- United States

- /

- Oil and Gas

- /

- NYSE:KRP

Kimbell Royalty Partners (KRP): Revisiting Valuation After Recent Share Price Weakness

Reviewed by Simply Wall St

Kimbell Royalty Partners (KRP) has quietly slipped about 17% over the past month and nearly 30% this year, putting the stock back on many income focused investors watchlists.

See our latest analysis for Kimbell Royalty Partners.

The recent slide in Kimbell Royalty Partners’ 30 day share price return of minus 16.6 percent caps a year to date share price return of nearly minus 30 percent, even as its five year total shareholder return of roughly 150 percent signals that long term momentum has not completely faded.

If this recent weakness has you rethinking where to find durable income and growth, it could be a good moment to explore fast growing stocks with high insider ownership as potential fresh ideas beyond energy royalties.

With the units now trading at just half of the average analyst price target and suggesting a steep intrinsic discount, is Kimbell a mispriced cash flow vehicle, or is the market already bracing for weaker royalty growth ahead?

Most Popular Narrative: 33.1% Undervalued

With Kimbell Royalty Partners last closing at $11.50 against a most popular narrative fair value near $17, the embedded growth expectations behind that gap deserve a closer look.

The analysts have a consensus price target of $17.2 for Kimbell Royalty Partners based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.0, and the most bearish reporting a price target of just $12.0.

Curious how a low current margin business gets marked for steep profit expansion and premium valuation multiples, all discounted at a precise hurdle rate? The most popular narrative lays out a detailed roadmap of rising revenues, sharply improving profitability and a future earnings multiple more often associated with fast growing sectors. Want to see exactly which financial levers have to fire in sequence for that target price to hold up? Read on to unpack the full growth and valuation blueprint behind this call.

Result: Fair Value of $17.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained acquisition cost inflation or faster than expected declines in legacy wells could quickly compress margins and challenge those optimistic profit and valuation assumptions.

Find out about the key risks to this Kimbell Royalty Partners narrative.

Another View

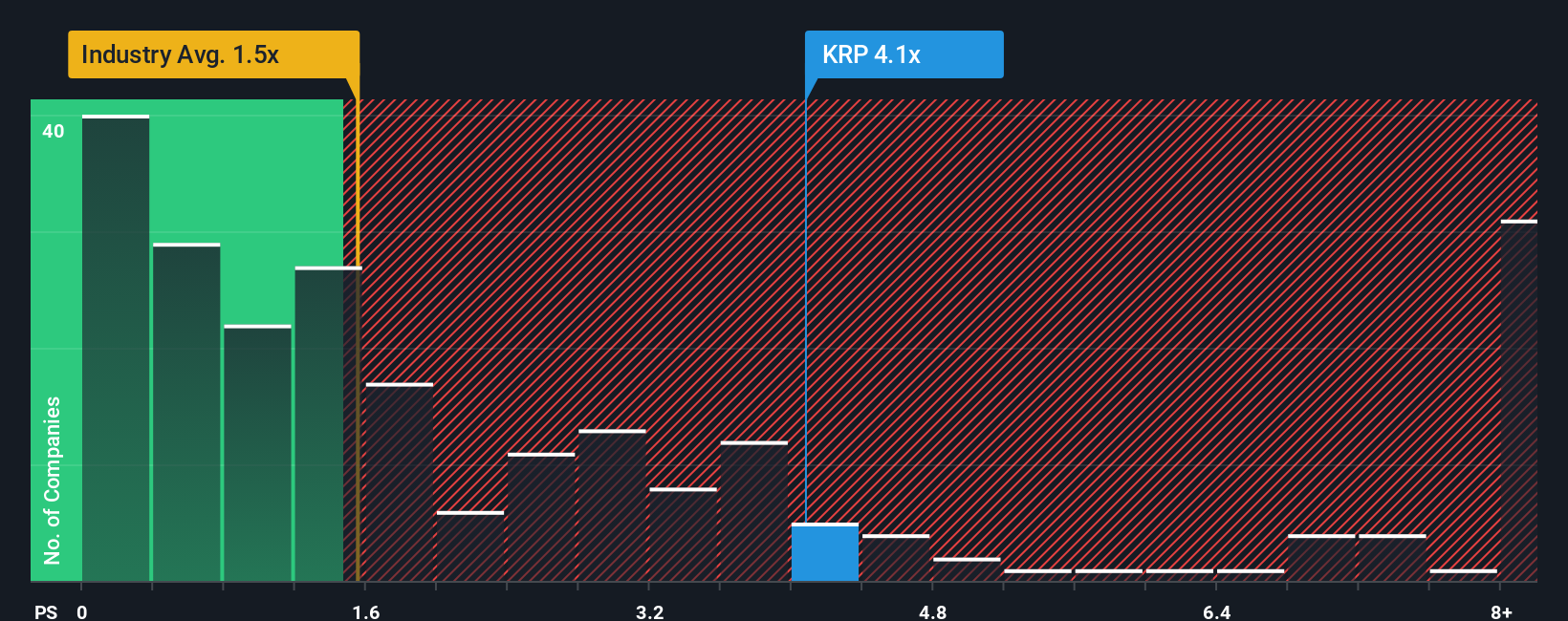

While the popular narrative leans on future earnings and a rich 34.7 times multiple, the current price to sales of 3.4 times tells a tougher story. It sits above the industry at 1.5 times, peers at 2.8 times, and even its own fair ratio of 3.3 times. This hints at less margin of safety than the headline undervaluation suggests and raises the question of which lens to trust when sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kimbell Royalty Partners Narrative

If you are not fully aligned with this perspective, or would rather dig into the numbers yourself, you can quickly craft a custom view in just a few minutes, Do it your way.

A great starting point for your Kimbell Royalty Partners research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with just one opportunity. Use Simply Wall St's powerful Screener to uncover more targeted ideas that match your goals before the market moves on.

- Capture potential growth by reviewing these 25 AI penny stocks that are shaping the next wave of intelligent technology and automation.

- Support your income strategy by focusing on these 13 dividend stocks with yields > 3% that can provide cash returns through changing market cycles.

- Monitor evolving finance trends by following these 80 cryptocurrency and blockchain stocks that are involved in blockchain, tokenization and digital payments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kimbell Royalty Partners might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KRP

Kimbell Royalty Partners

Owns and acquires mineral and royalty interests in oil and natural gas properties in the United States.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)