- United States

- /

- Energy Services

- /

- NYSE:KGS

Kodiak Gas Services, Inc. (NYSE:KGS) Shares Slammed 27% But Getting In Cheap Might Be Difficult Regardless

Kodiak Gas Services, Inc. (NYSE:KGS) shares have had a horrible month, losing 27% after a relatively good period beforehand. Still, a bad month hasn't completely ruined the past year with the stock gaining 37%, which is great even in a bull market.

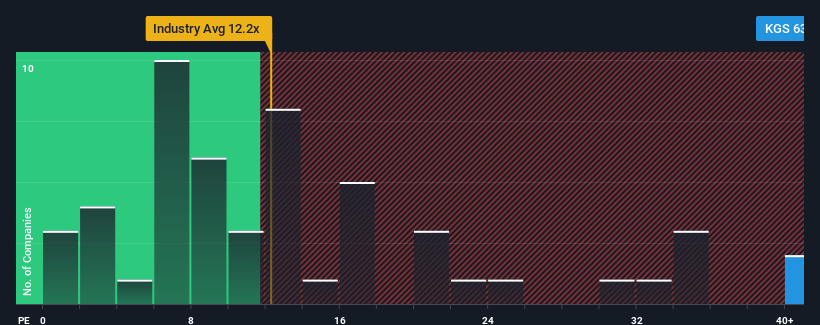

In spite of the heavy fall in price, given close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may still consider Kodiak Gas Services as a stock to avoid entirely with its 63.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

With earnings growth that's superior to most other companies of late, Kodiak Gas Services has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Kodiak Gas Services

Is There Enough Growth For Kodiak Gas Services?

The only time you'd be truly comfortable seeing a P/E as steep as Kodiak Gas Services' is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 104% last year. Still, incredibly EPS has fallen 82% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 69% per annum as estimated by the six analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 11% per annum, which is noticeably less attractive.

With this information, we can see why Kodiak Gas Services is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Kodiak Gas Services' P/E

Kodiak Gas Services' shares may have retreated, but its P/E is still flying high. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Kodiak Gas Services' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

You should always think about risks. Case in point, we've spotted 4 warning signs for Kodiak Gas Services you should be aware of, and 2 of them make us uncomfortable.

If you're unsure about the strength of Kodiak Gas Services' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kodiak Gas Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:KGS

Kodiak Gas Services

Operates contract compression infrastructure for customers in the oil and gas industry in the United States.

Slight and fair value.

Similar Companies

Market Insights

Community Narratives