- United States

- /

- Oil and Gas

- /

- NYSE:INSW

Can International Seaways' (INSW) New Bond Issue Reinforce Its Sustainability Ambitions Amid Fleet Modernization?

Reviewed by Sasha Jovanovic

- On October 7, 2025, International Seaways, Inc. completed a US$250 million private placement of senior unsecured bonds maturing in 2030 with participation from four investors.

- This capital injection supports International Seaways' ongoing efforts to upgrade its fleet with eco-friendly vessels while divesting older ships in response to tightening environmental regulations.

- We'll examine how this significant bond issuance strengthens International Seaways' balance sheet and lifts its investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

International Seaways Investment Narrative Recap

To be a shareholder in International Seaways, you need to believe in the long-term relevance of crude and product shipping and that modernizing the fleet will help the company adapt to stricter environmental demands. The recent US$250 million private bond placement appears supportive of the short-term catalyst, fleet renewal, but does not materially reduce the biggest risk: the potential drag from declining fossil fuel demand and tightening regulation. Among the recent announcements, the September 2025 issuance of US$250 million in 7.125% senior unsecured bonds stands out. These proceeds are earmarked for repurchasing six VLCCs and general corporate purposes, which ties directly to the catalyst of fleet modernization and maintaining competitiveness under new environmental standards. However, as investors weigh all the potential, it’s worth noting that the biggest threat remains if crude demand trends shift faster than expected and...

Read the full narrative on International Seaways (it's free!)

International Seaways' outlook anticipates $848.0 million in revenue and $288.7 million in earnings by 2028. This is based on a 2.0% annual revenue growth rate and a $50.1 million increase in earnings from the current $238.6 million.

Uncover how International Seaways' forecasts yield a $53.50 fair value, a 23% upside to its current price.

Exploring Other Perspectives

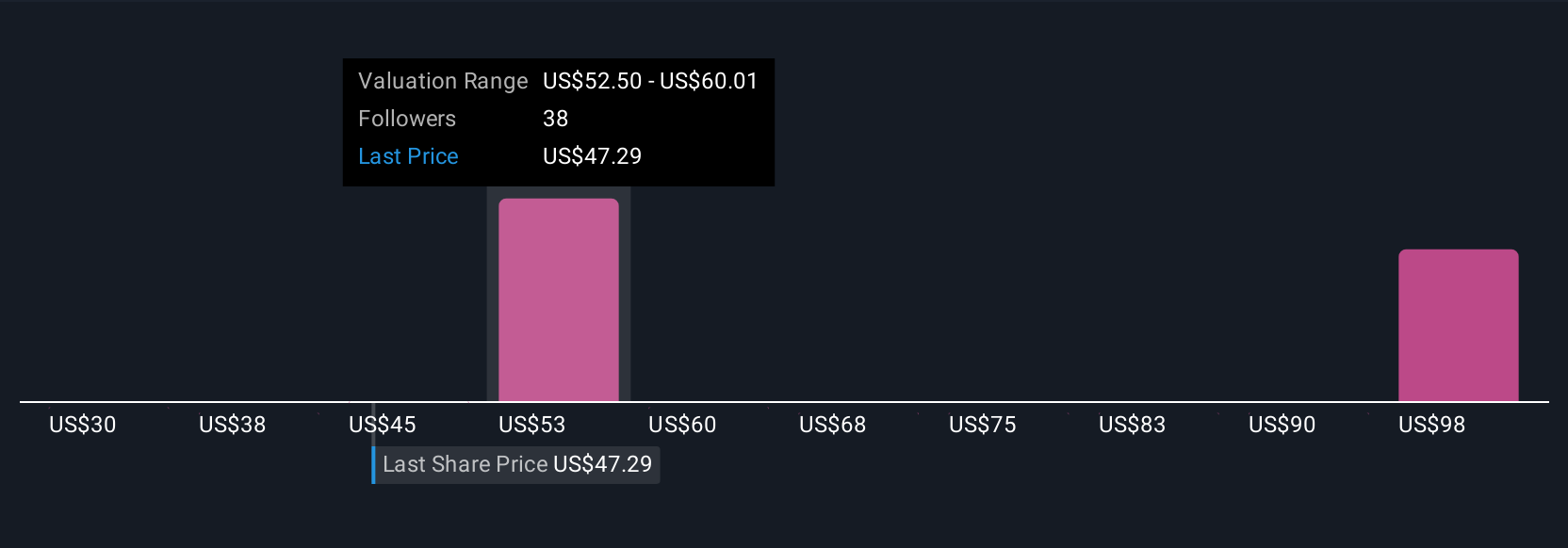

Six members of the Simply Wall St Community estimate International Seaways’ fair value anywhere from US$30 to US$108.61 per share. While opinions differ, many are focused on how fleet renewal could support margins in a changing energy market; explore several viewpoints to inform your own outlook.

Explore 6 other fair value estimates on International Seaways - why the stock might be worth over 2x more than the current price!

Build Your Own International Seaways Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your International Seaways research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free International Seaways research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate International Seaways' overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INSW

International Seaways

Owns and operates a fleet of oceangoing vessels for the transportation of crude oil and petroleum products in the international flag trade.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives