- United States

- /

- Oil and Gas

- /

- NYSE:PBF

Is Martinez Refinery Restart and Renewable Diesel Expansion Changing the Outlook for PBF Energy (PBF)?

Reviewed by Sasha Jovanovic

- PBF Energy recently announced progress toward a full restart of its Martinez refinery by the end of 2025, alongside exceeding cost-saving targets and expanding renewable diesel output to between 16,000 and 18,000 barrels per day in the third quarter.

- This milestone highlights PBF Energy’s ongoing transition as it aims to improve operational efficiency and capture opportunities within the evolving renewable fuels market.

- To assess the implications for PBF Energy, we’ll examine how Martinez’s expected restart shapes the company’s future earnings outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

PBF Energy Investment Narrative Recap

To be a shareholder in PBF Energy, you need to believe in the company's ability to adapt operationally as the refining sector transitions toward renewables and tightens capacity, all while managing significant regulatory and operational risks at key assets like the Martinez refinery. The recent Martinez restart update is positive for the near-term volume and cost-saving catalyst, but existing risks tied to project delays and regional regulation remain material, so the news does not fundamentally alter downside scenarios.

The most relevant recent announcement is PBF's confirmation that it expects to exceed its refining business improvement initiative savings targets (aiming for US$230 million in annual savings by 2025 and US$350 million by 2026). This progress, paired with the Martinez restart, helps underline management’s focus on operational efficiency and margin support, a key counterbalance to volatile refining profits as the company readies for more consistent output.

However, while management is confident in Martinez, investors should also be aware that ongoing permitting and regulatory constraints...

Read the full narrative on PBF Energy (it's free!)

PBF Energy's narrative projects $33.5 billion in revenue and $71.3 million in earnings by 2028. This requires 3.4% yearly revenue growth and a $1,053.6 million increase in earnings from -$982.3 million today.

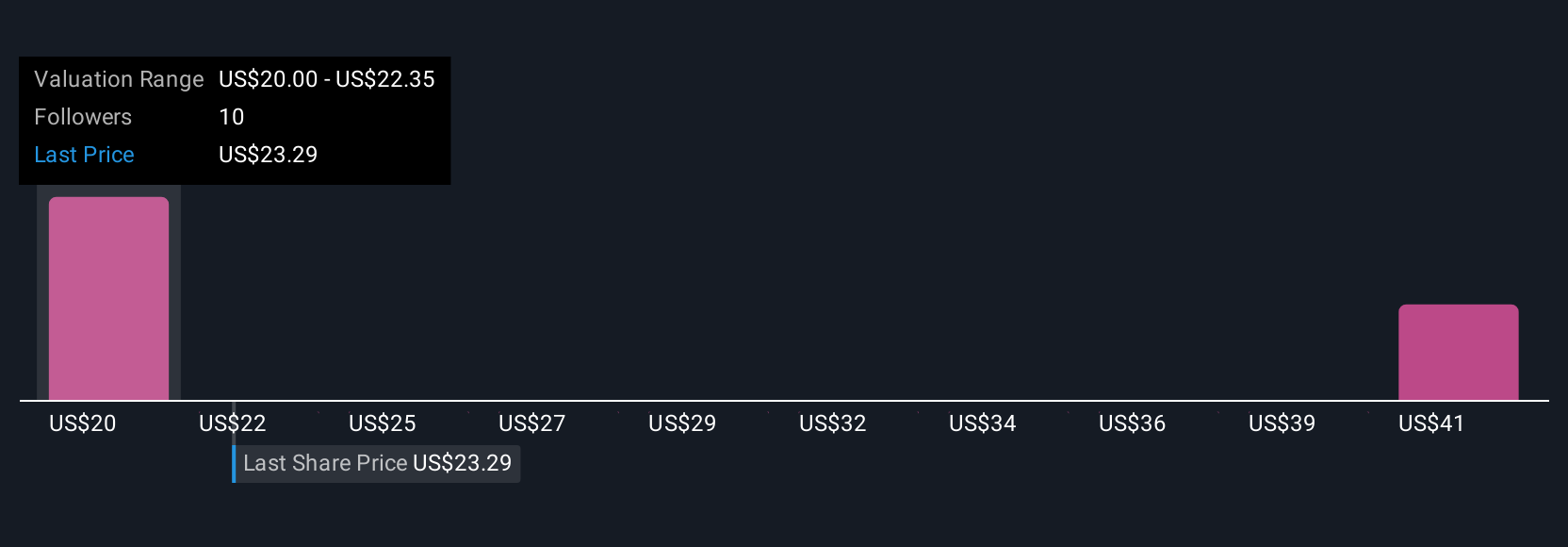

Uncover how PBF Energy's forecasts yield a $25.75 fair value, a 9% downside to its current price.

Exploring Other Perspectives

Five fair value views from the Simply Wall St Community range from US$3.49 to US$350.33 per share. With this kind of disparity, and the company's future prospects tied closely to progress at Martinez, you will want to examine the different opinions to find what matters to you.

Explore 5 other fair value estimates on PBF Energy - why the stock might be worth less than half the current price!

Build Your Own PBF Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PBF Energy research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PBF Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PBF Energy's overall financial health at a glance.

No Opportunity In PBF Energy?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PBF

PBF Energy

Through its subsidiaries, engages in refining and supplying petroleum products.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives