- United States

- /

- Oil and Gas

- /

- NYSE:FRO

How Investors May Respond To Frontline (FRO) Board Refresh And Major VLCC Fleet Reshaping

Reviewed by Sasha Jovanovic

- Frontline plc’s 2025 Annual General Meeting on 8 December 2025 approved Richard C. Prince as a new director and backed wide share issuance authority, following the US$290 million sale of its five oldest VLCCs and fleet growth to 84 vessels after acquiring 24 VLCCs from Euronav.

- This combination of board refresh and large-scale asset rotation highlights Frontline’s move toward a younger, more flexible tanker fleet that could influence capital allocation choices.

- Next, we’ll explore how Frontline’s fleet reshaping through asset sales and Euronav acquisitions may alter its existing investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Frontline Investment Narrative Recap

To own Frontline, you need to believe that crude and product tanker demand will remain healthy enough for its modern fleet to earn through shipping cycles, despite energy transition and rate volatility. The AGM’s board refresh, wide share issuance authority and VLCC sales/acquisitions do not materially change the near term focus on charter rates as the key catalyst, or the main risks around spot exposure, regulation and future oil demand.

The AGM approval to issue up to 377,377,111 new shares or convertible securities over the next twelve months is the announcement that most directly intersects with Frontline’s evolving fleet profile. It sits alongside a younger, larger VLCC fleet that is positioned to benefit if longer trade routes and limited global tanker supply support tonne mile demand, even as investors watch carefully for any dilution or shifts in capital allocation.

Yet alongside this fleet renewal and growth story, investors should be aware of how future environmental rules and carbon costs could...

Read the full narrative on Frontline (it's free!)

Frontline's narrative projects $1.3 billion revenue and $828.1 million earnings by 2028. This assumes revenues will decrease by 10.7% per year and earnings will increase by about $590 million from $238.0 million today.

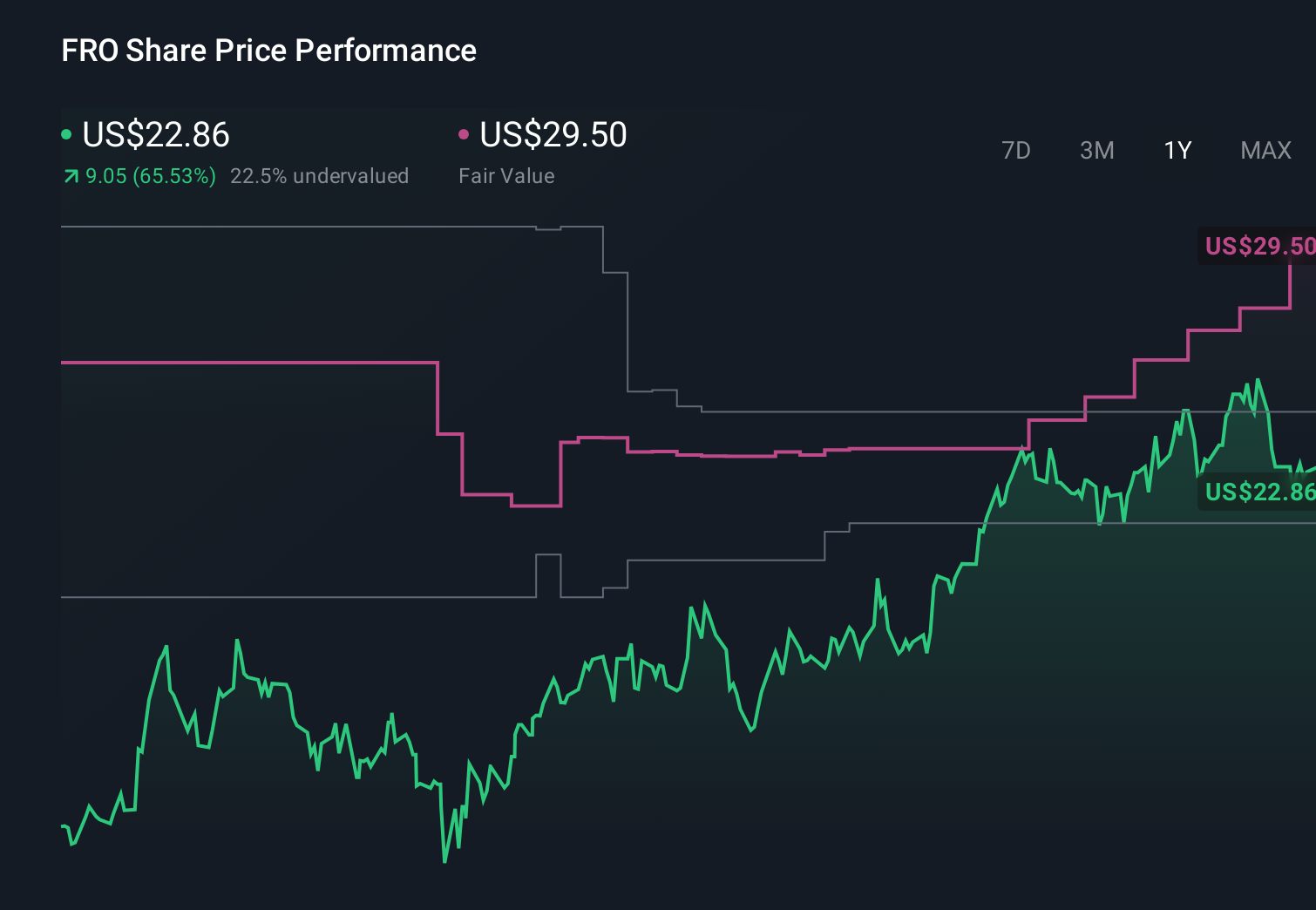

Uncover how Frontline's forecasts yield a $29.50 fair value, a 30% upside to its current price.

Exploring Other Perspectives

Eight fair value estimates from the Simply Wall St Community range widely, from US$9.65 to US$67.47 per share, underscoring how far apart individual views can be. Set against this spread, the reliance on strong long haul crude flows and limited global fleet growth as key supports for Frontline’s earnings shows why you may want to consider several contrasting scenarios before deciding how its performance might evolve.

Explore 8 other fair value estimates on Frontline - why the stock might be worth over 2x more than the current price!

Build Your Own Frontline Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Frontline research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Frontline research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Frontline's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FRO

Frontline

A shipping company, engages in the ownership and operation of oil and product tankers worldwide.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)