- United States

- /

- Media

- /

- OTCPK:KDOZ.F

December 2025's Promising Penny Stocks To Consider

Reviewed by Simply Wall St

As the U.S. markets show resilience with major indexes rising despite mixed economic signals, investors are increasingly looking beyond traditional stocks to explore other opportunities. Penny stocks, often associated with smaller or newer companies, remain an intriguing area for those seeking potential value in less conventional investments. While the term may seem outdated, these stocks can still offer significant opportunities when backed by robust financials and a clear growth path.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Here Group (HERE) | $3.08 | $249.08M | ✅ 3 ⚠️ 2 View Analysis > |

| Dingdong (Cayman) (DDL) | $1.79 | $368.6M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.87 | $676.31M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $3.28 | $551.9M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.26 | $1.36B | ✅ 5 ⚠️ 1 View Analysis > |

| FinVolution Group (FINV) | $4.93 | $1.3B | ✅ 3 ⚠️ 1 View Analysis > |

| Puma Biotechnology (PBYI) | $4.87 | $245.4M | ✅ 3 ⚠️ 3 View Analysis > |

| CI&T (CINT) | $4.54 | $586.77M | ✅ 5 ⚠️ 0 View Analysis > |

| BAB (BABB) | $0.825 | $5.99M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $4.00 | $90.62M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 352 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Pulmonx (LUNG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pulmonx Corporation is a commercial-stage medical technology company offering minimally invasive treatments for severe emphysema, with a market cap of $72.18 million.

Operations: The company's revenue is generated entirely from its medical products segment, totaling $91.66 million.

Market Cap: $72.18M

Pulmonx Corporation, a commercial-stage medical technology company, faces challenges as it remains unprofitable with increasing losses over the past five years. Despite this, its revenue is growing steadily, with a forecasted growth rate of 22.3% annually. The company recently reported third-quarter sales of US$21.5 million and expects full-year revenue between US$89 million and US$90 million, maintaining a gross margin of approximately 73%. Pulmonx's financial stability is supported by sufficient cash runway for over two years. Recent executive changes include Glendon E. French's return as CEO and Derrick Sung's appointment as CFO amidst ongoing strategic adjustments.

- Click to explore a detailed breakdown of our findings in Pulmonx's financial health report.

- Review our growth performance report to gain insights into Pulmonx's future.

FutureFuel (FF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: FutureFuel Corp. manufactures and sells diversified chemical, bio-based fuel, and bio-based specialty chemical products in the United States, with a market cap of $146.74 million.

Operations: The company generates revenue through two main segments: Biofuels, contributing $71.06 million, and Chemicals, accounting for $66.35 million.

Market Cap: $146.74M

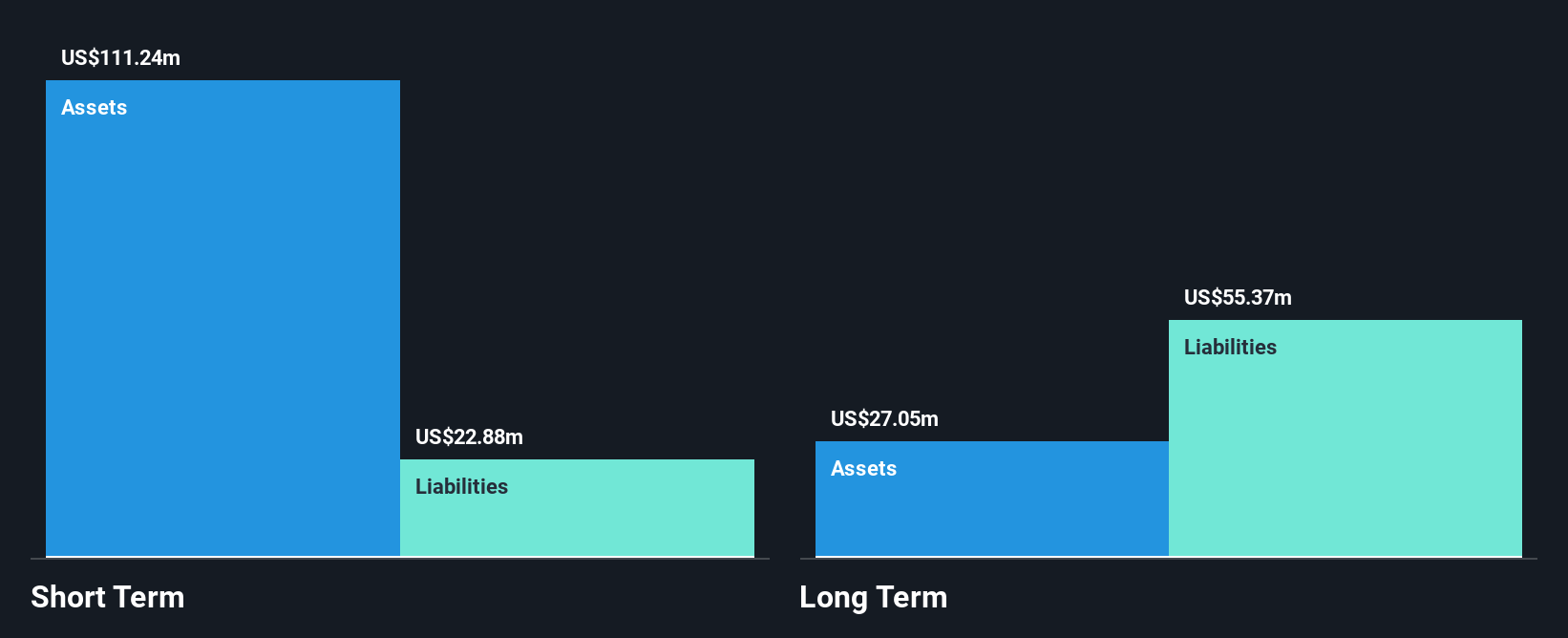

FutureFuel Corp. faces significant challenges as a penny stock, with recent earnings showing a sharp decline in sales to US$22.69 million for Q3 2025 from US$51.14 million the previous year, resulting in a net loss of US$9.33 million compared to last year's smaller loss of US$1.2 million. The company is currently unprofitable, with increasing losses over five years at an annual rate of 33.6%. Despite being debt-free and having short-term assets exceeding liabilities, its dividend yield of 7.23% is not sustainable under current financial conditions, and revenue has decreased significantly year-over-year.

- Click here and access our complete financial health analysis report to understand the dynamics of FutureFuel.

- Evaluate FutureFuel's historical performance by accessing our past performance report.

Kidoz (KDOZ.F)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kidoz Inc. is a global AdTech software developer offering a mobile advertising platform aimed at children, teens, and families, with a market cap of $30.73 million.

Operations: The company's revenue is derived from its Ad Tech Advertising sales, amounting to $16.28 million.

Market Cap: $30.73M

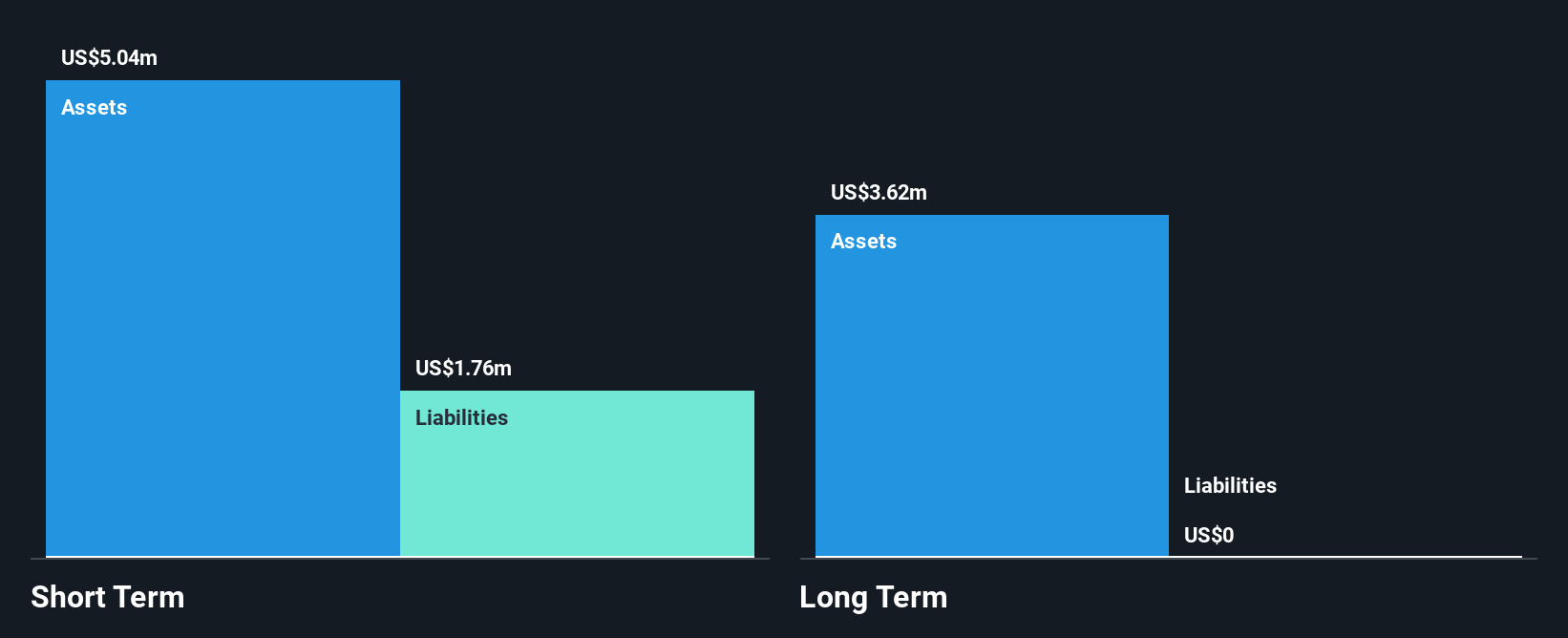

Kidoz Inc., an AdTech software developer, has shown resilience as a penny stock with its recent transition to profitability and no long-term liabilities. The company reported Q3 2025 sales of US$3.67 million, up from US$2.29 million the previous year, though it remains in a net loss position with US$0.18 million for the quarter. Its revenue is forecasted to grow at 13.99% annually, supported by high-quality earnings and an experienced management team averaging 3.6 years tenure. Despite volatility in share price and low return on equity at 8.5%, Kidoz's debt-free status offers financial stability amidst market fluctuations.

- Take a closer look at Kidoz's potential here in our financial health report.

- Explore Kidoz's analyst forecasts in our growth report.

Summing It All Up

- Jump into our full catalog of 352 US Penny Stocks here.

- Ready To Venture Into Other Investment Styles? These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kidoz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:KDOZ.F

Kidoz

A global AdTech software developer that provides a mobile advertising platform targeting children, teens, and families.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026