- United States

- /

- Energy Services

- /

- NYSE:HLX

Helix Energy Solutions (HLX): Margin Surge Reinforces Bullish Narrative, Outpacing Market Profit Growth

Reviewed by Simply Wall St

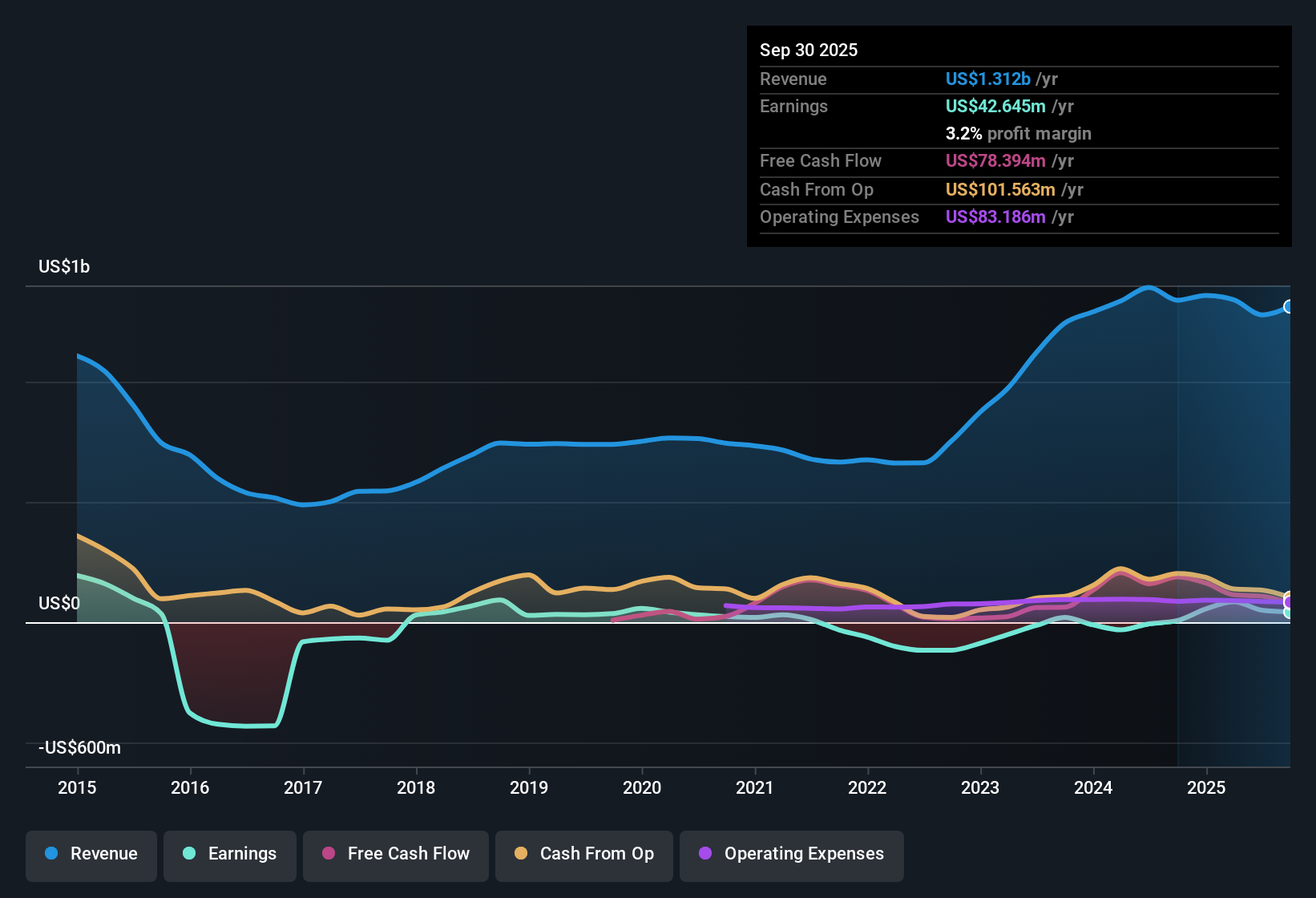

Helix Energy Solutions Group (HLX) delivered standout earnings momentum this year, with its net profit margin rising to 3.2% from just 0.5% a year ago. EPS growth has surged an impressive 493.9% over the past year, while the company’s earnings have maintained a brisk 29.7% average annual increase over the last five years. Investors are eyeing projected profit growth of 46.8% per year for the next three years, far above the US market average. At the same time, revenue is expected to grow at a more subdued 3.8% annually.

See our full analysis for Helix Energy Solutions Group.Next up, we’ll see how these headline results compare with the dominant narratives in the market, highlighting where consensus meets contention.

See what the community is saying about Helix Energy Solutions Group

Contract Backlog Gives Revenue Cushion

- Recent contract wins, including an 800-day North Sea trenching deal and a three-year Exxon decommissioning agreement, have expanded Helix's backlog and provided greater revenue visibility through at least 2027.

- Analysts' consensus view highlights that geographic diversification and a focus on renewables and regulatory-driven decommissioning are expected to stabilize long-term earnings and increase pricing power.

- The company’s growing mix of long-term, multi-year contracts in new regions supports not only topline growth but also helps buffer against volatility in traditional markets.

- Consistent investment in advanced robotics and vessel capabilities is seen as supporting higher margins and reducing overall earnings volatility, aligning with the consensus that Helix will be less dependent on boom and bust cycles.

- Consensus points to lasting impacts from these contract wins, laying groundwork for stable growth even as revenue growth rates lag the broader US energy service market.

- As the company secures projects linked to regulatory abandonment and offshore wind, it creates a defensible base for future cash flow.

What does this mean for the balanced perspective on Helix’s future? See how analysts weigh in on the big picture, and whether these numbers confirm or challenge consensus expectations. 📊 Read the full Helix Energy Solutions Group Consensus Narrative.

Margin Expansion Anchored by Higher Utilization

- Profit margins are expected to improve from 3.9% to 7.4% by 2028, reflecting more efficient operations and higher vessel utilization from a deeper pipeline of renewable energy and decommissioning work.

- According to analysts' consensus, Helix’s expansion and steady activity in its Robotics segment, especially in renewables and site clearance, is anticipated to support a lift in average margins and strengthen net profitability, even if spot market segments remain volatile.

- Backlog growth pairs with strong demand for offshore maintenance, which improves utilization and resilience in the face of fluctuating oil and gas activity.

- Consensus notes that Helix’s focus on automation and technology upgrades positions it as a preferred provider, giving it both margin upside and competitive advantages over less-specialized peers.

High Valuation vs. Industry Peers

- At a price-to-earnings ratio of 24.1x, Helix trades at a premium above the US energy services industry average of 14.6x and projected future multiple of 16.7x, adding tension to the story despite the current $7.00 share price being well below the $9.50 analyst target.

- Analysts' consensus view notes that while Helix’s discounted share price signals potential value, investors need to believe in doubled earnings ($103 million by 2028) and rising margins to justify the premium. Otherwise, the higher valuation could limit future upside.

- The premium PE ratio suggests that the market is already pricing in much of the anticipated earnings growth and margin improvement baked into the consensus thesis.

- With many peers trading on lower earnings multiples, the company’s progress on executing contracts and growing free cash flow will be under close watch by investors focused on valuation discipline.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Helix Energy Solutions Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the results from another angle? In just a few minutes, you can shape your own narrative and bring your perspective to life. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Helix Energy Solutions Group.

See What Else Is Out There

Helix’s premium valuation means investors face more downside risk if earnings and margin improvements fall short of the already high expectations priced in.

If you're concerned about paying too much for potential, discover better value opportunities with these 877 undervalued stocks based on cash flows that do not require perfection to deliver upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Helix Energy Solutions Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HLX

Helix Energy Solutions Group

An offshore energy services company, provides specialty services to the offshore energy industry in Brazil, the United States, North Sea, the Asia Pacific, West Africa, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)