- United States

- /

- Energy Services

- /

- NYSE:LBRT

Liberty Energy (LBRT): One-Off $115M Gain Challenges Views on Recurring Profitability

Reviewed by Simply Wall St

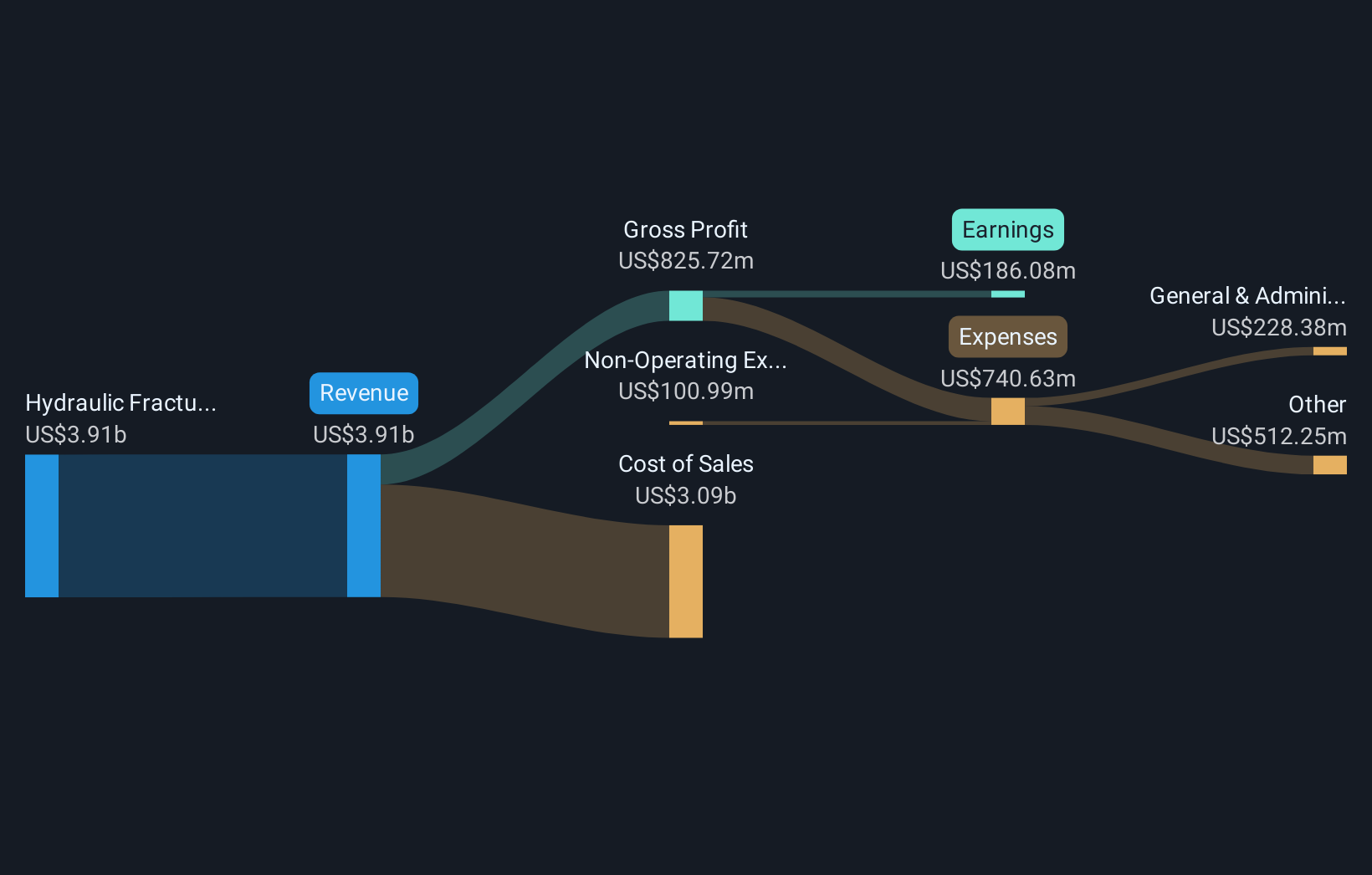

Liberty Energy (LBRT) reported a substantial one-off gain of $115.0 million for the twelve months ended June 30, 2025, which significantly shaped the year’s bottom line. Over the past five years, earnings have grown at an impressive 47.4% per year, but the most recent annual period saw negative earnings growth. This is a sharp contrast to the longer-term trend. With revenue forecast to expand at just 2.3% per year, well below the broader US market’s 10% average, investors are likely to weigh ongoing profitability prospects against a backdrop of slower top-line momentum and recent short-term volatility.

See our full analysis for Liberty Energy.Next, we will set these headline results against the core narratives shaping market sentiment to see which perspectives hold up and which get re-examined.

See what the community is saying about Liberty Energy

Margin Compression Expected by 2028

- Analysts forecast Liberty's profit margins dropping from 5.3% today to 1.0% by 2028, despite only modest annual revenue growth of about 1.8% over the next three years.

- Analysts' consensus view is that shrinking margins are likely to pressure future earnings and valuation.

- This margin decline is expected to result from industry consolidation and ongoing pricing headwinds, particularly as rig counts and customer activity soften in the core completion business.

- Leadership in advanced technology and strategic partnerships is seen as a partial offset. However, consensus suggests these strengths may not fully make up for margin pressure in the near term.

- Curious how numbers become stories that shape markets? Explore Community Narratives 📊 Read the full Liberty Energy Consensus Narrative.

Long-Term Profit Trends Diverge from the Recent Dip

- Liberty grew earnings by a robust 47.4% per year over the last five years but saw negative earnings growth in the latest period. This reversal cannot be directly compared to the multi-year trend.

- Analysts' consensus narrative weighs Liberty's decade of profitability gains against the backdrop of recent volatility.

- The presence of a one-off $115.0 million gain has skewed the headline number, prompting investors to focus instead on underlying, recurring operational results.

- While strategic investments and technology leadership support the bullish long-term thesis, concerns remain over delayed diversification and cyclical end-market risks.

Valuation Relies on High Multiple Amid Business Headwinds

- To reach the consensus analyst target of $14.15, Liberty would need to trade at a price-to-earnings ratio of 70.3x on expected 2028 earnings, which is much higher than the current US Energy Services industry multiple of 15.0x and the company's present valuation of 7.5x.

- Analysts' consensus view underscores the valuation disconnect between current share price of $15.32 and future expectations.

- This setup suggests analysts believe the market is undervaluing Liberty's long-term earnings power, even as they project near-term operational challenges.

- However, for this optimism to prove justified, investors would need to have high conviction in Liberty's recovery and margin stabilization. These factors have not yet materialized in recent earnings momentum.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Liberty Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you interpret these results another way? Share your perspective and build your own narrative in just a few minutes by clicking Do it your way

See What Else Is Out There

Liberty’s near-term outlook is clouded by shrinking profit margins and revenue growth that trails the market. This raises questions about durability and consistency.

If you’d prefer companies with reliable expansion and steady performance through changing conditions, use our stable growth stocks screener (2085 results) to discover stronger, more consistent growth stories.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LBRT

Liberty Energy

Provides hydraulic fracturing services and related technologies to onshore oil and natural gas exploration, and production companies in North America.

Excellent balance sheet with moderate risk.

Similar Companies

Market Insights

Community Narratives