- United States

- /

- Oil and Gas

- /

- NYSE:PBF

Is There Now an Opportunity in PBF Energy After Shares Drop 6% This Week?

Reviewed by Bailey Pemberton

So you are eyeing PBF Energy stock and weighing your next move. Maybe the rollercoaster of prices has your finger hovering over the “buy” or “sell” button, or maybe you are just trying to understand whether now is a smart entry point. Either way, you are not alone. The latest action has been anything but dull. In just the past week, shares have slipped 6.1%, erasing some of the steady momentum built earlier this year. Still, zoom out a bit and you see a stock that is up 490.6% over the last five years, despite some choppy patches over the last twelve months. This kind of swing gets people talking about what is really driving PBF Energy’s value, and whether recent developments in oil refining, global energy demand, and market sentiment are changing the game for good or just for now.

Of course, everything comes down to what you are actually getting for your money. That is where the numbers start to matter, and PBF Energy’s valuation score gives us some early clues. On a scale where a company earns a point for every sign it is undervalued, out of six major checks, PBF Energy scores a 3. In other words, it checks half the boxes for being priced below its true worth, which is enough to keep things interesting for value-focused investors but not quite an open-and-shut bargain.

Next, let’s break down how the different valuation methods stack up for PBF Energy. We will go through the common yardsticks, but stick around, because there is a smarter twist on valuation you will want to see at the end.

Why PBF Energy is lagging behind its peers

Approach 1: PBF Energy Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true value by projecting its expected future cash flows and discounting them to today’s dollar value. This approach captures not only today’s performance but also what the company could earn over the next decade and beyond.

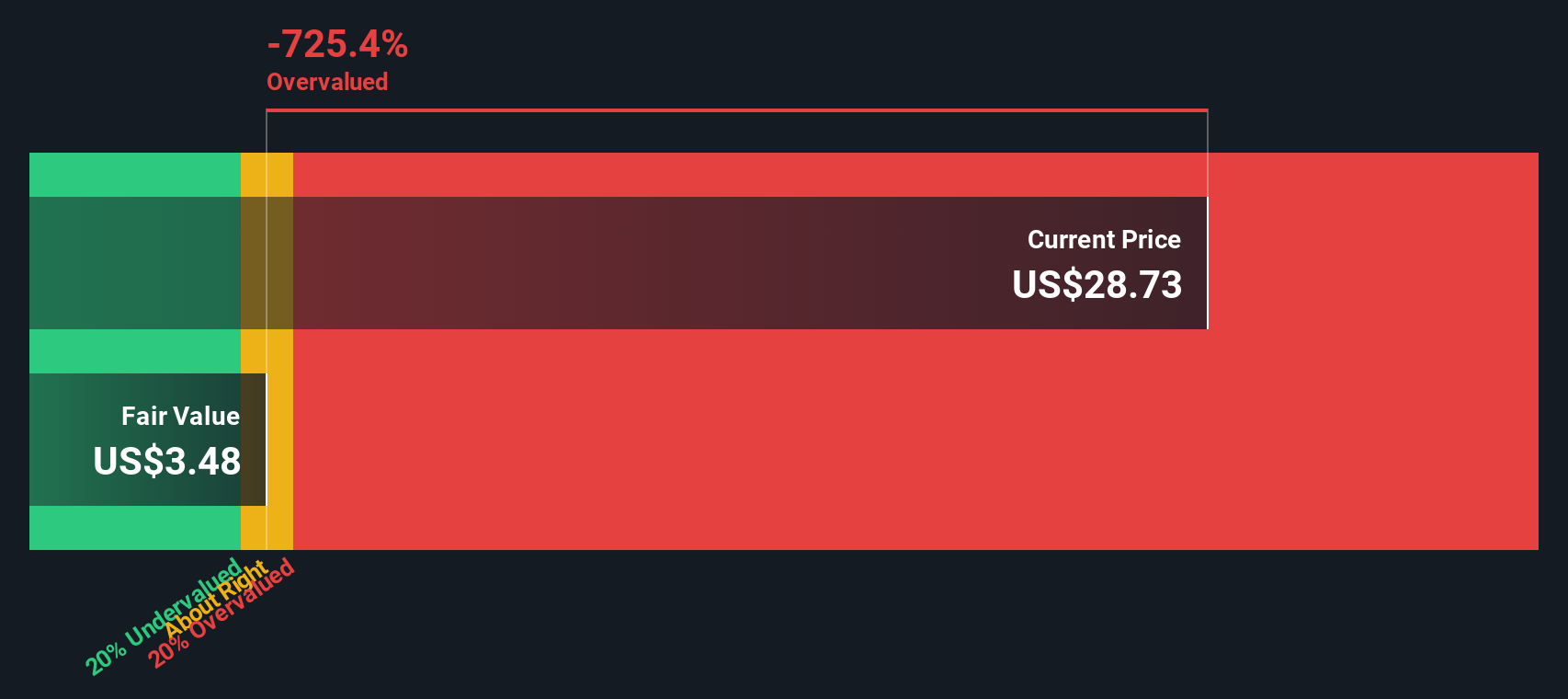

For PBF Energy, the current Free Cash Flow stands at -$1.34 billion, meaning the business has burned through more cash than it generated over the last twelve months. Projections suggest some recovery, with analysts expecting annual Free Cash Flow to rise to $78.3 million by the end of 2027, before gradually shrinking thereafter. These forward-looking numbers are primarily based on analyst estimates for the next five years and then extrapolated by Simply Wall St for subsequent years out to 2035.

After discounting all these projected cash flows to their present value, the estimated intrinsic value per share comes out to $3.47. Compared to the current share price, that implies PBF Energy is 737.7% overvalued using this method. In short, the DCF model suggests the stock is trading at a steep premium to what the company’s future cash flows are currently worth.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests PBF Energy may be overvalued by 737.7%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: PBF Energy Price vs Sales

When assessing a company’s value, the Price-to-Sales (P/S) ratio is often preferred for businesses in capital-intensive sectors like oil refining that may have fluctuating earnings or negative profits in certain years. The P/S ratio compares a company’s stock price to its total revenues, making it a solid way to examine value, especially when profits are not a consistent guide.

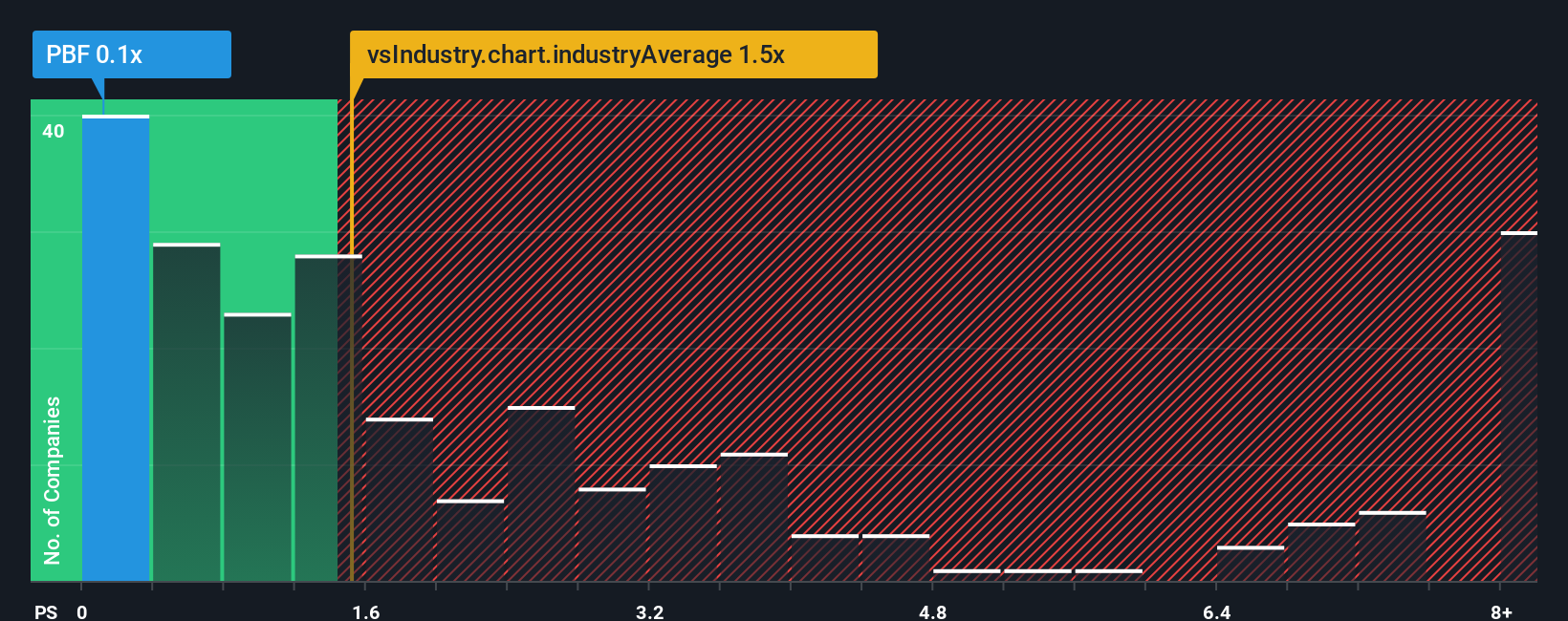

Growth expectations and risk also play a big part in what counts as a “normal” or “fair” P/S ratio. Companies with higher expected revenue growth or lower risk profiles tend to trade at higher P/S multiples, while those facing more uncertainty or industry headwinds generally come in lower. When comparing PBF Energy, its current P/S ratio sits at 0.11x, which is a significant discount compared to the oil and gas industry average of 1.54x and a peer group average of 0.26x. By these traditional standards, the stock appears attractively priced.

Simply Wall St takes things a step further with its “Fair Ratio,” a proprietary multiple that calculates what would be a reasonable valuation based on not just revenue growth, but also risk, margins, industry trends, and company size. By weighing all these factors, the Fair Ratio offers a more tailored and comprehensive reference point than simple peer or industry comparisons can. For PBF Energy, the Fair Ratio is 0.47x, closely aligned with its actual P/S ratio.

Comparing the Fair Ratio to the current P/S, the figures indicate that the stock’s valuation is about in line with what you would expect based on its fundamentals and outlook.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your PBF Energy Narrative

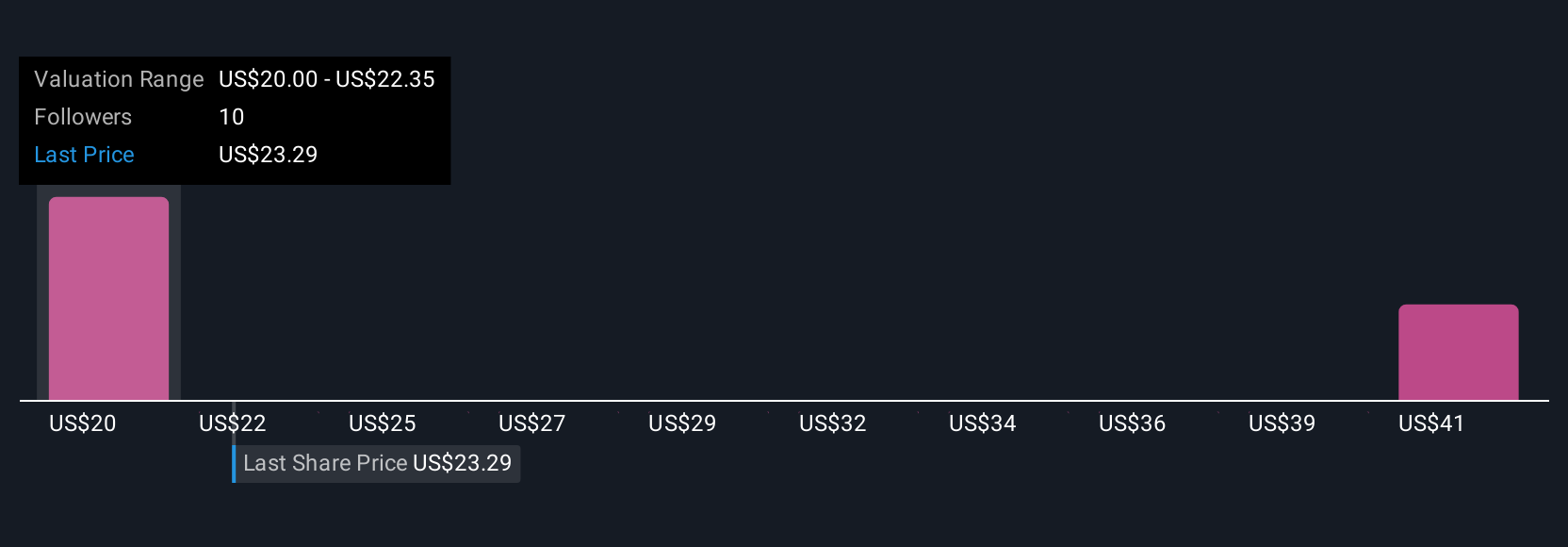

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, approachable way to make investing personal. It is the story you tell about a company, supported by your expectations for its future revenue, earnings, and profit margins, and the fair value you believe those numbers create.

Unlike traditional metrics, Narratives connect your unique perspective about PBF Energy’s business and industry changes directly to a detailed financial forecast, then to a clear estimate of what the shares are really worth. On Simply Wall St's Community page, millions of investors can easily create, compare, and track these Narratives to see how their stories stack up against the consensus view.

Narratives empower you to decide when to buy or sell by comparing your Fair Value to the current market Price. Because they update automatically with every major news event or earnings release, your analysis stays relevant and dynamic.

For example, with PBF Energy, one Narrative might highlight tightening supply and cost savings as reasons to expect earnings growth and set a Fair Value above today's price. Another might focus on operational risks and changing energy demand to support a more conservative outlook below the current price. This helps you see in real time how different investor perspectives can lead to different investment decisions.

Do you think there's more to the story for PBF Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PBF

PBF Energy

Through its subsidiaries, engages in refining and supplying petroleum products.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives