- United States

- /

- Oil and Gas

- /

- NYSE:FLNG

FLEX LNG Shares Rise 19.7% as LNG Fleet Expansion Sparks Valuation Debate

Reviewed by Bailey Pemberton

- Wondering if FLEX LNG is undervalued right now? You're not alone. Many investors are asking whether this is the right moment to get on board or to take their profits.

- The stock has posted impressive gains over the last year, delivering a 19.7% return, and has climbed 8.2% year-to-date despite a slight dip of 0.9% in the past week.

- Recent news around the liquefied natural gas market and shipping sector has caught investors' attention, with regulatory changes and fleet expansion announcements boosting both optimism and uncertainty. Headlines about global energy demand and FLEX LNG's vessel charters have kept volatility in play, which helps explain the recent swings in the share price.

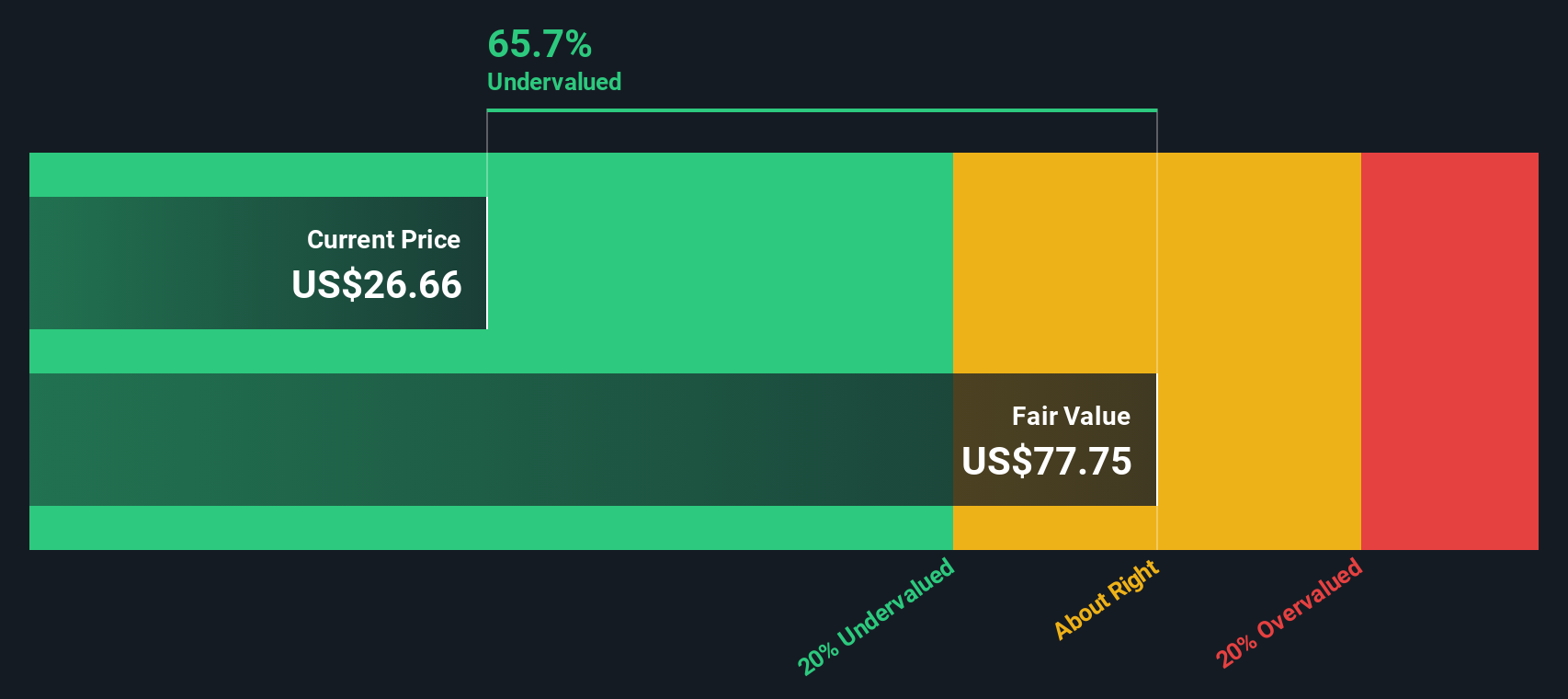

- When it comes to valuation, FLEX LNG scores a 3 out of 6 based on our standard checks for undervaluation. In the next sections, we’ll break down what those numbers really mean using traditional methods, before exploring a smarter way to understand FLEX LNG’s value at the end of the article.

Approach 1: FLEX LNG Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach is commonly used to estimate a company’s true value by projecting its future cash flows and discounting them back to today’s value. For FLEX LNG, this model looks at anticipated cash generated by the business and adjusts it to reflect what that cash is worth in 2024 dollars.

According to the latest calculation, FLEX LNG’s current free cash flow stands at $156.6 million. Analysts anticipate steady growth in cash flow, with projections reaching $215.5 million by the end of 2027 and continuing higher through to 2035, although at a slower rate in later years as growth tapers off. Beyond the five-year outlook, estimates rely on industry-standard growth rates extrapolated by Simply Wall St.

DCF modeling results in an intrinsic value for FLEX LNG of $94.98 per share. Using this approach, FLEX LNG appears to be trading at a 72.3% discount, which suggests the stock may be significantly undervalued compared to its estimated value based on future cash generation potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests FLEX LNG is undervalued by 72.3%. Track this in your watchlist or portfolio, or discover 930 more undervalued stocks based on cash flows.

Approach 2: FLEX LNG Price vs Earnings

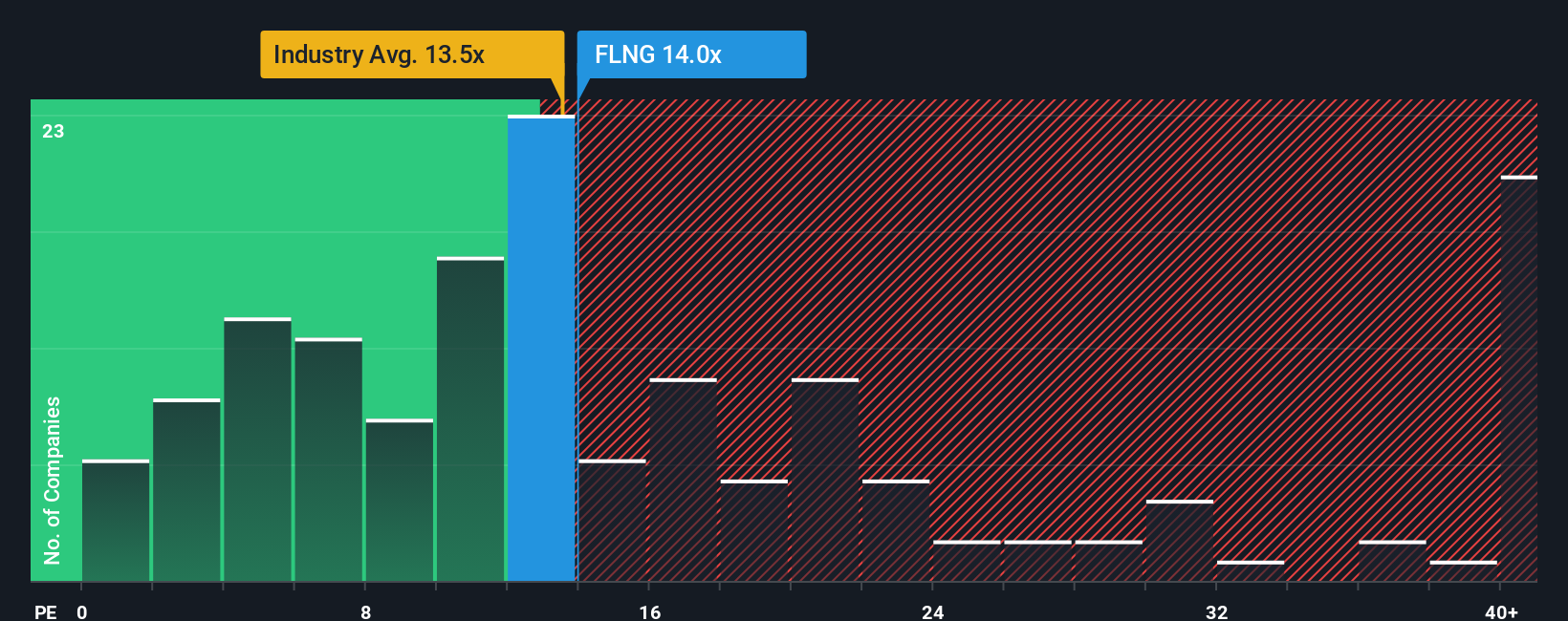

The Price-to-Earnings (PE) ratio is widely considered a go-to metric for valuing profitable companies like FLEX LNG. Since it compares a company's share price to its earnings per share, it helps investors quickly gauge how much the market is willing to pay for each dollar of profit. This makes it especially useful for stable, established businesses where profits are a key driver of value.

It is important to remember that growth prospects and risk factors both play a significant role in setting what constitutes a "normal" or "fair" PE ratio for a stock. Higher expected growth or premium profitability can justify a higher multiple. Added risks or slower growth typically bring these numbers down.

At present, FLEX LNG trades on a PE ratio of 14.4x. For context, this is a little above the Oil and Gas industry average of 13.3x and the company's close peer average of 12.4x. However, multiples alone do not tell the whole story. Simply Wall St's proprietary "Fair Ratio" method provides a more tailored valuation metric by factoring in FLEX LNG’s unique earnings growth prospects, profit margins, market cap, and specific risks. The calculated Fair Ratio for FLEX LNG currently sits at 17.0x, which is above both its live multiple and the standard industry or peer benchmarks. This suggests that, when accounting for FLEX LNG's strengths and risk profile, the stock's current PE ratio is actually below what would be justified.

In short, while FLEX LNG may appear slightly pricier than its sector at first glance, it is still trading below the level suggested by its Fair Ratio. This points to an undervalued position based on earnings fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your FLEX LNG Narrative

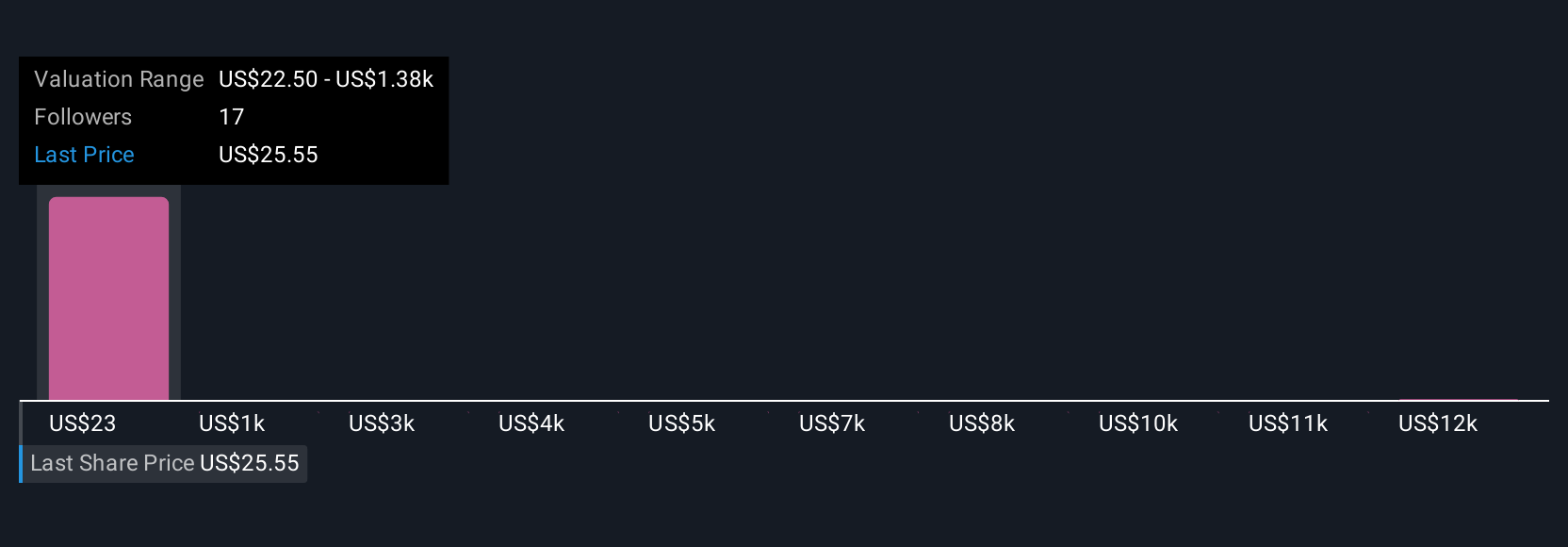

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own investment story. It connects what you believe about FLEX LNG’s business future to real numbers, forecasts, and fair value calculations. Rather than relying solely on analyst targets or traditional valuation ratios, Narratives allow you to ground your perspective in concrete assumptions for future revenue, profit margins, and risk, and then see how this outlook compares to the current share price.

On Simply Wall St's popular Community page, Narratives make this process easy and accessible to everyone. Here, you can create or explore investment stories for FLEX LNG, instantly seeing the fair value implied by your assumptions and comparing that to the live market price. Narratives are dynamic too. They automatically update when new earnings, news, or company developments are published, ensuring your outlook is always relevant and up-to-date.

This means that whether you believe FLEX LNG's modern ships and strong contracts will drive long-term earnings growth, or you are more concerned about oversupply risks and rising costs, your Narrative can reflect your unique view. For example, right now, the most optimistic FLEX LNG Narrative puts fair value nearly 47% above today’s price, while the most cautious expects it to trade almost 7% lower. This shows there are multiple stories and opportunities to consider.

Do you think there's more to the story for FLEX LNG? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FLNG

FLEX LNG

Engages in the seaborne transportation of liquefied natural gas (LNG) worldwide.

Solid track record and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion