- United States

- /

- Oil and Gas

- /

- NYSE:PSX

Elliott Opposes Phillips 66 (NYSE:PSX) Board Over Governance And Leadership Concerns

Reviewed by Simply Wall St

Phillips 66 (NYSE:PSX) experienced a flat price movement over the past week, declining by 1%. This movement coincided with an active period for the company, as Elliott Investment Management communicated with shareholders regarding their concerns over governance and board structure, urging support for their proposed board nominees. Despite these developments, the broader market climbed 1.8% amidst positive economic data and investor optimism, aided by strong earnings reports from major firms. Phillips 66’s recent operational updates and activist communications likely added weight to its performance amidst the prevailing market enthusiasm.

The recent interaction between Phillips 66 and Elliott Investment Management may add complexity to the current narrative. With a consensus price target of US$128.81, the stock seems undervalued compared to its current price of US$106.00, reflecting a potential upside. Over the past five years, Phillips 66 has delivered a total return of 74.06%, signaling robust long-term performance compared to its more modest movements in the short term. However, over the past year, PSX has underperformed both its industry, with the US Oil and Gas sector returning 8.9%, and the broader US market, which saw a 9.5% gain.

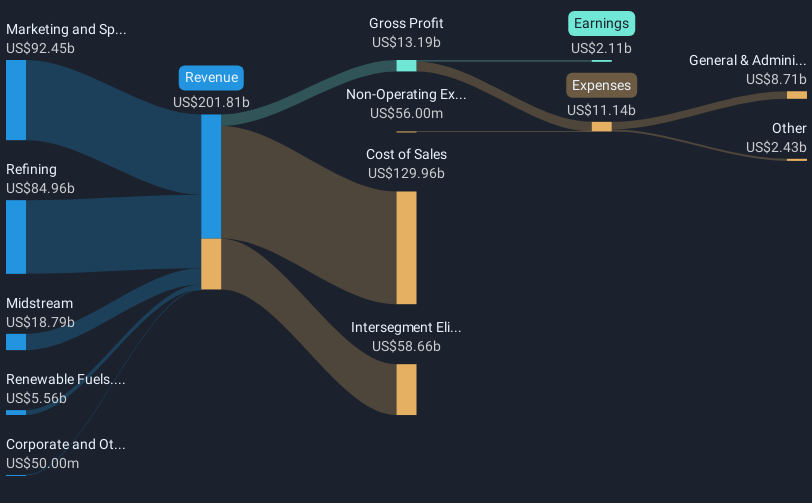

The governance issues raised by Elliott could impact investor sentiment, potentially influencing revenue and earnings forecasts. Concerns about governance may lead to increased pressure for strategic shifts, possibly impacting the company's focus and operational priorities. Altogether, these dynamics could introduce volatility to earnings forecasts, which are expected to rise significantly to US$5.0 billion by 2028, assuming successful execution of planned initiatives in NGL and Midstream segments. The flattening of recent share price movements must be considered in light of these forecasts and external pressures, as well as in the context of its discounted valuation relative to analyst expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Phillips 66, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PSX

Phillips 66

Operates as an energy manufacturing and logistics company in the United States, the United Kingdom, Germany, and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives