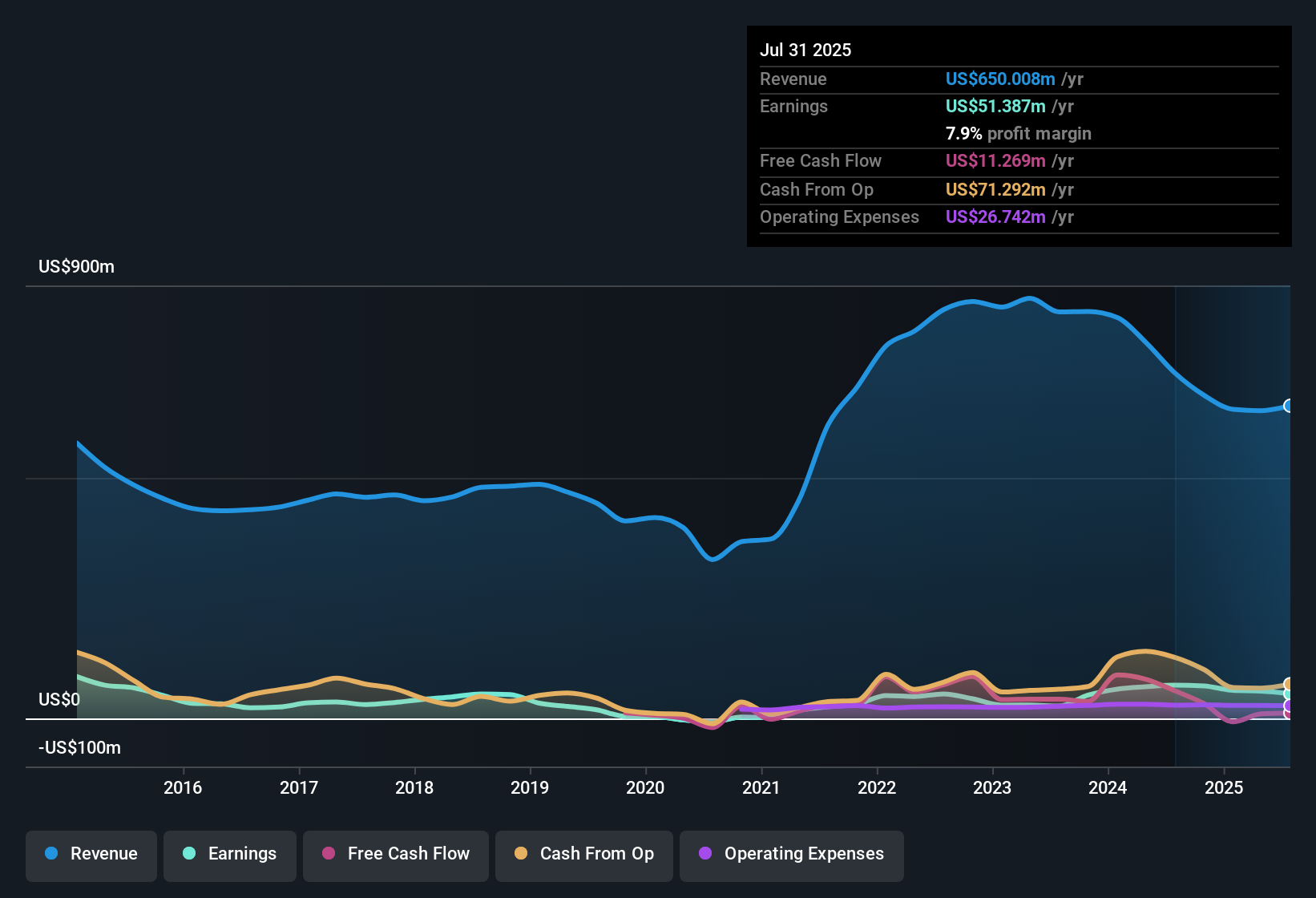

REX American Resources (REX) has just posted its Q2 2026 numbers, with revenue of $158.6 million, net income of $7.1 million and EPS of $0.22 setting the tone for how investors will read the latest move in margins and profitability. The company has seen quarterly revenue hover in a tight band around the mid $150 million mark over the past year, while EPS has stepped down from $0.35 in Q2 2025 and $0.70 in Q3 2025 to $0.22 this quarter. This puts the spotlight firmly on how durable its profit engine really is as margins come under pressure.

See our full analysis for REX American Resources.With the headline numbers on the table, the next step is to see how this earnings print lines up with the dominant narratives around REX and whether the recent squeeze on profitability really changes the longer term story investors have been telling themselves.

See what the community is saying about REX American Resources

Margins Slip From 9.6 percent To 7.9 percent

- Over the last 12 months, REX’s net profit margin was 7.9 percent compared with 9.6 percent in the prior year, showing that less of each dollar of revenue is turning into profit even though trailing 12 month net income is still $51.4 million.

- Critics in the bearish camp focus on this margin squeeze, arguing that cost pressures and potentially lower selling prices could keep profitability under strain.

- They highlight that analysts already expect profit margins to narrow further from 9.1 percent today to 6.0 percent in three years. The recent 7.9 percent margin therefore aligns with that concern rather than contradicting it.

- They also point to risks around higher freight and logistics costs and possible project delays, which would make it harder for REX to lift margins back toward the 9.6 percent level seen previously.

Five Year Earnings Up 30.7 percent Per Year

- Looking over a longer stretch, earnings have grown at an average rate of 30.7 percent per year over the past five years, and trailing 12 month earnings are described as high quality, with $650.0 million of revenue generating $51.4 million of net income.

- Supporters of the bullish narrative lean heavily on this multi year track record and the planned growth projects to argue that REX can rebuild profitability from the recent dip.

- They note that carbon capture and sequestration, if approved, could add 45Z and 45Q tax credits on top of operating income. This would directly help margins and keep that five year profit growth story intact.

- They also point to potential capacity expansion at the One Earth Energy plant and a share repurchase program, which together could lift both total earnings and earnings per share even if revenue growth stays around the 9.3 percent annual pace analysts expect.

P E Of 22.6x Versus DCF Value

- On valuation, REX trades at a trailing P E of 22.6 times, above the wider US Oil and Gas average of 13.6 times but below the peer group at 36.8 times, while the current share price of $35.07 sits far above the DCF fair value of about $2.09.

- Consensus style concerns around valuation tension come through here, as investors must balance that premium multiple against both the margin pressures and the big gap to the DCF fair value.

- The stock’s higher P E than the broader industry suggests the market is still pricing in elements of that 30.7 percent five year earnings growth, even though margins over the last year have come down to 7.9 percent.

- At the same time, the DCF fair value of roughly $2.09 compared with a $35.07 share price indicates that at least one valuation framework implies the shares are richly priced relative to the cash flows currently being modeled.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for REX American Resources on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use your own lens to test the data and build a fresh long term view in minutes, Do it your way.

Explore Alternatives

REX’s narrowing margins, softer earnings trend and rich valuation multiple all raise questions about how much upside is left without a reset in expectations.

If stretched pricing and shrinking profitability make you uneasy, use our these 907 undervalued stocks based on cash flows to quickly focus on companies where current share prices better reflect underlying cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:REX

Flawless balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026