Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Nabors Industries Ltd. (NYSE:NBR) does have debt on its balance sheet. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

See our latest analysis for Nabors Industries

What Is Nabors Industries's Debt?

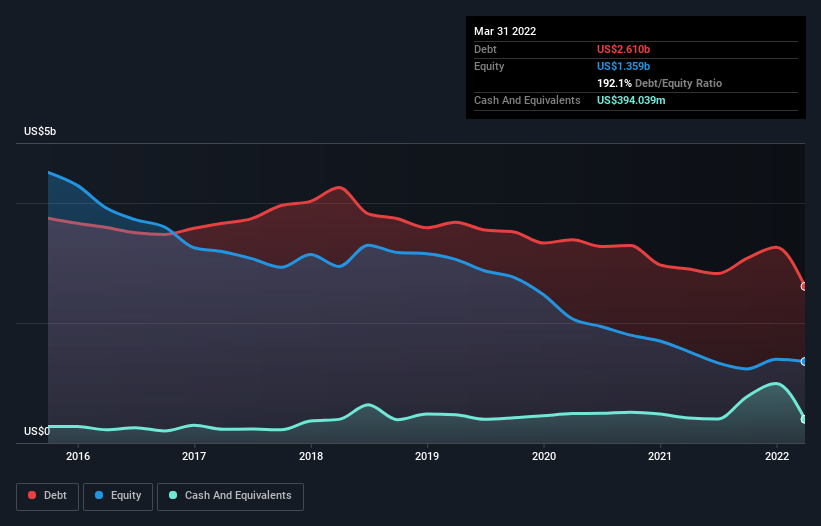

The image below, which you can click on for greater detail, shows that Nabors Industries had debt of US$2.61b at the end of March 2022, a reduction from US$2.90b over a year. However, because it has a cash reserve of US$394.0m, its net debt is less, at about US$2.22b.

A Look At Nabors Industries' Liabilities

According to the last reported balance sheet, Nabors Industries had liabilities of US$513.4m due within 12 months, and liabilities of US$2.99b due beyond 12 months. Offsetting these obligations, it had cash of US$394.0m as well as receivables valued at US$324.7m due within 12 months. So it has liabilities totalling US$2.78b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the US$1.02b company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. After all, Nabors Industries would likely require a major re-capitalisation if it had to pay its creditors today. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Nabors Industries's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, Nabors Industries reported revenue of US$2.1b, which is a gain of 13%, although it did not report any earnings before interest and tax. We usually like to see faster growth from unprofitable companies, but each to their own.

Caveat Emptor

Over the last twelve months Nabors Industries produced an earnings before interest and tax (EBIT) loss. Indeed, it lost a very considerable US$176m at the EBIT level. Combining this information with the significant liabilities we already touched on makes us very hesitant about this stock, to say the least. That said, it is possible that the company will turn its fortunes around. But we think that is unlikely since it is low on liquid assets, and made a loss of US$626m in the last year. So we think this stock is quite risky. We'd prefer to pass. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 2 warning signs for Nabors Industries that you should be aware of.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Nabors Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NBR

Nabors Industries

Provides drilling and drilling-related services for land-based and offshore oil and natural gas wells in the United States and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives