- United States

- /

- Energy Services

- /

- NYSE:FTI

TechnipFMC (FTI): Evaluating Valuation After Recent Share Price Dip and Strong Long-Term Returns

Reviewed by Kshitija Bhandaru

TechnipFMC (FTI) has seen shares dip around 9% over the past month. This comes despite steady revenue and net income growth over the past year. Investors seem to be weighing recent market sentiment alongside longer-term returns.

See our latest analysis for TechnipFMC.

Despite some recent selling pressure, TechnipFMC’s 30-day share price return of -9.7% comes after a strong run so far this year. Its 21.7% year-to-date share price gain and robust 37.7% total shareholder return over the past year reinforce its longer-term momentum. Three- and five-year total returns remain well above the broader market.

If you’re interested in discovering what else is making waves beyond energy, now’s a good moment to broaden your approach and explore fast growing stocks with high insider ownership

With the stock trading nearly 19% below analyst price targets and annual profits growing, investors are considering whether TechnipFMC is undervalued at current levels or if the market is already accounting for its future prospects.

Most Popular Narrative: 13.7% Undervalued

The prevailing narrative assigns TechnipFMC a fair value that sits noticeably above its last close price, suggesting room for further upside. This valuation draws on a blend of ambitious growth targets and sector dynamics that continue to evolve.

"Expansion and recurring tail of Subsea services revenues, driven by a growing installed base and long-duration contracts (20 to 35 years), provide predictable, high-margin income streams that underpin long-term earnings stability and net margin improvement. Continued investment and leadership in subsea innovation (for example, all-electric subsea systems, hybrid flexible pipe, and CO2 capture technology) position TechnipFMC to capture value from both conventional oil & gas projects and the rising demand for energy transition infrastructure such as CCS and hydrogen, fostering top-line diversification and future margin upside."

Want to know which financial levers are fueling this optimism? The fair value hinges on projected margin improvements and bold earnings targets. Discover which assumptions shape the story and why analysts are paying close attention.

Result: Fair Value of $41.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slow adaptation to the energy transition and ongoing geopolitical risks could still challenge TechnipFMC’s future revenue growth and the predictability of its earnings.

Find out about the key risks to this TechnipFMC narrative.

Another View: Looking at Multiples

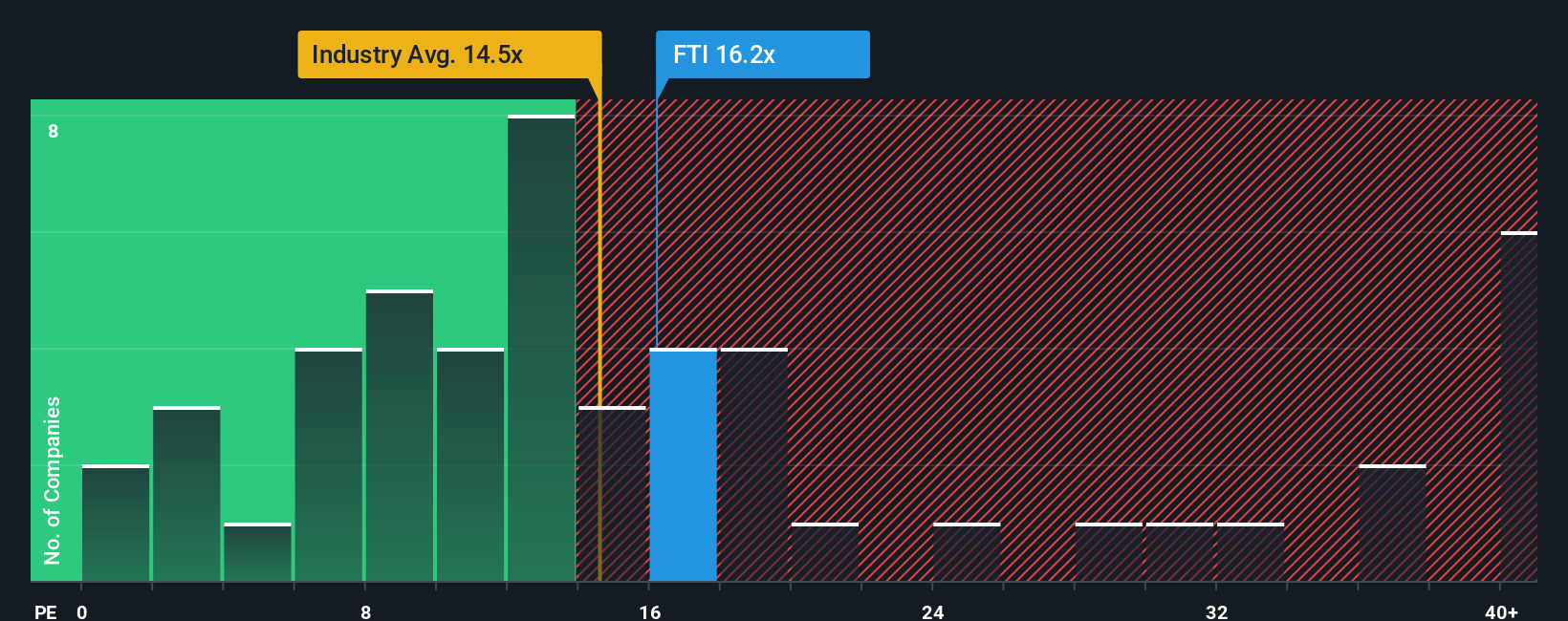

Switching gears, the company’s price-to-earnings ratio stands at 15.8x, noticeably higher than both its peer average of 11.5x and the US Energy Services industry average of 14.1x. While it looks reasonable compared to its fair ratio of 16.7x, the premium suggests investors are paying up for growth. However, does paying above the industry norm increase risk, or does it reflect justified optimism?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TechnipFMC Narrative

If you have a different perspective or want to dive deeper, you can quickly analyze the numbers yourself and build a storyline of your own. Do it your way

A great starting point for your TechnipFMC research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Widen your investment search and get ahead of the crowd by taking advantage of exclusive tools designed to find standout opportunities in today’s fast-moving market. Make your portfolio work smarter by spotting trends others might miss, and be the first to benefit from tomorrow’s winners.

- Unlock powerful yield potential and generate steady income by checking out these 18 dividend stocks with yields > 3%, which consistently offer attractive dividends above 3%.

- Jump into the world of emerging tech opportunities as you browse these 25 AI penny stocks, which are poised to transform industries with artificial intelligence innovation.

- Capitalize on strong fundamentals and price gaps by reviewing these 877 undervalued stocks based on cash flows, as these may be overlooked but could deliver superior returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TechnipFMC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FTI

TechnipFMC

Engages in the energy projects, technologies, systems, and services businesses in Europe, Central Asia, North America, Latin America, the Asia Pacific, Africa, the Middle East, and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives