- United States

- /

- Energy Services

- /

- NYSE:LBRT

Liberty Energy (LBRT): Valuation in Focus After Power Expansion Plans and Dividend Hike Spark Stock Rally

Reviewed by Simply Wall St

Liberty Energy (NYSE:LBRT) grabbed investors’ attention after its third-quarter update. Even with lower Q3 revenue and profit, the stock quickly bounced higher as management offered surprisingly optimistic guidance and unveiled bold plans beyond oilfield services.

See our latest analysis for Liberty Energy.

The stock’s run to a six-month high says it all: Liberty Energy’s upbeat management outlook and ambitious power expansion have completely shifted sentiment, propelling a 45% share price gain over the past month. However, its one-year total shareholder return remains modest at -5.8%. It is clear that investors are betting on momentum and the company’s ability to navigate the oilfield downturn with a diversified, growth-focused strategy.

If this kind of turnaround has you wondering about where the next opportunities might be, it could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

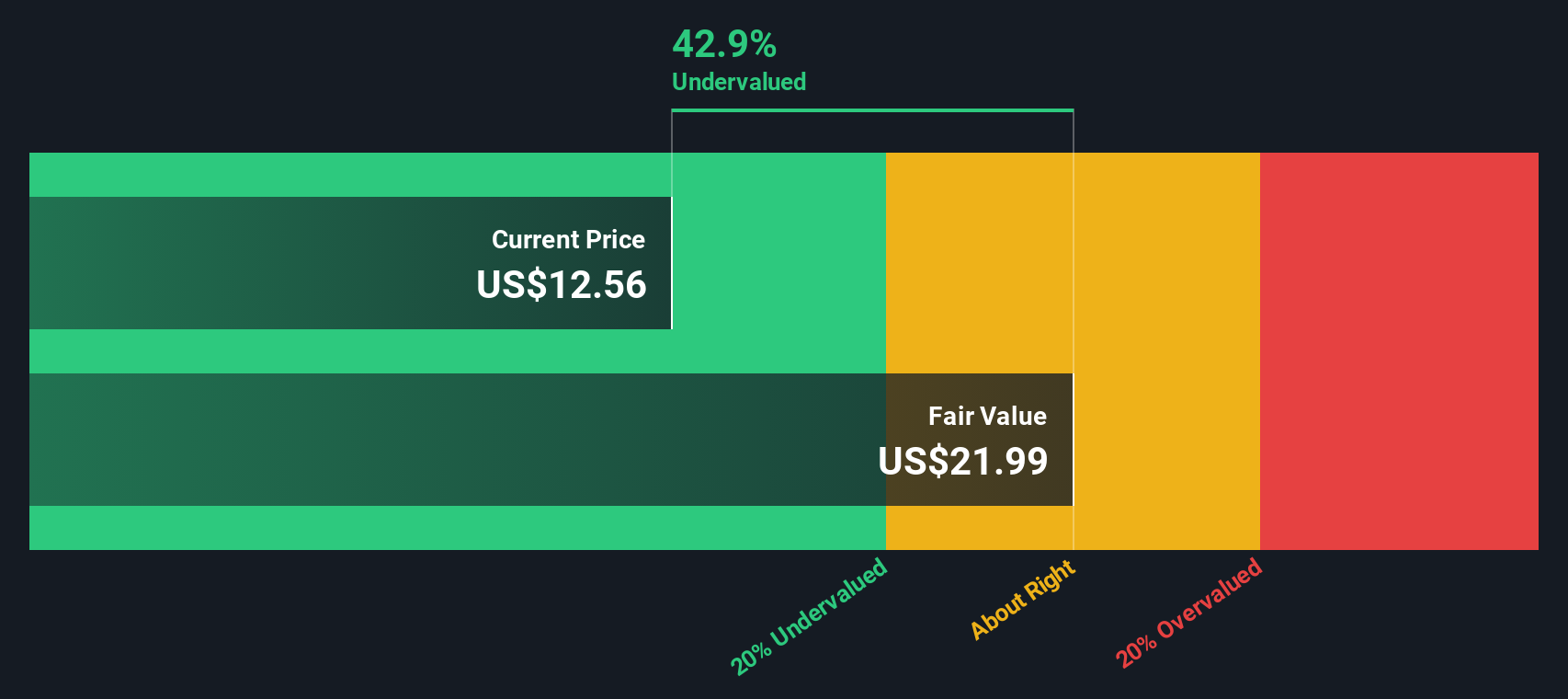

With Liberty Energy’s shares jumping to their highest level in half a year, the real question is whether the latest optimism leaves the stock undervalued or if the market is already factoring in all that future growth potential.

Most Popular Narrative: 12% Overvalued

Liberty Energy’s most-followed valuation narrative implies the stock is currently trading above its consensus fair value, with the last close ($15.91) sitting notably above the latest target price ($14.15). This creates a clear contrast between enthusiastic price action and more cautious expectations from those tracking long-term fundamentals.

“Liberty's leadership in next-generation technology, including its digiPrime/digiFleet natural gas-powered frac solutions and modular, low-emission power generation, is enabling market share gains, operational efficiencies, longer asset life, and stronger pricing with top-tier customers, supporting improved margins and higher free cash flow.”

What’s really behind this bold valuation call? All eyes are on pivotal future figures: revenue growth, margin compression, and a profit multiple that defies industry norms. Eager to discover the critical financial forecast that’s moving the market? Unlock the underlying logic and see which assumptions truly tilt the scales.

Result: Fair Value of $14.15 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer completions activity and ongoing pricing pressure could quickly reverse sentiment. This reminds investors that momentum shifts remain a constant risk.

Find out about the key risks to this Liberty Energy narrative.

Another View: Discounted Cash Flow Tells a Different Story

While analyst price targets suggest Liberty Energy is overvalued based on future earnings multiples, our DCF model arrives at a very different outcome. According to the SWS DCF model, shares are actually trading about 17% below intrinsic value. This hints at potential upside if the company meets its cash flow assumptions. Which perspective should investors trust when the numbers send such mixed signals?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Liberty Energy Narrative

If you’re not convinced by these perspectives or prefer to dive into the numbers yourself, you can easily build your own view in minutes. Do it your way

A great starting point for your Liberty Energy research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Seize your edge by tapping into fresh market opportunities you might be missing. The right stock could supercharge your portfolio. Don't let the best ideas slip by.

- Uncover fast-growing businesses making waves in healthcare innovation as you check out these 33 healthcare AI stocks.

- Accelerate your returns by targeting companies rewarding shareholders with generous income using these 17 dividend stocks with yields > 3%.

- Ride the momentum of digital currency adoption with these 79 cryptocurrency and blockchain stocks, connecting you to firms shaping tomorrow’s financial landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LBRT

Liberty Energy

Provides hydraulic fracturing services and related technologies to onshore oil and natural gas exploration, and production companies in North America.

Excellent balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives