- United States

- /

- Oil and Gas

- /

- NYSE:FRO

Frontline's (FRO) Weaker Earnings Prompt Questions About Its Path to Sustainable Profit Growth

Reviewed by Simply Wall St

- Frontline plc recently reported its second quarter and first half 2025 results, revealing a year-over-year decline in both sales and net income with second quarter sales at US$480.08 million and net income at US$77.54 million.

- The reduction in basic and diluted earnings per share to US$0.35 for the quarter, from US$0.84 a year earlier, highlights a weakening in operating performance compared to the prior year.

- We'll review how the sharp drop in revenue and profit impacts Frontline's investment narrative and expectations for its future earnings growth.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Frontline Investment Narrative Recap

Frontline shares tend to attract investors who see profit opportunities in the volatility of global energy demand and shipping rates, and who believe the company’s modern tanker fleet and balance sheet can ride out short-term turbulence. The latest earnings report, showing reduced revenue, profit, and earnings per share, may challenge near-term optimism, but unless there is a persistent decline in global oil exports, the primary investment catalyst, spot-exposed, efficient tankers, remains in place, while the biggest risk continues to be disruptions from geopolitical events.

Among Frontline’s recent updates, its Q1 2025 dividend declaration of US$0.18 per share is most relevant here, as it reflects management’s response to falling earnings by reducing payouts from prior quarters. This move underlines a connection between underlying profitability and shareholder returns, especially if current earnings headwinds persist and impact future dividend policy.

Yet, while investors may focus on tankers and trade routes, it’s the unpredictable effects of regulatory or geopolitical shifts that could...

Read the full narrative on Frontline (it's free!)

Frontline's narrative projects $1.4 billion revenue and $858.6 million earnings by 2028. This requires a 10.0% annual revenue decline and a $510.5 million increase in earnings from the current $348.1 million.

Uncover how Frontline's forecasts yield a $24.01 fair value, a 15% upside to its current price.

Exploring Other Perspectives

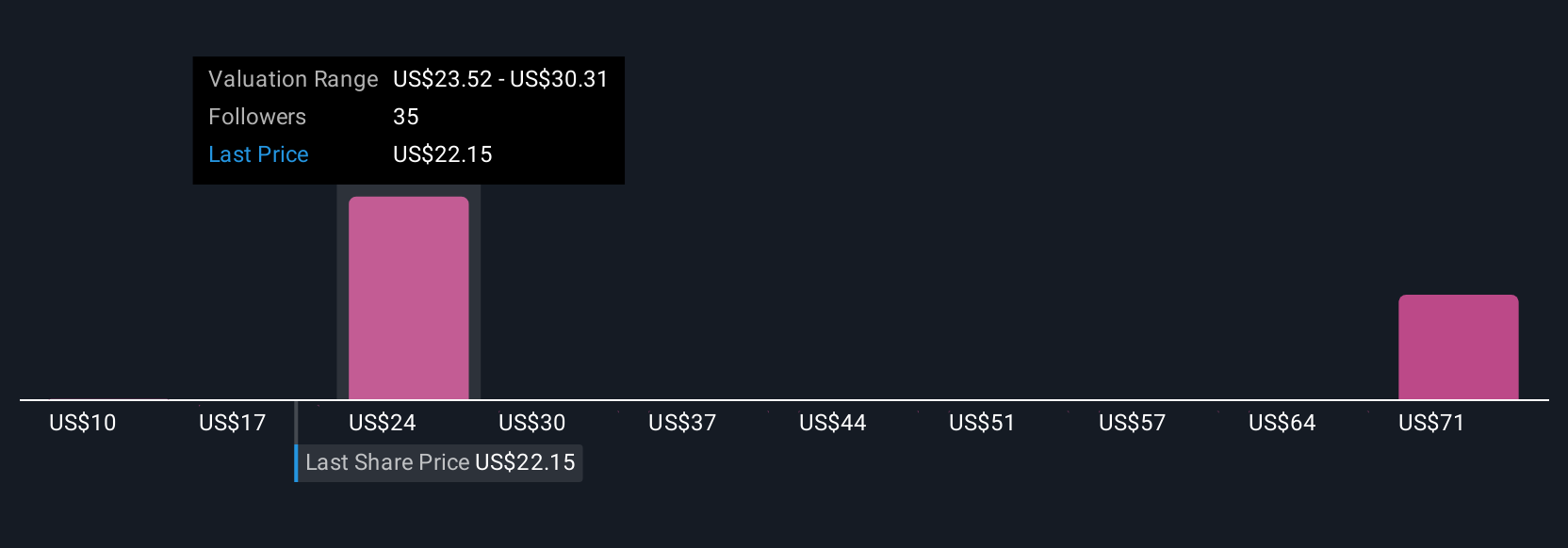

Six fair value estimates from the Simply Wall St Community range between US$9.94 and US$78.64. While views differ widely, the ongoing risk that lower global oil exports might further reduce demand for Frontline’s fleet could shape future debates on the company’s earnings outlook.

Explore 6 other fair value estimates on Frontline - why the stock might be worth less than half the current price!

Build Your Own Frontline Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Frontline research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Frontline research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Frontline's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FRO

Frontline

A shipping company, engages in the ownership and operation of oil and product tankers worldwide.

Good value with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives