- United States

- /

- Banks

- /

- NYSE:FHN

3 Reliable Dividend Stocks To Consider With Yields Up To 8.7%

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped by 1.4%, but over the longer term, it has risen by 11% in the past year with earnings forecast to grow by 14% annually. In this fluctuating environment, reliable dividend stocks can offer a steady income stream and potential for growth, making them an attractive option for investors seeking stability and returns.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 6.09% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 7.10% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 6.15% | ★★★★★★ |

| Ennis (NYSE:EBF) | 5.34% | ★★★★★★ |

| Chevron (NYSE:CVX) | 5.06% | ★★★★★★ |

| Credicorp (NYSE:BAP) | 5.35% | ★★★★★☆ |

| Southside Bancshares (NYSE:SBSI) | 5.12% | ★★★★★☆ |

| Valley National Bancorp (NasdaqGS:VLY) | 5.06% | ★★★★★☆ |

| Huntington Bancshares (NasdaqGS:HBAN) | 4.02% | ★★★★★☆ |

| Carter's (NYSE:CRI) | 9.89% | ★★★★★☆ |

Click here to see the full list of 146 stocks from our Top US Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

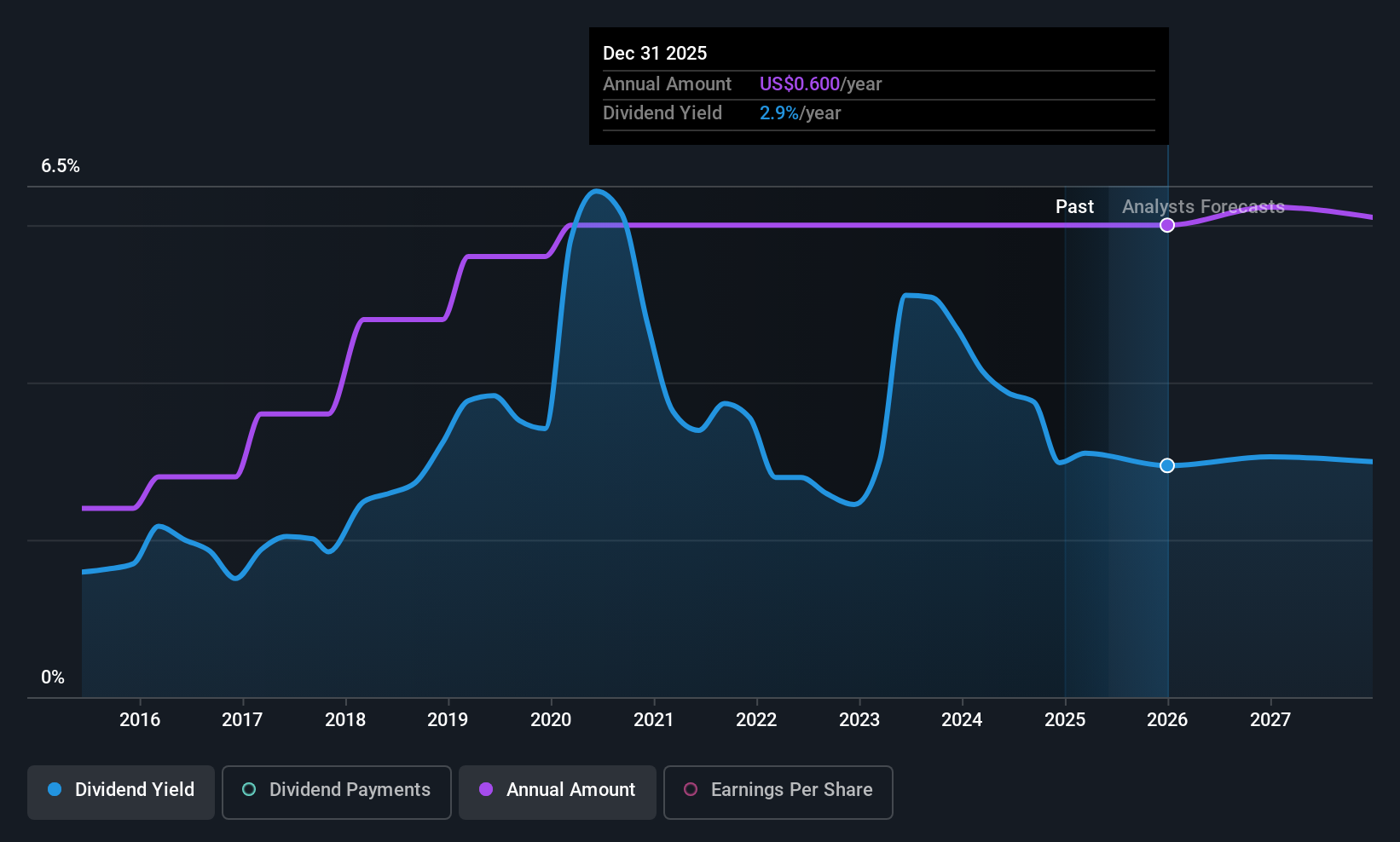

First Horizon (NYSE:FHN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: First Horizon Corporation, with a market cap of $9.86 billion, operates as the bank holding company for First Horizon Bank, offering a range of financial services.

Operations: First Horizon Corporation's revenue segments include Wholesale generating $430 million and Commercial, Consumer, and Wealth contributing $2.85 billion.

Dividend Yield: 3%

First Horizon's dividend yield of 3.04% is reliable, with a stable payout history over the past decade. The company's dividends are well covered by earnings, with a current payout ratio of 41.5%, projected to decrease to 32.5% in three years, indicating sustainability. Recent activities include share buybacks totaling $488.87 million and amendments to company bylaws affecting board composition. Additionally, First Horizon has declared cash dividends on various preferred stock series payable in mid-2025.

- Unlock comprehensive insights into our analysis of First Horizon stock in this dividend report.

- The analysis detailed in our First Horizon valuation report hints at an deflated share price compared to its estimated value.

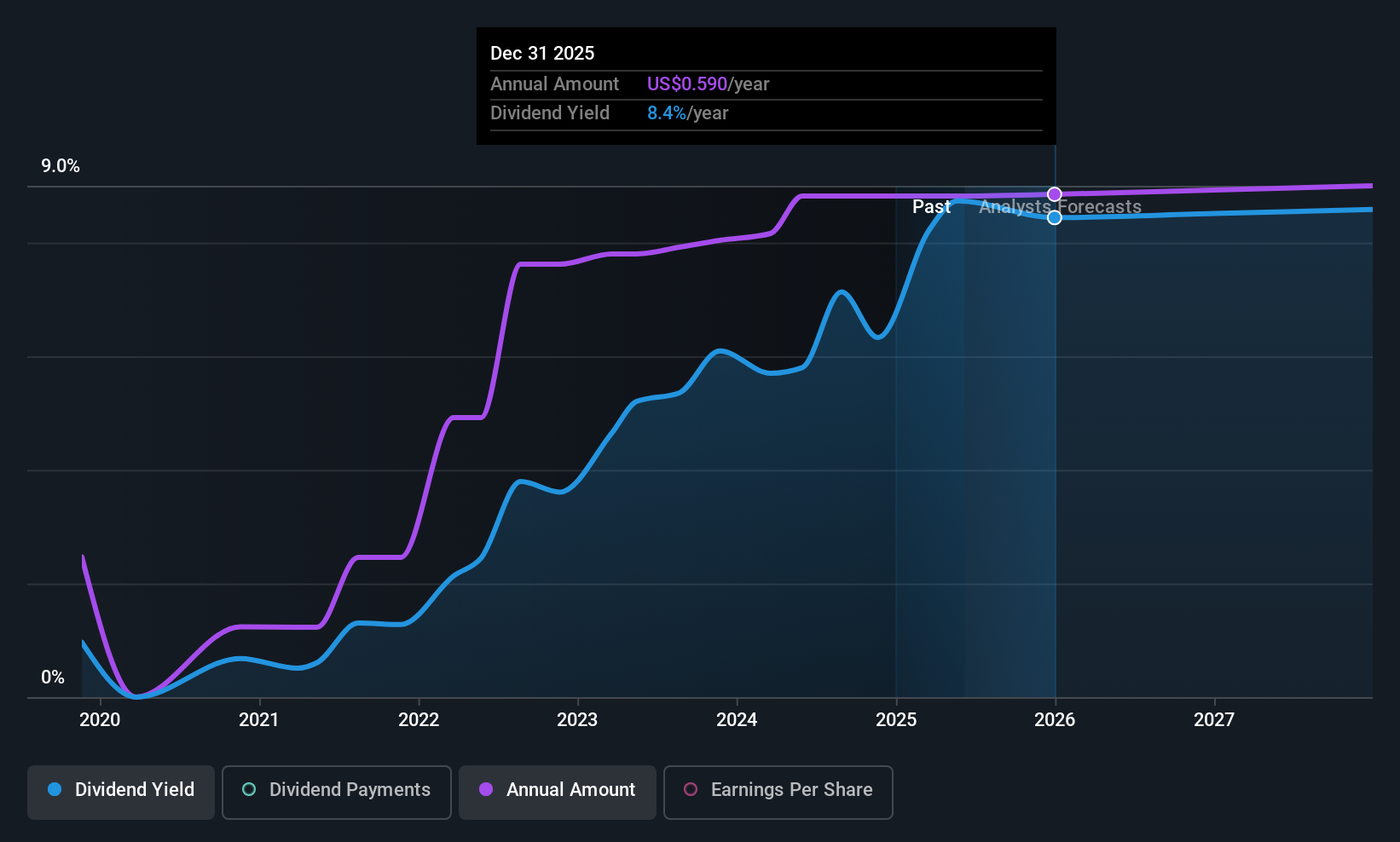

GeoPark (NYSE:GPRK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GeoPark Limited is an oil and natural gas exploration and production company operating in several Latin American countries, with a market cap of $346.91 million.

Operations: GeoPark Limited generates revenue primarily from its oil and gas exploration and production segment, amounting to $630.77 million.

Dividend Yield: 8.7%

GeoPark's dividend yield is among the top 25% in the U.S. market, supported by a low payout ratio of 38.5%, indicating sustainability despite a volatile six-year payment history. The company declared a quarterly dividend of $0.147 per share, approximately $7.5 million, payable June 2025. Although recent earnings showed declines with net income at $13.07 million for Q1 2025, new leadership under Felipe Bayon could influence future performance and strategy execution in core assets like Vaca Muerta and Llanos 34 Block.

- Take a closer look at GeoPark's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that GeoPark is trading behind its estimated value.

Southern Copper (NYSE:SCCO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Southern Copper Corporation is involved in mining, exploring, smelting, and refining copper and other minerals across Peru, Mexico, Argentina, Ecuador, and Chile with a market cap of $73.11 billion.

Operations: Southern Copper Corporation's revenue segments include $6.60 billion from Mexican Open-Pit operations, $4.84 billion from Peruvian Operations, and $713.10 million from the Mexican Industrial Minera Mexico and Subsidiaries (IMMSA) Unit.

Dividend Yield: 3%

Southern Copper's dividend payments are supported by a reasonable payout ratio of 43.6%, covered by both earnings and cash flows, but have been historically volatile over the past decade. Despite this instability, dividends have grown in the same period. Recent financial results show strong performance with Q1 2025 sales at US$3.12 billion and net income at US$945.9 million, reflecting a significant year-over-year increase, though its dividend yield remains below the top U.S. payers at 3.03%.

- Navigate through the intricacies of Southern Copper with our comprehensive dividend report here.

- According our valuation report, there's an indication that Southern Copper's share price might be on the expensive side.

Make It Happen

- Navigate through the entire inventory of 146 Top US Dividend Stocks here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FHN

First Horizon

Operates as the bank holding company for First Horizon Bank that provides various financial services.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives