- United States

- /

- Oil and Gas

- /

- NYSE:PARR

Assessing Par Pacific’s Value After 112% Rally and Latest Industry Momentum in 2025

Reviewed by Bailey Pemberton

If you’ve been following Par Pacific Holdings lately, you might be wondering whether it’s time to jump in, hold tight, or take some gains off the table. Watching the stock price surge over 112.8% year-to-date, with a jaw-dropping 414.6% climb in the past five years, it’s hard not to be impressed by the momentum. Even after a dip of 4.1% this past week, Par Pacific is still up more than 6% over the last month and has doubled in value in just a year. These eye-popping returns are not just random volatility. They reflect a mix of industry tailwinds and shifts in investor sentiment, especially as markets react to supply chain updates and broader trends in the energy sector.

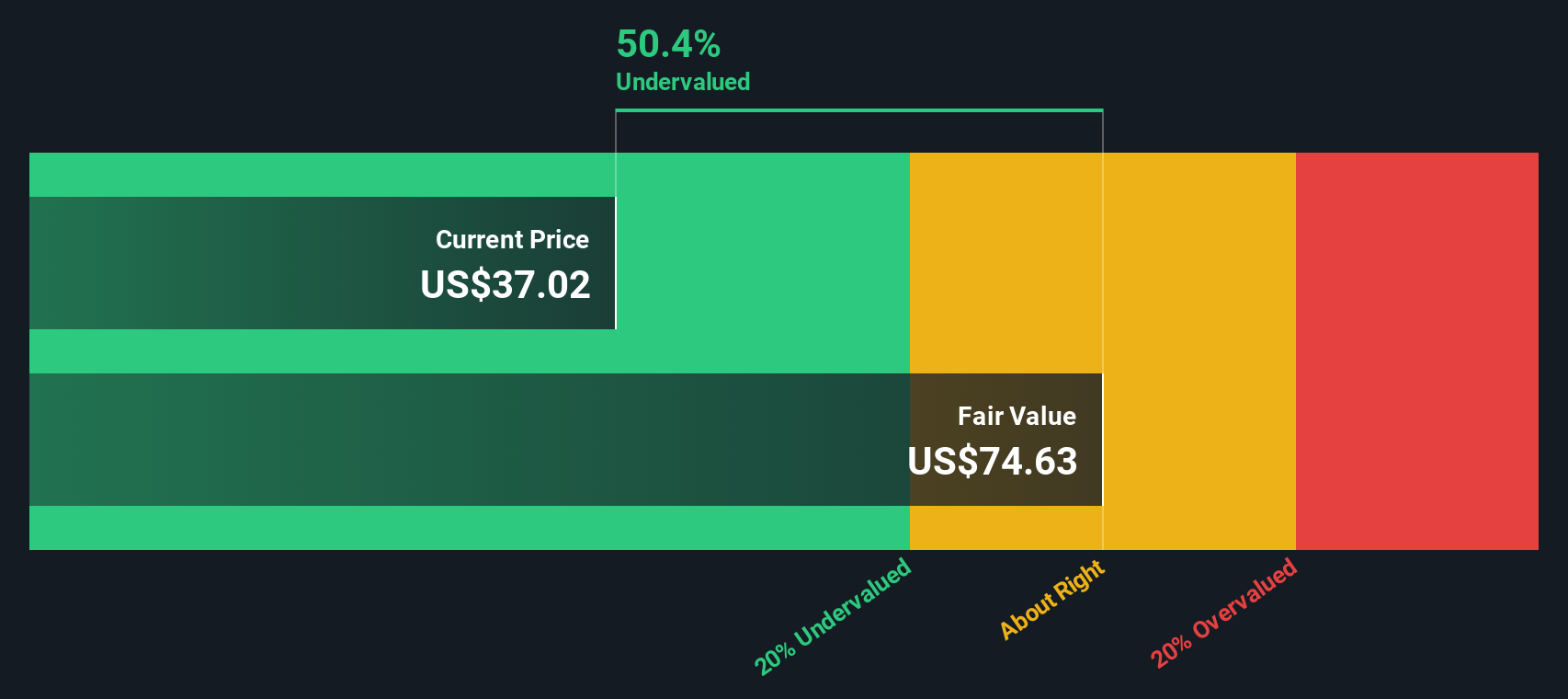

Of course, no discussion is complete without a closer look at valuation. Whether you’re a seasoned investor or analyzing the company for the first time, it’s important to ask if Par Pacific is actually trading below its true worth. On a quantitative basis, the company scores a 5 out of 6 on our value checklist, suggesting significant undervaluation relative to key metrics. However, traditional valuation models only tell part of the story.

In the next section, we will break down exactly how Par Pacific stacks up against a range of valuation methods. Later, we will explore a perspective that cuts through the noise and may reveal the real opportunity here.

Approach 1: Par Pacific Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by forecasting its future cash flows and then discounting them back to today’s dollars. Simply put, it aims to determine what Par Pacific Holdings is worth based on the money it is expected to generate in the coming years.

Par Pacific Holdings’ latest twelve-month free cash flow is $88.94 million. Analysts provide projections for the next several years, but longer-term estimates are extrapolated based on historical trends and industry outlook. According to these projections, free cash flow is forecast to reach approximately $191.19 million by 2035, with milestones along the way such as $165 million in 2026 and $164 million in 2028. These growing cash flows suggest the business is expected to keep strengthening its ability to generate value for shareholders over time.

Taking all these future cash flows into account, the DCF model calculates an intrinsic value of $57.67 per share for Par Pacific Holdings. This is about 38.4% higher than the current trading price, implying the stock is notably undervalued at today’s levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Par Pacific Holdings is undervalued by 38.4%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

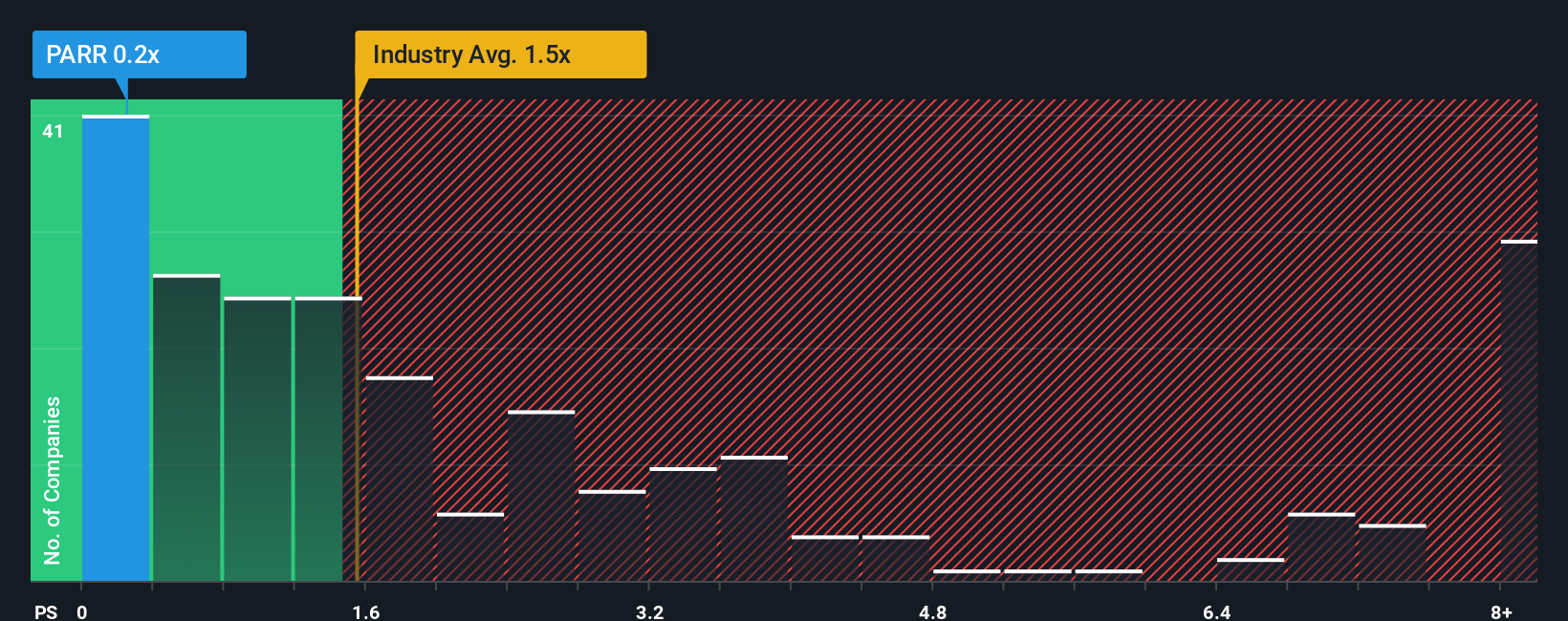

Approach 2: Par Pacific Holdings Price vs Sales

The price-to-sales (P/S) ratio is a commonly used multiple to value companies, especially in sectors like oil and gas where earnings can be volatile but revenue is a strong indicator of long-term potential. This metric helps investors see how much they are paying for every dollar of sales generated and is particularly effective when a company’s profits may fluctuate but sales are relatively stable.

Growth expectations and risk levels play a big role in determining what counts as a “fair” P/S ratio. Companies with above-average growth or more predictable revenue streams tend to command higher multiples. Those facing unique risks or slowdowns usually warrant lower ones. Context matters because a P/S ratio that seems high or low on its own may be appropriate when you consider the company’s outlook and industry position.

Currently, Par Pacific Holdings trades at a P/S ratio of 0.24x, well below the oil and gas industry average of 1.52x and the peer average of 0.53x. While these comparisons suggest the stock is trading at a meaningful discount, the “Fair Ratio” calculated by Simply Wall St refines this view. The Fair Ratio of 0.49x incorporates not just sales but also factors such as Par Pacific’s expected growth, profit margins, risks, and its market capitalization. This makes it a more reliable benchmark than just comparing with industry or peers. With Par Pacific’s actual P/S ratio around half of its Fair Ratio, the stock appears to be considerably undervalued on this basis.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Par Pacific Holdings Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are an intuitive tool that allow investors to tell the story behind their numbers by combining their perspective on a company's outlook with their own fair value and future estimates for revenue, earnings, and margins.

Rather than treating stock analysis as pure math, Narratives link a company's business story directly to a financial forecast and ultimately to what you believe is a fair price. This approach makes the reasoning for your investment decision transparent and actionable. The Simply Wall St platform, trusted by millions of investors globally, features Narratives on every company’s Community page. You can easily adjust your view, publish your thesis, and see how others think.

Narratives help you decide when to buy, hold, or sell by comparing your fair value (based on your assumptions and research) with the current share price. This allows you to cut through short-term noise and focus on what matters. Whenever new information comes in, such as earnings results or major news, Narratives update dynamically and help investors refine their outlook in real time.

For Par Pacific Holdings, one investor might build a bullish narrative around Asia’s energy demand and renewable fuels, projecting a fair value of $39.00. Another may focus on tightening regulations and lower profitability, resulting in a fair value of $23.00. Your unique perspective directly shapes your investment strategy.

Do you think there's more to the story for Par Pacific Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PARR

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives