- United States

- /

- Energy Services

- /

- NYSE:FTI

TechnipFMC (FTI): Assessing Valuation After Securing Major Petrobras Subsea Contracts in Brazil

Reviewed by Simply Wall St

TechnipFMC (NYSE:FTI) just secured two substantial subsea contracts from Petrobras, catching attention across the energy sector. The deals are focused on supplying highly engineered flexible pipe solutions for offshore oil and gas projects in Brazil’s rich pre-salt basins. One contract covers advanced gas injection risers, and the other involves risers and flowlines for major fields, reinforcing TechnipFMC’s ongoing partnership with Petrobras and highlighting its technical edge in challenging environments.

These contracts come as TechnipFMC shares have climbed about 67% over the past year and 33% so far in 2025. While momentum has been building, the company’s recent conference appearances and consistent deal flow, especially in Brazil, have helped drive fresh interest. Shorter-term gains, particularly over the past quarter, have also supported investor confidence that TechnipFMC’s growth narrative remains strong.

With the shares riding high after these new Petrobras awards, the big question is whether the current price reflects all potential future growth, or if there is more value left for investors to capture.

Most Popular Narrative: 4.5% Undervalued

The most widely followed narrative suggests TechnipFMC is modestly undervalued, with analysts seeing some upside potential even after its strong run.

Expansion and recurring tail of Subsea services revenues, driven by a growing installed base and long-duration contracts (20 to 35 years), provide predictable, high-margin income streams that underpin long-term earnings stability and net margin improvement.

Curious what underpins this high-conviction rating? There is a lot going on behind the scenes, from forward-looking revenue growth to future profit margins that are not typical for the sector. Want to see which forecasts for cash flow and market multiples are tipping the scales in TechnipFMC’s favor? The numbers behind this narrative could surprise you.

Result: Fair Value of $41.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing geopolitical risks in emerging markets and increased competition in subsea technologies could quickly change the story for TechnipFMC going forward.

Find out about the key risks to this TechnipFMC narrative.Another View: Earnings Ratios Tell a Different Story

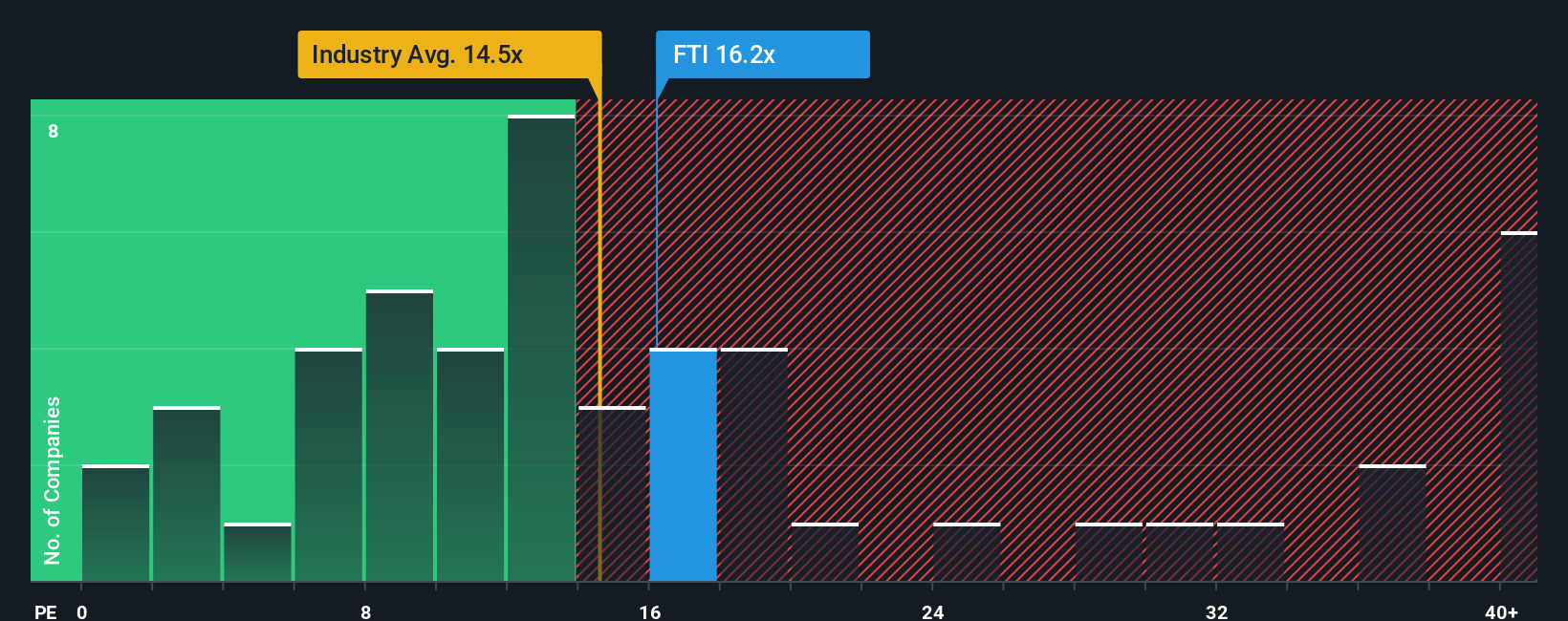

Looking at TechnipFMC through the lens of earnings ratios compared to the rest of the US energy services sector, the picture is a bit less optimistic. This method suggests shares might actually be a bit expensive right now. Which perspective truly captures the company’s value?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TechnipFMC Narrative

If you think there is more to TechnipFMC’s story or want to take a closer look at the numbers yourself, you can easily create your own perspective with the latest data. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding TechnipFMC.

Looking for More Investment Ideas?

Don’t miss your chance to strengthen your portfolio with emerging opportunities. Use the Simply Wall Street Screener to spot overlooked value, industry breakthroughs, and tomorrow’s market leaders today.

- Spot untapped companies with resilient financial fundamentals by starting with penny stocks with strong financials. This is a shortcut to firms showing real potential beyond their small price tags.

- Take advantage of shifting healthcare trends and find ground-floor innovation with healthcare AI stocks. This serves as your gateway to the AI-powered health revolution.

- Unlock fresh possibilities with undervalued stocks based on cash flows. Zero in on stocks the market may be missing, before others catch on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if TechnipFMC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:FTI

TechnipFMC

Engages in the energy projects, technologies, systems, and services businesses in Europe, Central Asia, North America, Latin America, the Asia Pacific, Africa, the Middle East, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

<html><head></head><body><div dir="auto">This is true here, but always true in the case of Alpha leaders. Often is takes a turn or two to get it right, like Gates to Nardella,  or Anton to Pinchar. This is when succession planning has failed or never happened. </div><div><br></div> </body></html>