- United States

- /

- Energy Services

- /

- NYSE:HAL

Should Investors Reconsider Halliburton After Shares Slide 9.6% in One Week?

Reviewed by Bailey Pemberton

If you’ve got Halliburton in your sights right now, you’re definitely not alone. The stock is coming off a tough patch that’s caught the attention of seasoned investors and newcomers alike. Over the past year, shares have slid by a pretty hefty 26.7%, and even the last month brought a -2.8% dip. More recently, a 9.6% drop in just one week has raised some eyebrows about whether risks are rising, or if there’s an opportunity hiding beneath the surface.

Despite the rocky ride, it’s important to look past the red ink and consider what’s driving these moves. Halliburton’s longer-term track record actually includes a remarkable 95.5% gain over the past five years, reminding us that sharp swings aren’t unusual in energy stocks, especially amid shifting market sentiment and evolving industry trends.

So, is the recent dip a warning sign, or just the market resetting its expectations? Here’s where things get interesting: Halliburton’s valuation score is a rock-solid 6 out of 6, meaning it checks all the boxes for being undervalued by conventional measures. That’s the sort of setup that value-focused investors pay close attention to.

Next, let’s break down each key valuation approach to see what’s really driving this score. Stick around, because after that, I’ll share a perspective on valuation that’s even more insightful for long-term investors.

Why Halliburton is lagging behind its peers

Approach 1: Halliburton Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's true worth by projecting future cash flows and then discounting them back to today's value. This method aims to answer what Halliburton is really worth based on how much cash it can generate over time.

For Halliburton, the current Free Cash Flow stands at $2.23 billion. Analysts forecast only the next five years, but projections extend further through additional modeling. By 2029, Halliburton's Free Cash Flow is expected to reach approximately $2.15 billion, with the ten-year outlook indicating a steady path of future growth in a similar range. These cash flows are all considered in dollars, aligning with how Halliburton reports its results.

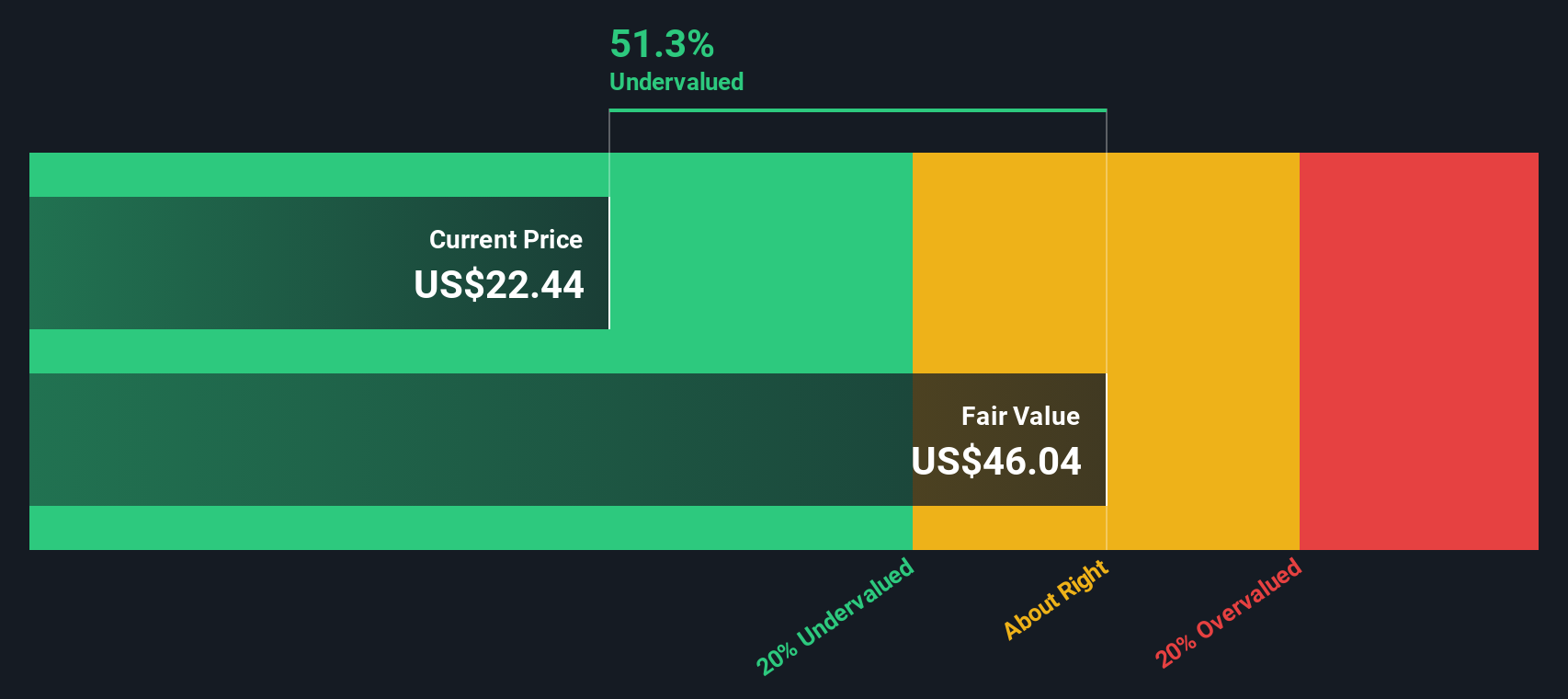

After discounting these future cash flows back to present value, the DCF model estimates Halliburton’s intrinsic fair value at $46.24 per share. This represents a 52.5% discount to the current stock price, suggesting it appears substantially undervalued by this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Halliburton is undervalued by 52.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Halliburton Price vs Earnings (PE)

For established and consistently profitable companies like Halliburton, the Price-to-Earnings (PE) ratio is a tried and true way to gauge valuation. The PE ratio tells you how much investors are willing to pay for each dollar of earnings, offering a clear perspective on market sentiment surrounding the company’s profitability.

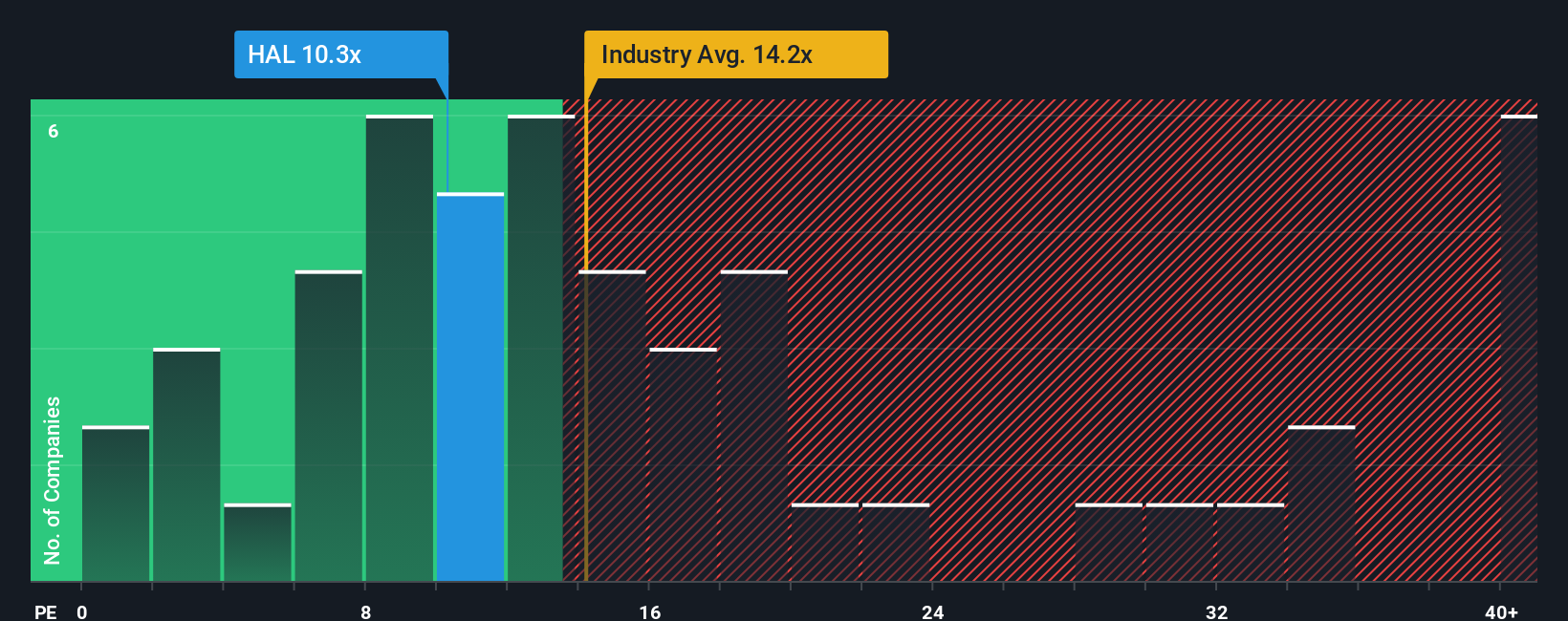

In general, a “normal” or fair PE ratio depends on a company’s growth outlook and how much risk investors are willing to take. Higher growth can justify a higher PE, while more risk typically pulls it down. Comparing Halliburton’s current PE ratio of 10.1x to the Energy Services industry average PE of 14.0x and the peer group average of 12.9x shows it is trading at a visible discount.

Looking beyond these broad comparisons, Simply Wall St’s proprietary Fair Ratio takes the analysis a step further. It factors in Halliburton’s earnings growth potential, profit margins, industry dynamics, company size, and risk profile to arrive at a tailored benchmark. The Fair Ratio for Halliburton is 16.5x, higher than both the industry and its actual PE. This makes it a more robust indicator, as it goes beyond superficial averages and focuses on the factors that truly drive valuation for Halliburton itself.

With the current PE at 10.1x and the Fair Ratio at 16.5x, Halliburton appears notably undervalued based on this metric, highlighting a potential opportunity if the gap closes.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Halliburton Narrative

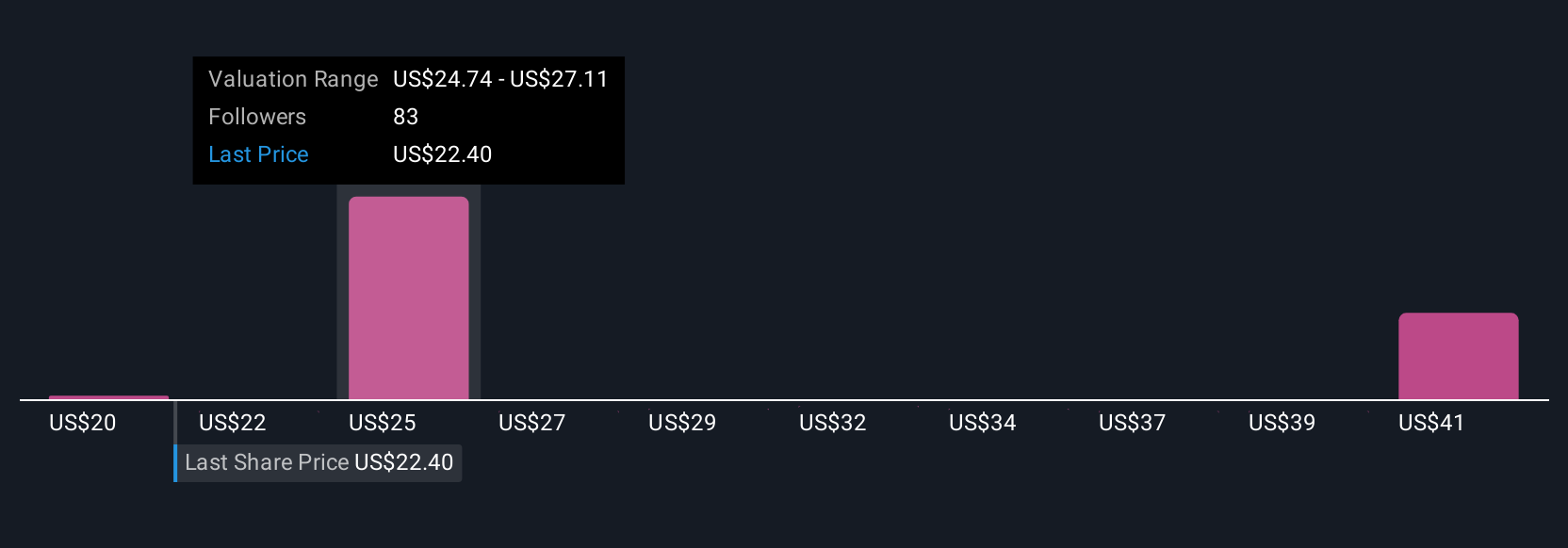

Earlier we mentioned there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your own story or perspective about a company, woven from what you believe about its future, such as how much it could earn, how fast it might grow, and what risks or opportunities lie ahead. By turning your perspective into specific forecasts for revenue, earnings, and margins, then connecting that to a fair value estimate, Narratives link the company's story directly to the numbers that drive investment decisions.

On Simply Wall St’s Community page, Narratives make this process easy and accessible, empowering millions of investors to share and refine their views. Narratives dynamically update when new information, such as earnings reports or news, comes in, so your estimates and fair value stay current. They also help you decide when to buy or sell by comparing your own Fair Value to the latest share price, so you can see at a glance if you think Halliburton is under- or over-priced.

For example, one Halliburton Narrative expects booming global energy demand to drive a fair value as high as $35.00, while a more cautious story focused on decarbonization risks sees a fair value closer to $20.00.

Do you think there's more to the story for Halliburton? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Halliburton might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:HAL

Halliburton

Provides products and services to the energy industry worldwide.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives