- United States

- /

- Oil and Gas

- /

- NYSE:MPC

Marathon Petroleum (NYSE:MPC) Sees 14% Rise This Quarter With Proposal Change in Focus

Reviewed by Simply Wall St

Marathon Petroleum (NYSE:MPC) has been in the spotlight due to shareholder activism from John Chevedden, with a proposal to change voting requirements opposed by the company ahead of its annual meeting. Despite this, the company's stock rose 14% over the last quarter. Key factors include a cash dividend declaration and a significant share buyback program. Though Marathon's earnings saw a decline, the broader market showed resilience, with the S&P 500 on track to end its recent losing streak. These dynamics might have supported MPC’s upward price movement against a backdrop of generally stabilizing market conditions.

The last five years have seen Marathon Petroleum's shares deliver a very large total return of 671.24%. This impressive performance can be partly attributed to several key developments. Strategic capital investments, particularly in the renewable diesel and midstream segments, have strengthened the company's market position. Marathon also increased its buyback plan by US$5 billion as of April 2024 to US$45.1 billion, signaling a strong commitment to returning value to shareholders. The opening of a soybean processing complex in November 2024, in partnership with ADM, provided further momentum by supporting its renewable fuel initiatives.

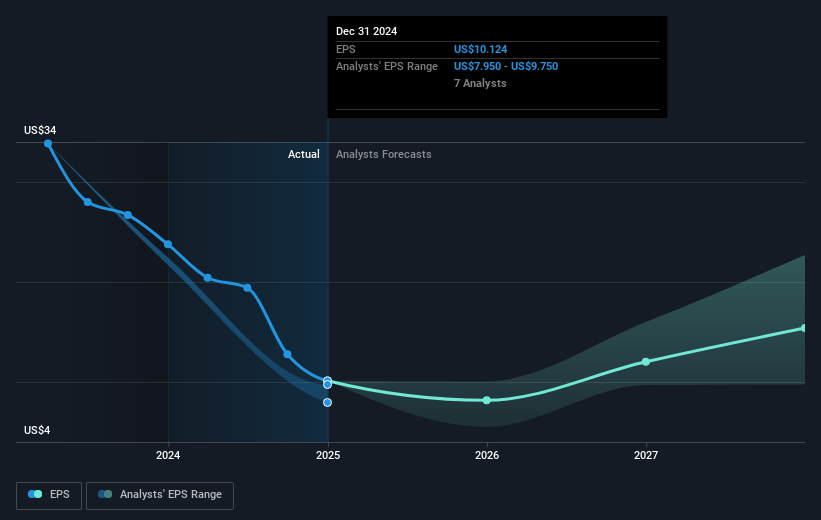

Despite past earnings declines, including a full-year net income decrease to US$3.45 billion in 2024, Marathon Petroleum's continued focus on high-return projects has bolstered its competitive edge. The addition of new capital project developments, such as those in Galveston Bay and LA Refineries, aims to elevate margins and enhance shareholder returns. Importantly, these efforts have positioned the company as a significant player in the integrated downstream energy sector, although recent annual returns have underperformed both the broader US market and the US Oil and Gas industry.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPC

Marathon Petroleum

Operates as an integrated downstream energy company in the United States.

Established dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives