- United States

- /

- Oil and Gas

- /

- NYSE:MUR

We Think Some Shareholders May Hesitate To Increase Murphy Oil Corporation's (NYSE:MUR) CEO Compensation

Key Insights

- Murphy Oil to hold its Annual General Meeting on 8th of May

- Total pay for CEO Roger Jenkins includes US$1.07m salary

- Total compensation is 71% above industry average

- Murphy Oil's total shareholder return over the past three years was 158% while its EPS grew by 103% over the past three years

Performance at Murphy Oil Corporation (NYSE:MUR) has been reasonably good and CEO Roger Jenkins has done a decent job of steering the company in the right direction. As shareholders go into the upcoming AGM on 8th of May, CEO compensation will probably not be their focus, but rather the steps management will take to continue the growth momentum. However, some shareholders will still be cautious of paying the CEO excessively.

Check out our latest analysis for Murphy Oil

How Does Total Compensation For Roger Jenkins Compare With Other Companies In The Industry?

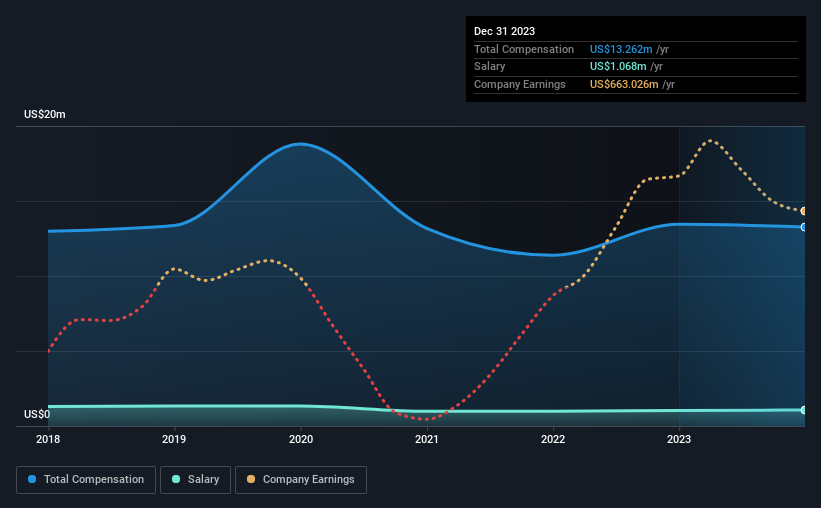

According to our data, Murphy Oil Corporation has a market capitalization of US$6.8b, and paid its CEO total annual compensation worth US$13m over the year to December 2023. That is, the compensation was roughly the same as last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$1.1m.

For comparison, other companies in the American Oil and Gas industry with market capitalizations ranging between US$4.0b and US$12b had a median total CEO compensation of US$7.7m. Hence, we can conclude that Roger Jenkins is remunerated higher than the industry median. What's more, Roger Jenkins holds US$46m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$1.1m | US$1.0m | 8% |

| Other | US$12m | US$12m | 92% |

| Total Compensation | US$13m | US$13m | 100% |

Talking in terms of the industry, salary represented approximately 13% of total compensation out of all the companies we analyzed, while other remuneration made up 87% of the pie. In Murphy Oil's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Murphy Oil Corporation's Growth

Murphy Oil Corporation has seen its earnings per share (EPS) increase by 103% a year over the past three years. Its revenue is down 18% over the previous year.

This demonstrates that the company has been improving recently and is good news for the shareholders. While it would be good to see revenue growth, profits matter more in the end. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Murphy Oil Corporation Been A Good Investment?

Most shareholders would probably be pleased with Murphy Oil Corporation for providing a total return of 158% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We did our research and spotted 2 warning signs for Murphy Oil that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MUR

Murphy Oil

Operates as an oil and gas exploration and production company in the United States, Canada, and internationally.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives