The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that NOV Inc. (NYSE:NOV) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for NOV

How Much Debt Does NOV Carry?

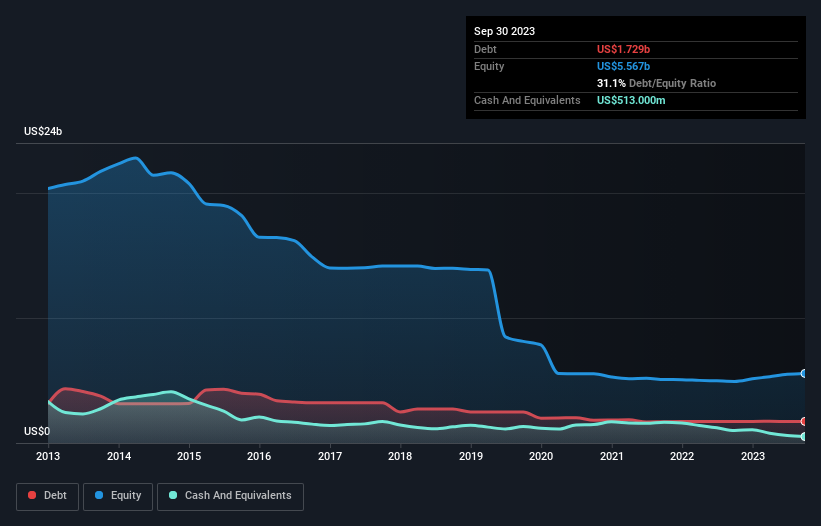

As you can see below, NOV had US$1.73b of debt, at September 2023, which is about the same as the year before. You can click the chart for greater detail. However, because it has a cash reserve of US$513.0m, its net debt is less, at about US$1.22b.

A Look At NOV's Liabilities

Zooming in on the latest balance sheet data, we can see that NOV had liabilities of US$2.37b due within 12 months and liabilities of US$2.56b due beyond that. Offsetting this, it had US$513.0m in cash and US$2.66b in receivables that were due within 12 months. So its liabilities total US$1.76b more than the combination of its cash and short-term receivables.

This deficit isn't so bad because NOV is worth US$7.81b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

NOV has a low net debt to EBITDA ratio of only 1.2. And its EBIT easily covers its interest expense, being 11.3 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Even more impressive was the fact that NOV grew its EBIT by 351% over twelve months. That boost will make it even easier to pay down debt going forward. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if NOV can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Over the last two years, NOV saw substantial negative free cash flow, in total. While investors are no doubt expecting a reversal of that situation in due course, it clearly does mean its use of debt is more risky.

Our View

NOV's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered were considerably better. There's no doubt that its ability to to grow its EBIT is pretty flash. When we consider all the elements mentioned above, it seems to us that NOV is managing its debt quite well. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. We'd be motivated to research the stock further if we found out that NOV insiders have bought shares recently. If you would too, then you're in luck, since today we're sharing our list of reported insider transactions for free.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if NOV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NOV

NOV

Designs, constructs, manufactures, and sells systems, components, and products for oil and gas drilling and production, and industrial and renewable energy sectors in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives