- United States

- /

- Energy Services

- /

- NYSE:FTI

TechnipFMC (FTI) Is Down 5.1% After Heidrun Extension Contract Win With Equinor Has The Bull Case Changed?

Reviewed by Simply Wall St

- Earlier this month, TechnipFMC was awarded a significant integrated Engineering, Procurement, Construction, and Installation (iEPCI™) contract valued between US$75 million and US$250 million by Equinor for the Heidrun extension project in the Norwegian North Sea.

- This latest contract highlights TechnipFMC's ability to secure and execute high-value, lifecycle-extending projects for major offshore operators.

- We'll examine how the Heidrun extension contract win reinforces TechnipFMC's project backlog and supports its subsea growth narrative.

TechnipFMC Investment Narrative Recap

Owning TechnipFMC stock means believing in the company’s ability to secure large, technically complex subsea projects that can feed a growing order backlog and drive profitability. The recent iEPCI contract from Equinor for the Heidrun extension reinforces this core narrative, supporting backlog visibility and subsea segment momentum. However, while this award supports near-term order inflows, it is only a single project and does not meaningfully alter the single biggest risk: sensitivity to commodity prices that influence client spending decisions.

Of the company’s recent updates, the announcement of a large contract win from Shell for Gato do Mato offshore Brazil stands out as most directly relevant. Like the Heidrun extension, this Shell project showcases TechnipFMC’s ability to win substantial iEPCI contracts with major clients, strengthening its backlog and supporting its Subsea revenue guidance. Together, such wins build a more stable foundation for near-term growth catalysts.

Yet, investors should also be aware that if commodity prices weaken again, TechnipFMC’s backlog and revenue trajectory could look very different...

Read the full narrative on TechnipFMC (it's free!)

TechnipFMC's narrative projects $11.1 billion revenue and $1.1 billion earnings by 2028. This requires 6.0% yearly revenue growth and a $245.5 million earnings increase from $854.5 million today.

Uncover how TechnipFMC's forecasts yield a $34.75 fair value, a 7% upside to its current price.

Exploring Other Perspectives

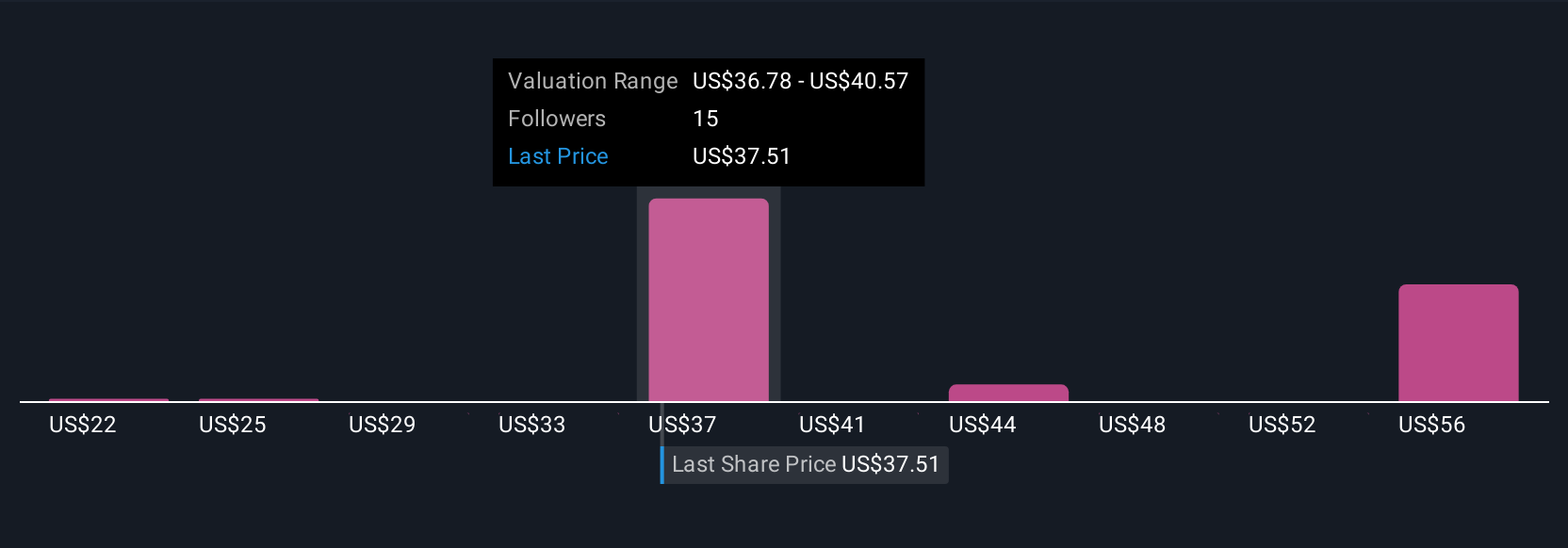

Five fair value estimates from the Simply Wall St Community span from US$21.65 to US$50.37 per share, reflecting sharply contrasting views on TechnipFMC’s outlook. Against this diversity, the company’s backlog growth and contract wins remain closely linked to shifts in commodity prices, reminding you that multiple perspectives are essential to understanding future outcomes.

Build Your Own TechnipFMC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TechnipFMC research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free TechnipFMC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TechnipFMC's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TechnipFMC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FTI

TechnipFMC

Engages in the energy projects, technologies, systems, and services businesses in Europe, Central Asia, North America, Latin America, the Asia Pacific, Africa, the Middle East, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives