- United States

- /

- Energy Services

- /

- NYSE:OIS

Shareholders in Oil States International (NYSE:OIS) have lost 70%, as stock drops 12% this past week

While it may not be enough for some shareholders, we think it is good to see the Oil States International, Inc. (NYSE:OIS) share price up 12% in a single quarter. But that is little comfort to those holding over the last half decade, sitting on a big loss. The share price has failed to impress anyone , down a sizable 70% during that time. Some might say the recent bounce is to be expected after such a bad drop. But it could be that the fall was overdone.

With the stock having lost 12% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Oil States International

Because Oil States International made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually desire strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years Oil States International saw its revenue shrink by 5.8% per year. That's not what investors generally want to see. The share price decline of 11% compound, over five years, is understandable given the company is losing money, and revenue is moving in the wrong direction. We don't think anyone is rushing to buy this stock. Not that many investors like to invest in companies that are losing money and not growing revenue.

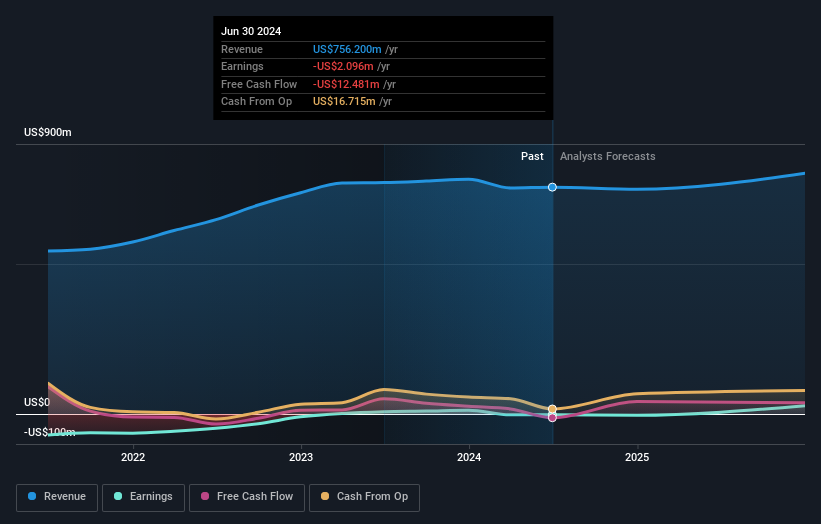

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Oil States International's financial health with this free report on its balance sheet.

A Different Perspective

While the broader market gained around 21% in the last year, Oil States International shareholders lost 45%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. You could get a better understanding of Oil States International's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OIS

Oil States International

Through its subsidiaries, provides engineered capital equipment and products for the energy, industrial, and military sectors worldwide.

Flawless balance sheet and undervalued.