- United States

- /

- Oil and Gas

- /

- NYSE:OKE

Will ONEOK’s (OKE) Unshaken Dividend After Mont Belvieu Fire Reinforce Its Cash Flow Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, ONEOK, Inc. experienced a fire at its Mont Belvieu, Texas, fractionation complex, prompting a temporary shutdown but resulting in no injuries and minimal operational disruption, according to the company.

- Shortly after the incident, the board affirmed its quarterly dividend at US$1.03 per share, reflecting confidence in ongoing cash flows and operational stability.

- We'll explore how ONEOK's reaffirmed dividend, following the recent Mont Belvieu fire, shapes the company's forward-looking investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

ONEOK Investment Narrative Recap

To own shares of ONEOK, investors need confidence in the continued expansion of US natural gas and NGL volumes, the reliability of fee-based contracts, and integration benefits from recent acquisitions. The recent Mont Belvieu fire was contained quickly with no injuries, and management expects minimal financial impact, suggesting this event is unlikely to affect the company’s biggest near-term catalyst: capturing increased volume from new infrastructure projects. Similarly, the most significant current risk, sensitivity to commodity price spreads and market volatility, remains unchanged in the short term following the incident.

Among recent company news, the October 15 dividend affirmation stands out. The board maintained its US$1.03 per share quarterly dividend, signaling steady cash flow and operational confidence despite the temporary Mont Belvieu shutdown. This stability supports the view that ONEOK’s core earnings power can weather isolated operational incidents and maintains its priority on shareholder returns.

However, even as operational resilience is revealed, it remains important for investors to remember that if commodity price spreads tighten further…

Read the full narrative on ONEOK (it's free!)

ONEOK's outlook calls for $34.0 billion in revenue and $4.2 billion in earnings by 2028. This scenario assumes a 6.7% annual revenue growth rate and a $1.1 billion increase in earnings from the current $3.1 billion level.

Uncover how ONEOK's forecasts yield a $93.32 fair value, a 35% upside to its current price.

Exploring Other Perspectives

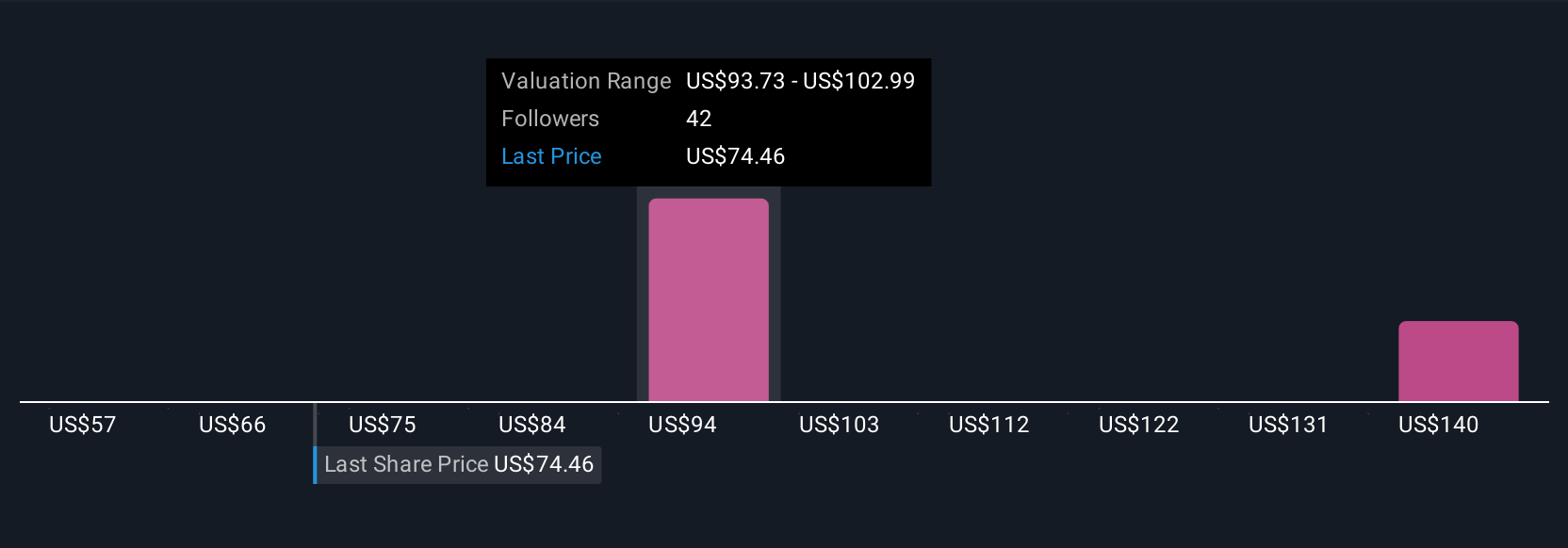

Simply Wall St Community members provided eight fair value estimates for ONEOK ranging from US$65 to US$152.16 per share, reflecting varied outlooks. While these opinions are diverse, keep in mind the ongoing earnings sensitivity to commodity price spreads could influence the company’s longer-term profit outlook beyond operational incidents, consider exploring these differing viewpoints for a broader understanding.

Explore 8 other fair value estimates on ONEOK - why the stock might be worth over 2x more than the current price!

Build Your Own ONEOK Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ONEOK research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ONEOK research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ONEOK's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OKE

ONEOK

Operates as a midstream service provider of gathering, processing, fractionation, transportation, storage, and marine export services in the United States.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives