- United States

- /

- Energy Services

- /

- NYSE:NE

Noble (NE): Evaluating Valuation After S&P 1000 Entry and Executive Share Sale

Reviewed by Kshitija Bhandaru

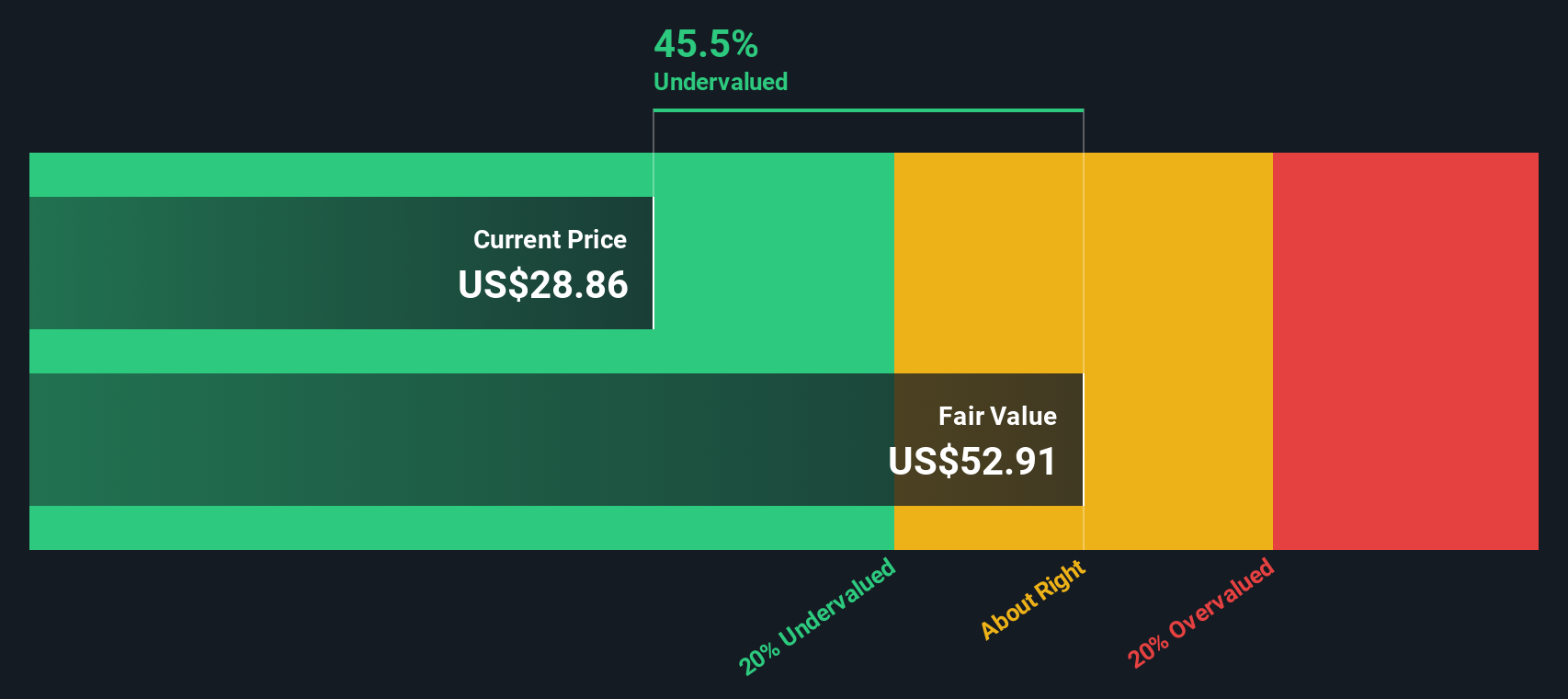

Most Popular Narrative: 14.5% Undervalued

According to the most widely followed valuation narrative, Noble currently trades below what analysts consider its fair value. This assessment suggests the market is discounting some of the company’s future potential, offering a possible opportunity for investors.

Fleet modernization, operational efficiencies, and diversification into energy transition projects are expected to enhance market opportunities, reduce earnings volatility, and improve free cash flow.

Want to know what really justifies this bullish target? Analysts are betting on growth levers that could reshape Noble’s entire profit outlook. They have built this valuation around a set of forward-looking numbers, especially earnings and margins, that might surprise even seasoned investors. Curious what those key financial assumptions are, and why consensus sees so much upside? The details in the full breakdown may challenge your expectations.

Result: Fair Value of $34.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, near-term softness in offshore demand and unpredictable global spending could challenge Noble’s rebound and make it more difficult to meet revenue and earnings targets.

Find out about the key risks to this Noble narrative.Another View: Our DCF Model Says Undervalued Too

Looking at Noble through the lens of the SWS DCF model, the story is much the same as before. The shares appear undervalued based on the present value of future cash flows. Does this reinforce the analysts' bullish narrative, or is there still room for surprise?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Noble for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Noble Narrative

If you like to dig deeper or want to form your own perspective, you can shape a completely custom view of Noble in just a few minutes. Do it your way

A great starting point for your Noble research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Unlock even more market opportunities using Simply Wall Street’s handpicked screeners. Take action now to spot companies with the brightest potential and make sure your next winning idea does not slip away.

- Tap into small-cap potential by adding penny stocks with strong financials to your radar. This screener features ambitious businesses with strong financials aiming for serious growth.

- Capture reliable income streams when you review dividend stocks with yields > 3%. This screener is focused on companies offering yields above 3% and a steady record of shareholder rewards.

- Get ahead of the AI revolution by seeking out promising tech innovators through AI penny stocks. Here, breakthrough artificial intelligence is turning future ideas into reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Noble might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NE

Noble

Operates as an offshore drilling contractor for the oil and gas industry worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives