- United States

- /

- Energy Services

- /

- NYSE:OII

Does Oceaneering International’s 19% ROCE Signal a Turning Point for OII’s Profitability?

Reviewed by Sasha Jovanovic

- Oceaneering International recently reported a return on capital employed (ROCE) of 19%, considerably exceeding the Energy Services industry average of 9.2%, signaling a meaningful shift to profitability after years of losses.

- This transition was achieved with a stable level of capital employed, and investor recognition of these improved fundamentals has resulted in a very large shareholder return over the past five years.

- We'll explore how Oceaneering International's industry-leading ROCE raises fresh considerations for the company's future investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Oceaneering International Investment Narrative Recap

To be a shareholder in Oceaneering International, you need confidence in its ability to deliver sustainable returns as it capitalizes on niche strengths in subsea and defense technologies, all while facing pressure from the global energy transition. While the recent surge in ROCE underscores profitability, it does not materially change the biggest short-term catalyst, securing recurring revenues from decommissioning and long-term offshore contracts, nor does it reduce the risk posed by cyclical offshore oil and gas spending. Of the latest company announcements, the new multi-year subsea IMR services contract with bp in the Greater Tortue Ahmeyim field stands out. This win supports the primary catalyst of building backlog visibility and stable revenues, although it does not shield Oceaneering from ongoing sector cyclicality. But even with stronger fundamentals, investors should remain mindful that cyclical swings in offshore oil and gas demand could mean...

Read the full narrative on Oceaneering International (it's free!)

Oceaneering International's outlook anticipates $3.1 billion in revenue and $185.9 million in earnings by 2028. This is based on an expected annual revenue growth rate of 4.2% and a decrease in earnings of $16.3 million from current earnings of $202.2 million.

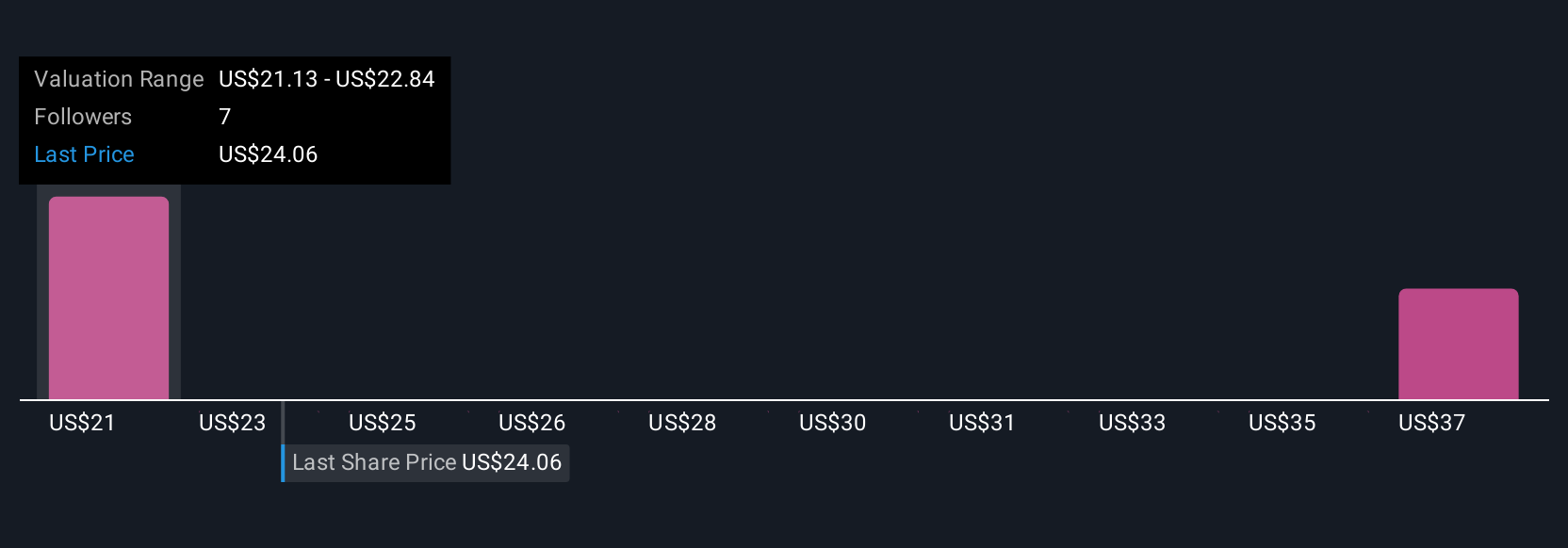

Uncover how Oceaneering International's forecasts yield a $22.38 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Oceaneering's fair value from US$21.43 to US$39.53, across three independent analyses. Against this backdrop, the risk of overreliance on traditional offshore oil and gas spending remains top of mind for many.

Explore 3 other fair value estimates on Oceaneering International - why the stock might be worth 12% less than the current price!

Build Your Own Oceaneering International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Oceaneering International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Oceaneering International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Oceaneering International's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OII

Oceaneering International

Provides engineered services and products, and robotic solutions to the offshore energy, defense, aerospace, manufacturing, and entertainment industries in the United States, Africa, the United Kingdom, Norway, Brazil, Asia, Australia, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives