- United States

- /

- Energy Services

- /

- NYSE:FTI

Did TechnipFMC’s (FTI) New Captain Field Subsea Award Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- TechnipFMC recently announced it has been awarded a “significant” US$75 million to US$250 million contract by Ithaca Energy to design, manufacture, and install flexible risers, flowlines, and associated hardware for the Captain development in the U.K. North Sea.

- This award deepens TechnipFMC’s long-running role in enhancing the Captain field, following its support for the second phase of the field’s enhanced oil recovery project in 2024.

- We’ll now examine how this new Captain field contract, expanding TechnipFMC’s subsea project backlog, influences its longer-term investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

TechnipFMC Investment Narrative Recap

To own TechnipFMC, you need to believe its deepwater Subsea focus and technology can keep the order book healthy despite long term decarbonization headwinds and oil price volatility. The new Ithaca Captain contract modestly adds to backlog support but does not materially change the near term reliance on continued offshore project sanctioning, nor the key risk that longer term fossil fuel demand could constrain its addressable market.

Among recent announcements, the board’s repeated US$0.05 quarterly dividend and expanded US$3,800 million buyback authorization stand out, underscoring management’s confidence in cash generation from the Subsea backlog that contracts like Captain continue to underpin. For investors, these capital return commitments sit alongside the growing installed base of long duration Subsea service work, which together form an important part of the current TechnipFMC catalyst story.

Yet against this backdrop, investors should be aware of how long term decarbonization trends could eventually challenge...

Read the full narrative on TechnipFMC (it's free!)

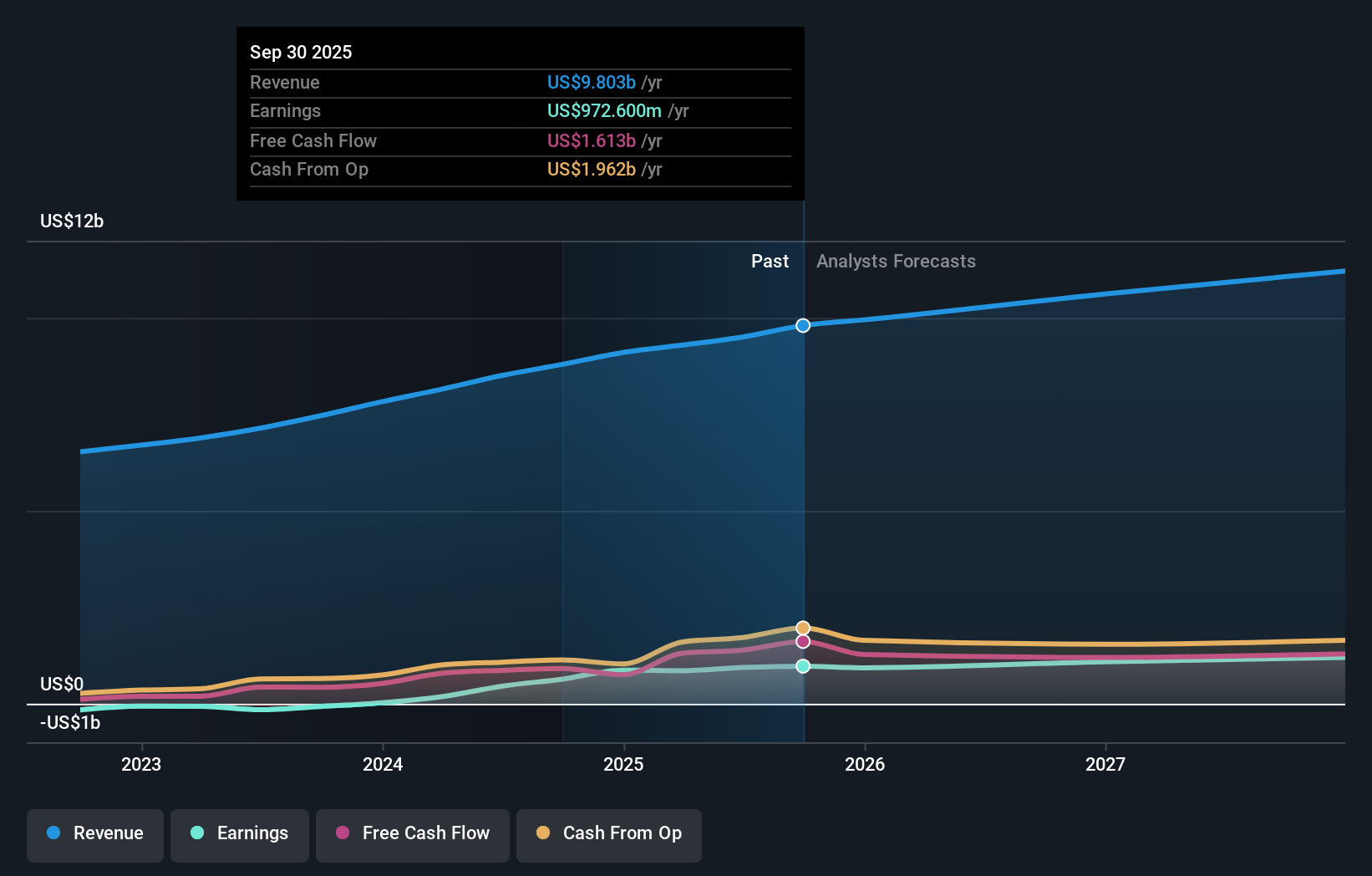

TechnipFMC's narrative projects $11.3 billion revenue and $1.2 billion earnings by 2028. This requires 5.8% yearly revenue growth and roughly a $262.5 million earnings increase from $937.5 million today.

Uncover how TechnipFMC's forecasts yield a $45.75 fair value, in line with its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community value TechnipFMC between US$21.65 and about US$67.49, highlighting very different expectations. Set against this wide spread, the company’s reliance on offshore project sanctioning in the face of energy transition risks invites you to weigh several contrasting views on its future performance.

Explore 5 other fair value estimates on TechnipFMC - why the stock might be worth as much as 46% more than the current price!

Build Your Own TechnipFMC Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TechnipFMC research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free TechnipFMC research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TechnipFMC's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if TechnipFMC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FTI

TechnipFMC

Engages in the energy projects, technologies, systems, and services businesses in Europe, Central Asia, North America, Latin America, the Asia Pacific, Africa, the Middle East, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026