- United States

- /

- Oil and Gas

- /

- NYSE:EOG

EOG Resources (NYSE:EOG) Secures Major Oil Exploration Concession In Abu Dhabi Basin

Reviewed by Simply Wall St

EOG Resources (NYSE:EOG) secured an oil exploration concession in Abu Dhabi, aligning with its growth strategy. Over the past month, the company's stock rose by nearly 8%. While this increase may have been influenced by the concession news and maintained dividend declarations, it coincides with a strong market performance where major indexes, such as the S&P 500, have seen gains. Other company activities, including a shareholder proposal questioning board members, likely had minimal impact compared to the broader positive market trends. Overall, EOG's price movement reflects a blending of company-specific developments with favorable market conditions.

We've identified 1 risk for EOG Resources that you should be aware of.

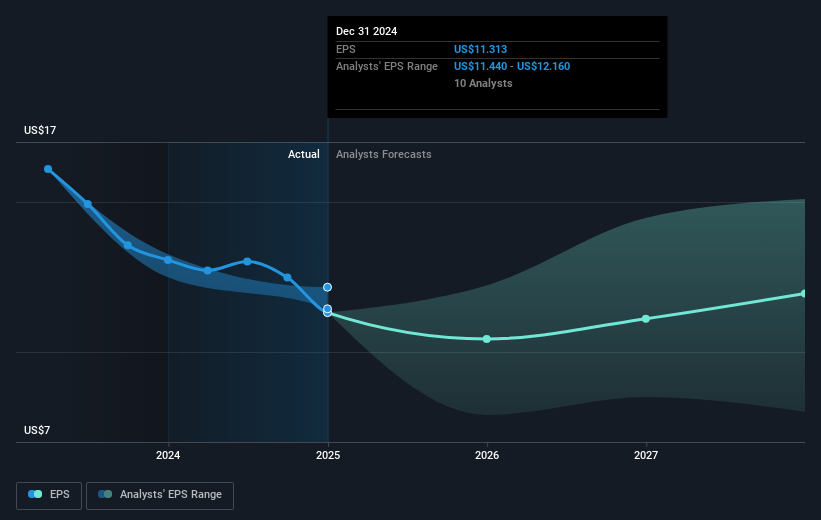

EOG Resources' recent acquisition of the Abu Dhabi oil exploration concession aligns with its ongoing efforts to expand drilling capacity and diversify revenue streams. This move could potentially strengthen revenue and earnings forecasts, especially as the company anticipates a 12% increase in natural gas production driven by LNG demand. These developments are likely aimed at enhancing free cash flow while pursuing moderate oil growth, despite the potential oversupply and tariff challenges.

Over the past five years, EOG's total shareholder return, including share price gains and dividends, was 181.89%. This suggests strong long-term performance. However, more recently, EOG underperformed the US market and the Oil and Gas industry; while the market saw an 11.2% increase, EOG's one-year performance fell short, with the company also lagging behind the industry's negative 5.2% performance.

In context to the price target, EOG's current share price is approximately a 19.7% discount to the consensus analyst price target of US$135.47. Achieving this target would require not only improved earnings and revenue growth but also changes in market perceptions of the company's valuation, as it would need to trade at a higher PE ratio than its current 10.4x. Investors must consider these dynamics when evaluating the company's future prospects and uncertainties in achieving such growth in a competitive industry landscape.

Understand EOG Resources' earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade EOG Resources, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EOG Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:EOG

EOG Resources

Explores for, develops, produces, and markets crude oil, natural gas liquids, and natural gas in producing basins in the United States, the Republic of Trinidad and Tobago, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives