- United States

- /

- Oil and Gas

- /

- NYSE:ASC

3 Reliable Dividend Stocks Yielding Up To 9%

Reviewed by Simply Wall St

As U.S. stock indexes continue to rise despite the ongoing government shutdown, investors are keenly observing how these developments might influence market dynamics and decision-making by the Federal Reserve. In this environment, dividend stocks can offer a reliable income stream, making them an attractive option for those looking to balance growth with stability in their portfolios.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Rayonier (RYN) | 10.74% | ★★★★★☆ |

| Peoples Bancorp (PEBO) | 5.48% | ★★★★★☆ |

| OceanFirst Financial (OCFC) | 4.48% | ★★★★★★ |

| Huntington Bancshares (HBAN) | 3.60% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.90% | ★★★★★★ |

| Ennis (EBF) | 5.51% | ★★★★★★ |

| Columbia Banking System (COLB) | 5.45% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.75% | ★★★★★☆ |

| Chevron (CVX) | 4.45% | ★★★★★★ |

| Banco Latinoamericano de Comercio Exterior S. A (BLX) | 5.55% | ★★★★★☆ |

Click here to see the full list of 123 stocks from our Top US Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Timberland Bancorp (TSBK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Timberland Bancorp, Inc. is the bank holding company for Timberland Bank, offering a range of community banking services in Washington, with a market cap of $257.84 million.

Operations: Timberland Bancorp, Inc. generates its revenue primarily through its community banking services, with the segment accounting for $78.34 million.

Dividend Yield: 3.2%

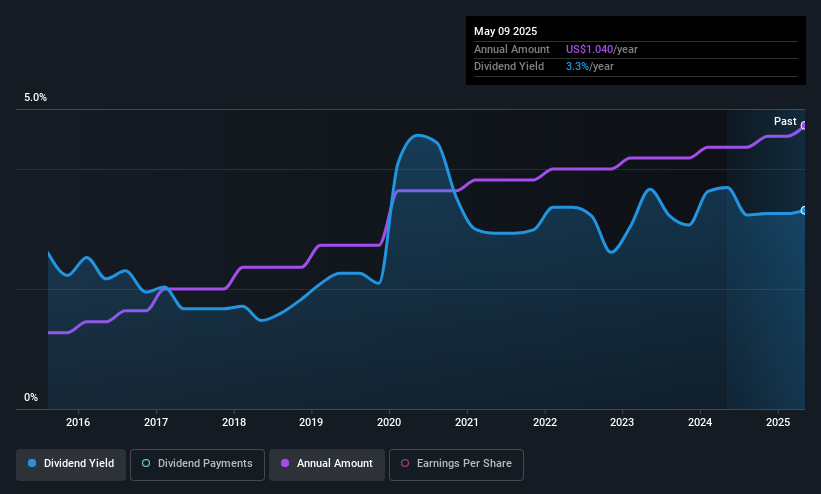

Timberland Bancorp recently declared a quarterly dividend of $0.26 per share, reflecting its stable and reliable dividend history over the past decade. With a payout ratio of 29.3%, dividends are well-covered by earnings, although its yield of 3.19% is lower than the top US dividend payers. The company reported solid financials with increased net income and earnings per share for Q3 2025, alongside an active buyback program enhancing shareholder value.

- Delve into the full analysis dividend report here for a deeper understanding of Timberland Bancorp.

- According our valuation report, there's an indication that Timberland Bancorp's share price might be on the cheaper side.

Ardmore Shipping (ASC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ardmore Shipping Corporation operates in the global seaborne transportation of petroleum products and chemicals, with a market cap of $490.74 million.

Operations: Ardmore Shipping Corporation's revenue primarily comes from transporting refined petroleum products and chemicals, totaling $324.20 million.

Dividend Yield: 7.9%

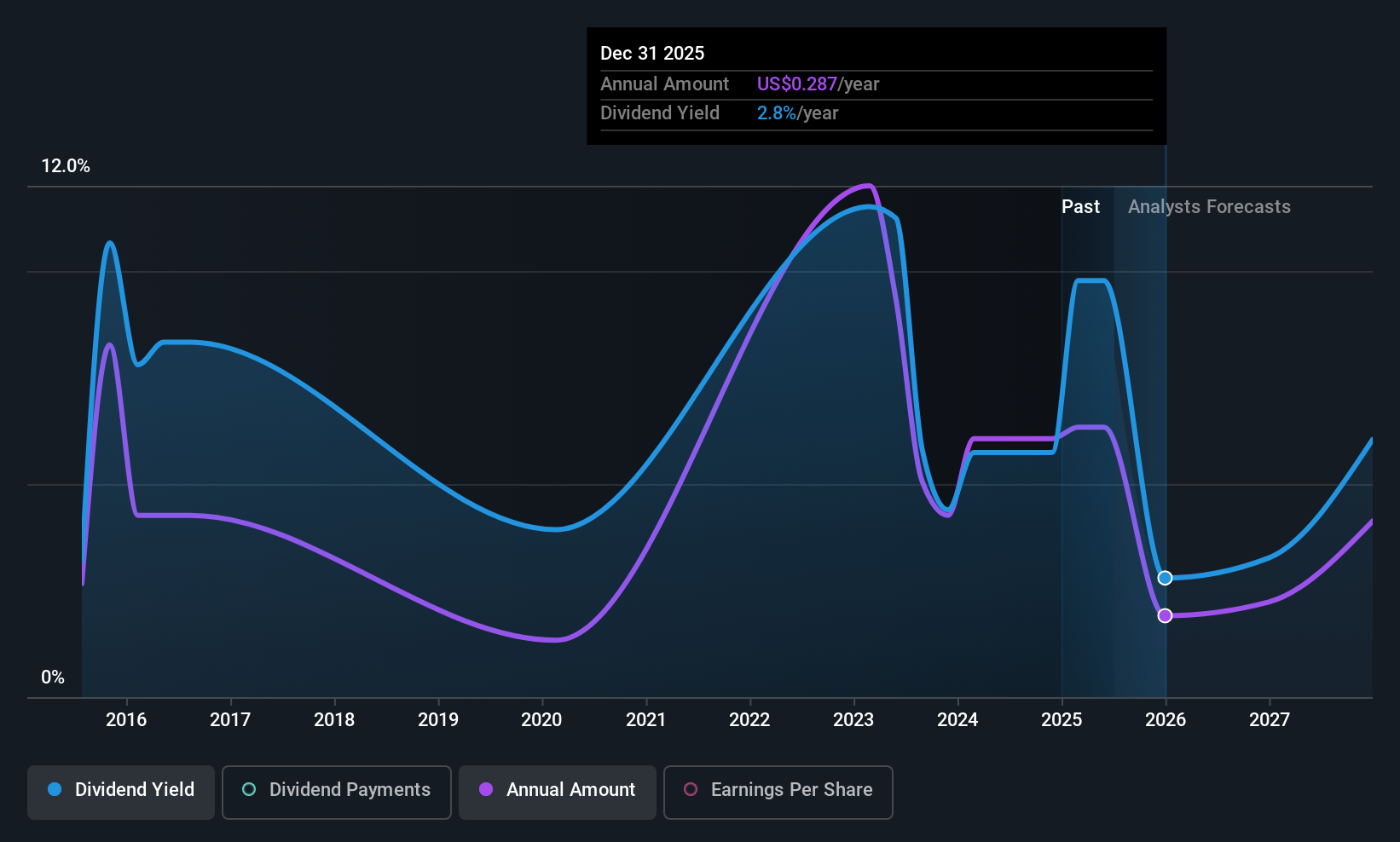

Ardmore Shipping's dividend payments have increased over the past decade, with a current yield of 7.86%, placing it among the top US dividend payers. Despite its strong earnings and cash flow coverage (payout ratios of 36.4% and 47.3% respectively), dividends have been volatile, with significant fluctuations over the years. Recent financials show a decline in Q2 net income to US$9.6 million from US$62.69 million year-on-year, indicating potential challenges in sustaining dividend reliability amidst fluctuating profits.

- Take a closer look at Ardmore Shipping's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Ardmore Shipping is trading behind its estimated value.

GeoPark (GPRK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GeoPark Limited is an oil and natural gas exploration and production company operating in several Latin American countries, with a market cap of $336.22 million.

Operations: GeoPark Limited generates revenue primarily from its oil and gas exploration and production segment, which amounts to $560.35 million.

Dividend Yield: 9%

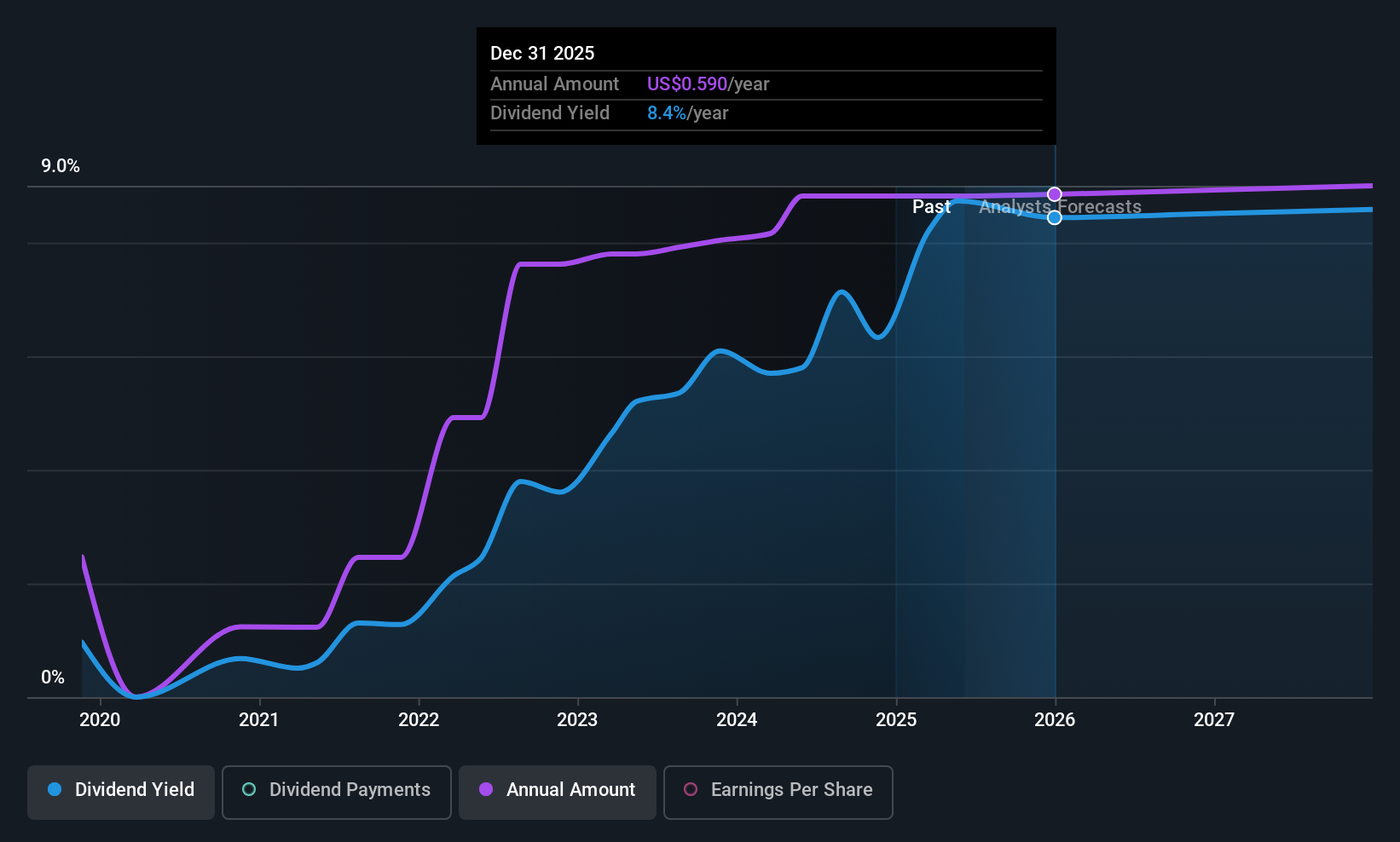

GeoPark's dividend yield of 9.02% ranks it in the top quartile of US dividend payers, supported by a payout ratio of 72.1% and a cash payout ratio of 29.7%. However, its dividends have been volatile over its six-year history, reflecting instability despite recent affirmations. The company's Q2 financials revealed a net loss and declining revenues, compounded by high debt levels and reduced profit margins from the previous year, raising concerns about future dividend sustainability amidst business expansions in Argentina.

- Dive into the specifics of GeoPark here with our thorough dividend report.

- The analysis detailed in our GeoPark valuation report hints at an deflated share price compared to its estimated value.

Key Takeaways

- Navigate through the entire inventory of 123 Top US Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:ASC

Ardmore Shipping

Engages in the seaborne transportation of petroleum products and chemicals worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives