- United States

- /

- Energy Services

- /

- NYSE:FLOC

Array Technologies And 2 Other Stocks Estimated To Be Trading Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market navigates through geopolitical tensions and fluctuating oil prices, major indices like the Dow Jones and S&P 500 have experienced both surges and declines, reflecting investor reactions to global events such as the Israel-Iran conflict. In this environment of uncertainty, identifying stocks trading below their intrinsic value can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Viking Holdings (VIK) | $46.56 | $93.10 | 50% |

| Peoples Financial Services (PFIS) | $47.70 | $93.66 | 49.1% |

| Mid Penn Bancorp (MPB) | $26.25 | $52.26 | 49.8% |

| Lincoln Educational Services (LINC) | $22.46 | $44.26 | 49.3% |

| Horizon Bancorp (HBNC) | $14.60 | $29.10 | 49.8% |

| First Reliance Bancshares (FSRL) | $9.10 | $17.83 | 49% |

| Expand Energy (EXE) | $116.46 | $232.06 | 49.8% |

| Clearfield (CLFD) | $38.01 | $75.13 | 49.4% |

| Central Pacific Financial (CPF) | $26.47 | $51.99 | 49.1% |

| Arrow Financial (AROW) | $25.32 | $49.74 | 49.1% |

Let's take a closer look at a couple of our picks from the screened companies.

Array Technologies (ARRY)

Overview: Array Technologies, Inc. manufactures and sells solar tracking technology products in the United States, Spain, Brazil, Australia, and internationally with a market cap of approximately $1.21 billion.

Operations: The company's revenue is derived from two main segments: STI Operations, contributing $304.31 million, and Array Legacy Operations, contributing $760.46 million.

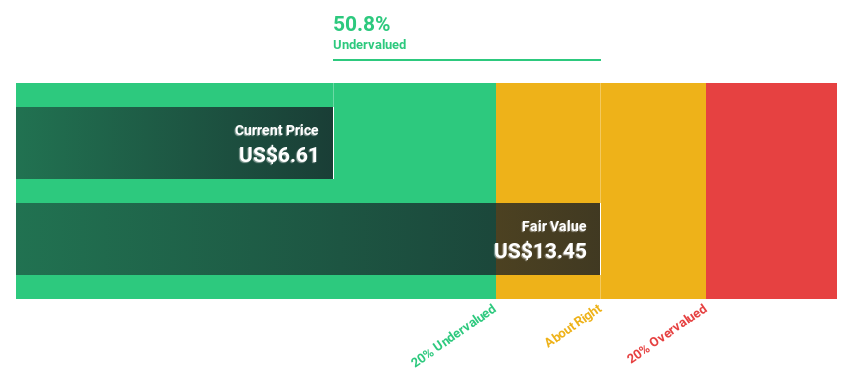

Estimated Discount To Fair Value: 19.3%

Array Technologies is trading at 19.3% below its estimated fair value of US$9.87, presenting a potential opportunity for investors focused on cash flows. Despite recent sales growth to US$302.36 million and improved profitability, the company's share price has been highly volatile over the past three months. The introduction of innovative products like DuraTrack Hail XP and SmarTrack enhancements could bolster future revenue streams, although projected growth remains slightly below market averages at 8.1% per year.

- Our expertly prepared growth report on Array Technologies implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Array Technologies' balance sheet by reading our health report here.

Flowco Holdings (FLOC)

Overview: Flowco Holdings Inc. offers production optimization, artificial lift, and methane abatement solutions for the U.S. oil and natural gas industry, with a market cap of $476.51 million.

Operations: The company's revenue is derived from its Production Solutions segment, which generated $397.63 million, and its Natural Gas Technologies segment, contributing $297.99 million.

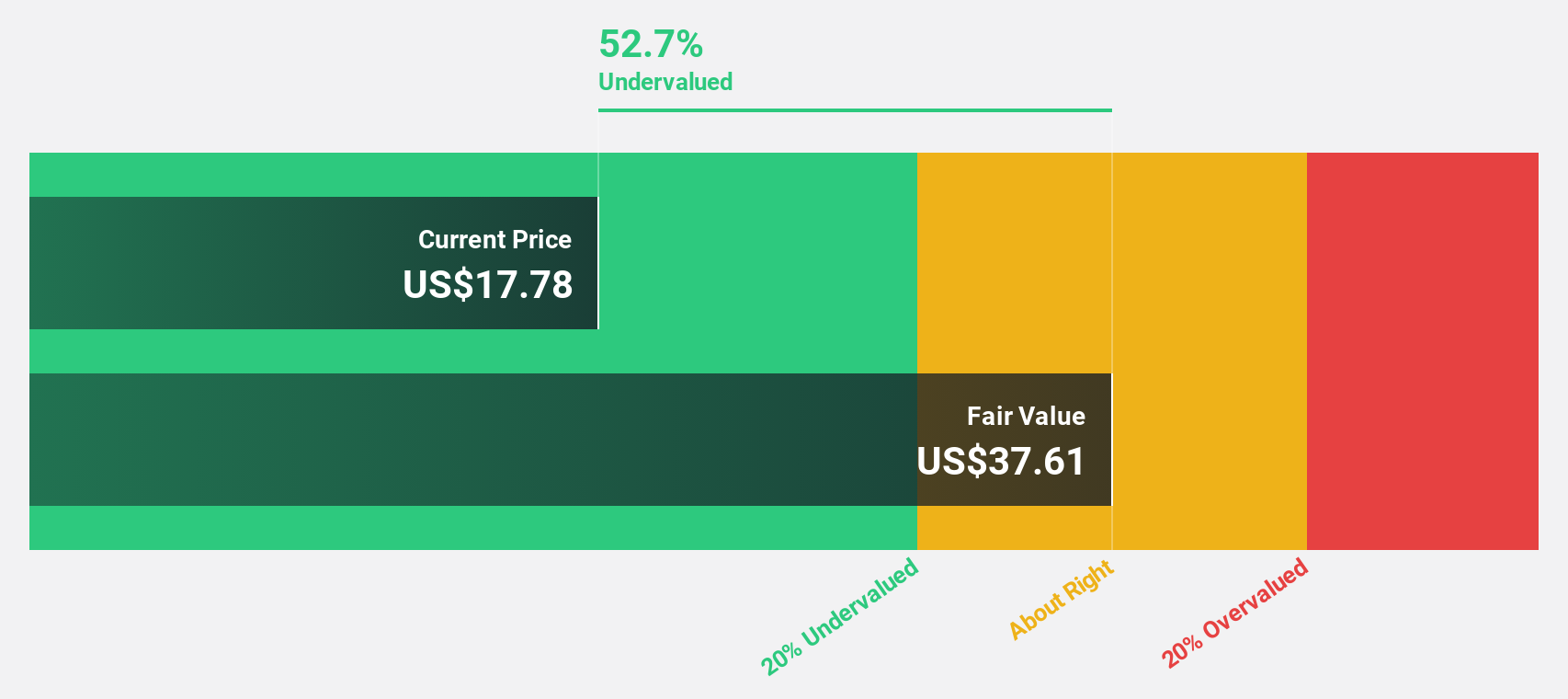

Estimated Discount To Fair Value: 43.4%

Flowco Holdings is trading at US$18.52, significantly below its fair value estimate of US$32.73, highlighting potential cash flow opportunities. Despite a recent drop in profit margins to 10.5%, revenue surged to US$192.35 million in Q1 2025 from US$66.71 million the previous year, indicating strong sales growth potential. The company has announced a $50 million share buyback program, which may enhance shareholder value amidst anticipated earnings growth of 26.8% annually over the next three years.

- According our earnings growth report, there's an indication that Flowco Holdings might be ready to expand.

- Unlock comprehensive insights into our analysis of Flowco Holdings stock in this financial health report.

Guild Holdings (GHLD)

Overview: Guild Holdings Company, with a market cap of $973.59 million, operates in the United States through its subsidiary by originating, selling, and servicing residential mortgage loans.

Operations: The company's revenue is derived from two main segments: $828.98 million from origination and $153.36 million from servicing residential mortgage loans.

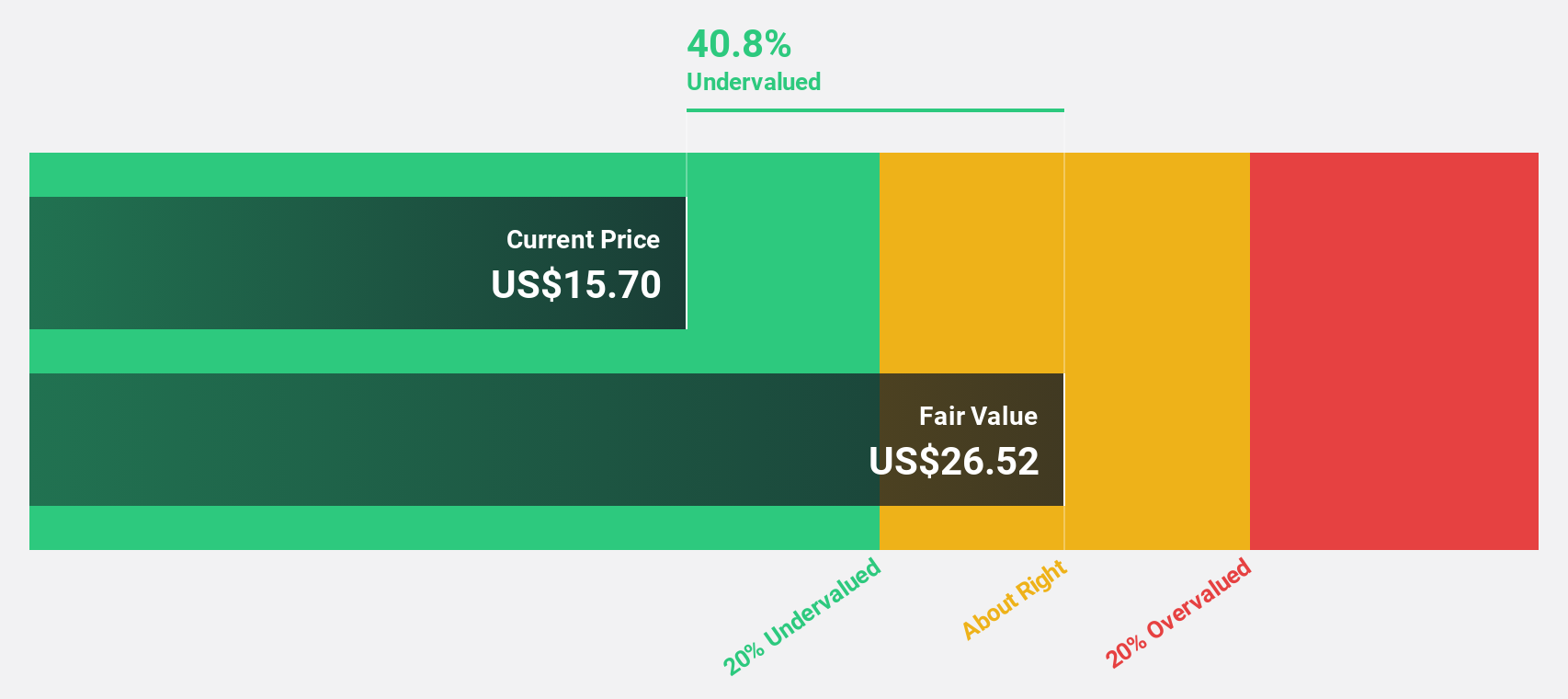

Estimated Discount To Fair Value: 41.6%

Guild Holdings is trading at US$15.65, considerably below its fair value estimate of US$26.81, suggesting it may be undervalued based on cash flows. Despite a Q1 revenue decline to US$198.49 million and a net loss of US$23.9 million, earnings are projected to grow significantly at 54.8% annually over the next three years, outpacing the broader market's growth rate. However, interest payments are not well covered by earnings, which could pose financial challenges.

- Our earnings growth report unveils the potential for significant increases in Guild Holdings' future results.

- Take a closer look at Guild Holdings' balance sheet health here in our report.

Where To Now?

- Click this link to deep-dive into the 173 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLOC

Flowco Holdings

Through its subsidiaries, provides production optimization, artificial lift, and methane abatement solutions for the oil and natural gas industry in the United States.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives