- United States

- /

- Energy Services

- /

- NYSE:OIS

Oil States International, Inc.'s (NYSE:OIS) Shares May Have Run Too Fast Too Soon

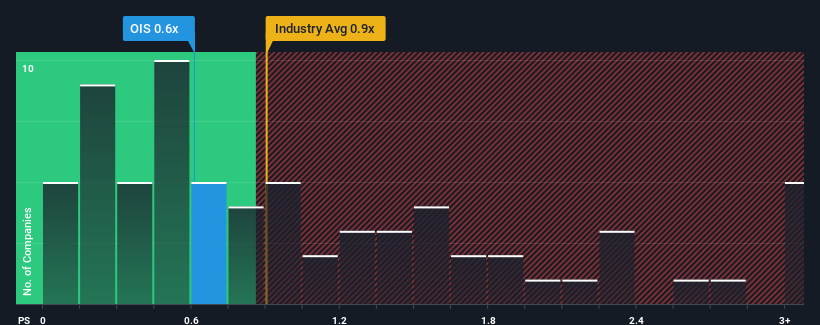

With a median price-to-sales (or "P/S") ratio of close to 0.9x in the Energy Services industry in the United States, you could be forgiven for feeling indifferent about Oil States International, Inc.'s (NYSE:OIS) P/S ratio of 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Oil States International

What Does Oil States International's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Oil States International has been relatively sluggish. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Oil States International will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Oil States International?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Oil States International's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 26% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 22% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 12% during the coming year according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 16%, which is noticeably more attractive.

With this in mind, we find it intriguing that Oil States International's P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From Oil States International's P/S?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Given that Oil States International's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 2 warning signs for Oil States International that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OIS

Oil States International

Through its subsidiaries, provides engineered capital equipment and products for the energy, industrial, and military sectors worldwide.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives