- United States

- /

- Energy Services

- /

- NYSE:LBRT

Liberty Energy (LBRT): Gauging Valuation After Sharp Earnings Reversal and Weak Outlook

Reviewed by Kshitija Bhandaru

Liberty Energy (NYSE:LBRT) has seen its earnings take a sharp turn recently, which has stirred up concern about the company’s future profitability. Recent reports now indicate expectations of a steep earnings decline in the next few years.

See our latest analysis for Liberty Energy.

Liberty Energy’s share price has barely budged lately, even as investors digest the company’s stark earnings reversal and muted profit outlook. The one-year total shareholder return is essentially flat, suggesting the market is holding back on expectations for a rebound until the earnings picture improves.

If you’re weighing what else might offer a compelling growth story, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

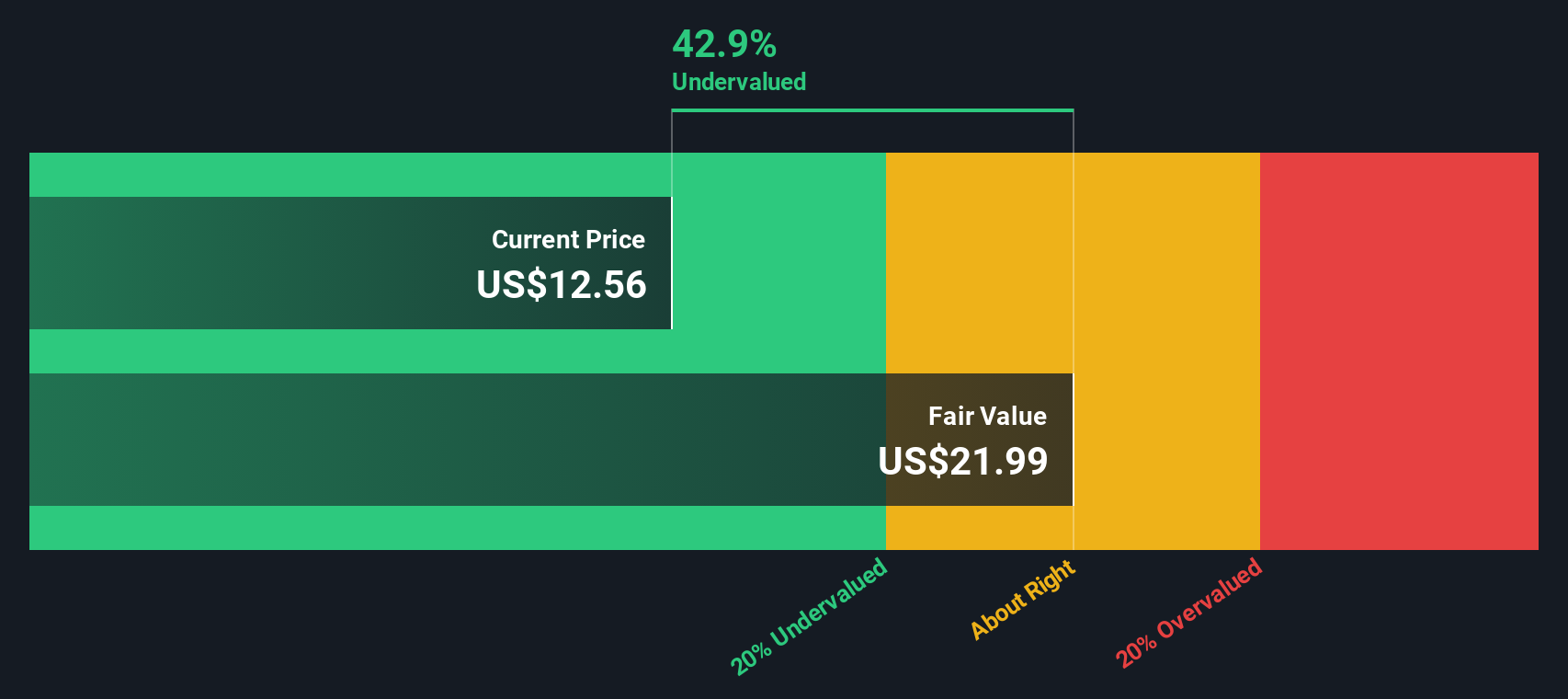

With shares trading at a significant discount to analyst price targets, investors are left to wonder if the current price already reflects the company’s gloomy earnings outlook or if a buying opportunity is quietly emerging.

Most Popular Narrative: 11.6% Undervalued

Liberty Energy’s most widely followed narrative suggests the company's fair value stands above its last close, hinting that the market might be underestimating its long-term potential at current prices.

Liberty's leadership in next-generation technology, including its digiPrime/digiFleet natural gas-powered frac solutions and modular, low-emission power generation, is enabling market share gains, operational efficiencies, longer asset life, and stronger pricing with top-tier customers. This supports improved margins and higher free cash flow.

Why do analysts think this valuation stacks up? Uncover the core financial assumption and a growth scenario that could turn the industry on its head. The answer may surprise you. Dig in to see the critical variables shaping this fair value.

Result: Fair Value of $14.61 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak oil prices and slowing U.S. completions activity could further dampen Liberty Energy’s growth outlook. This could test the bullish case for a rebound.

Find out about the key risks to this Liberty Energy narrative.

Another View: Our SWS DCF Model Points Higher

Taking a step back from price-to-earnings comparisons, our SWS DCF model suggests Liberty Energy could be considerably undervalued. It estimates a fair value of $21.94 per share, which is much higher than the current market price. Could the market be missing something big here?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Liberty Energy Narrative

If you want to check the numbers, explore different scenarios, or just trust your own analysis, you can craft your own Liberty Energy story in just a few minutes. Do it your way

A great starting point for your Liberty Energy research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the market to surprise you. Put your money to work where it counts by checking out ideas that savvy investors are acting on right now.

- Secure consistent income with stocks offering attractive yields by using these 19 dividend stocks with yields > 3% as your resource for reliable payout opportunities.

- Harness the potential of artificial intelligence by targeting companies making real breakthroughs through these 24 AI penny stocks in emerging tech spaces.

- Accelerate your search for hidden value by focusing on these 886 undervalued stocks based on cash flows that the market may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LBRT

Liberty Energy

Provides hydraulic fracturing services and related technologies to onshore oil and natural gas exploration, and production companies in North America.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives