- United States

- /

- Oil and Gas

- /

- NYSE:DK

Top 3 Undervalued Small Caps With Insider Action In US For January 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it has shown a robust 23% increase over the past year with earnings projected to grow by 15% annually in the coming years. In this context, identifying small-cap stocks that are perceived as undervalued and exhibit insider activity can present intriguing opportunities for investors looking to capitalize on potential growth within a dynamic market landscape.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| OptimizeRx | NA | 1.1x | 44.89% | ★★★★★☆ |

| Quanex Building Products | 32.3x | 0.8x | 40.23% | ★★★★☆☆ |

| Franklin Financial Services | 8.9x | 1.8x | 42.22% | ★★★★☆☆ |

| McEwen Mining | 4.3x | 2.2x | 43.86% | ★★★★☆☆ |

| ProPetro Holding | NA | 0.7x | 32.42% | ★★★★☆☆ |

| First United | 13.1x | 3.0x | 48.72% | ★★★☆☆☆ |

| RGC Resources | 17.3x | 2.4x | 20.78% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -73.80% | ★★★☆☆☆ |

| Sabre | NA | 0.4x | -67.81% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

SolarEdge Technologies (NasdaqGS:SEDG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: SolarEdge Technologies is a company that designs and manufactures solar inverters and other energy solutions, with a market cap of $7.42 billion.

Operations: SolarEdge Technologies generates revenue primarily from its solar segment, contributing $961.61 million, and energy storage, which adds $74.19 million. The company's cost of goods sold (COGS) has fluctuated significantly over time, impacting its gross profit margin, which reached a low of -69.33% in the latest reported period. Operating expenses have been consistently high across various categories such as sales & marketing and research & development.

PE: -0.5x

SolarEdge Technologies, a smaller U.S. company in the renewable energy sector, recently navigated significant leadership changes with new board members and a CEO to steer its strategic focus on core solar activities. The company ceased its Energy Storage division, aiming for US$7.5 million quarterly savings by late 2025 while maintaining solar battery sales for commercial markets. Despite recent financial challenges with a net loss of US$1.2 billion in Q3 2024, insider confidence is evident through share purchases over the past year, suggesting belief in future growth potential amidst volatile share prices and high-risk funding sources.

- Unlock comprehensive insights into our analysis of SolarEdge Technologies stock in this valuation report.

Explore historical data to track SolarEdge Technologies' performance over time in our Past section.

Chimera Investment (NYSE:CIM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Chimera Investment is a company that focuses on investing, on a leveraged basis, in a diversified portfolio of mortgage assets and has a market capitalization of $1.23 billion.

Operations: Chimera Investment's revenue primarily comes from its diversified portfolio of mortgage assets, with a recent gross profit margin of 93.19%. The company has experienced fluctuations in its net income margin, which was notably negative during certain periods but reached 61.20% in the latest quarter ending September 2024. Operating expenses have varied over time, impacting profitability alongside changes in cost of goods sold (COGS).

PE: 4.2x

Chimera Investment, a smaller company in the U.S. market, has shown mixed financial signals. Despite a significant increase in net income to US$136 million for Q3 2024, earnings are expected to decline by an average of 30.8% annually over the next three years. The company's reliance on external borrowing poses higher risk, yet insider confidence is marked by board changes including Cynthia B. Walsh's appointment and strategic moves like acquiring Palisades Group.

Delek US Holdings (NYSE:DK)

Simply Wall St Value Rating: ★★★☆☆☆

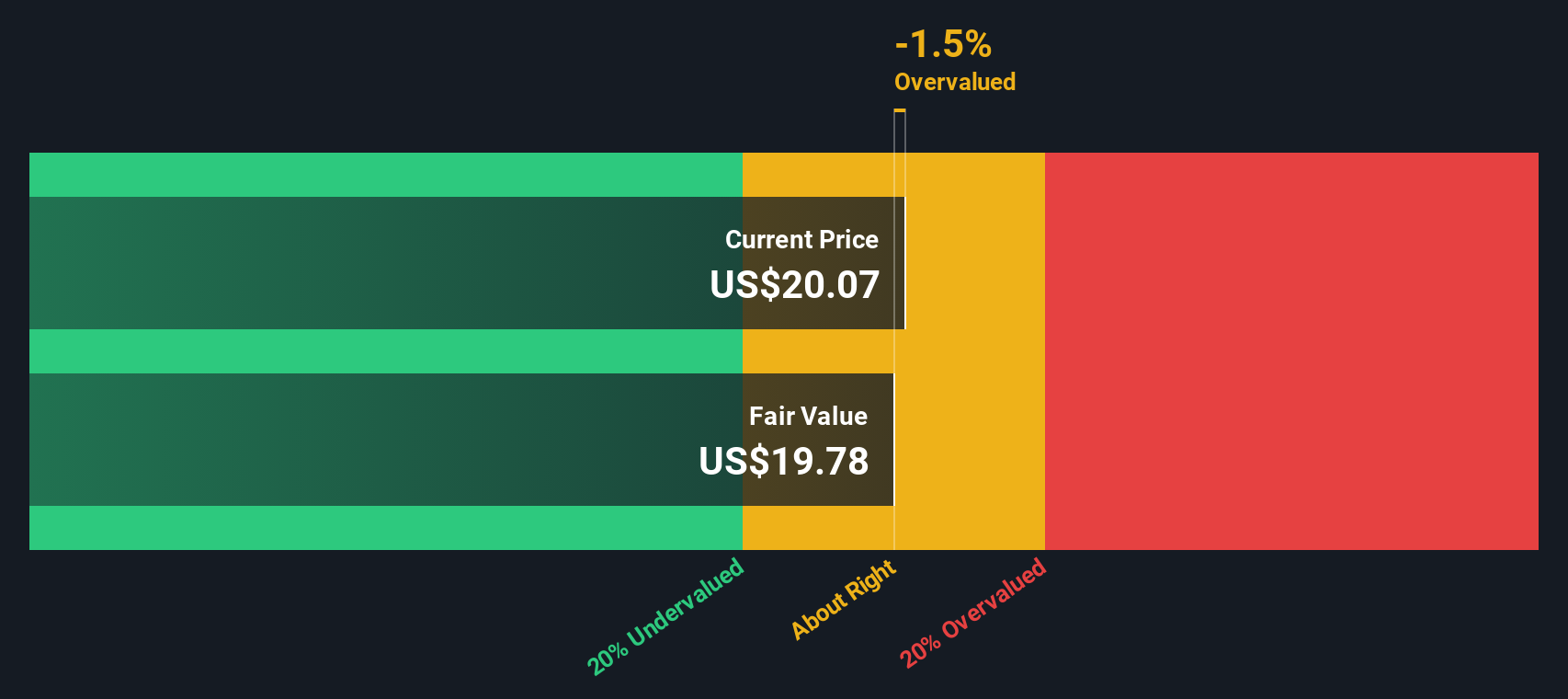

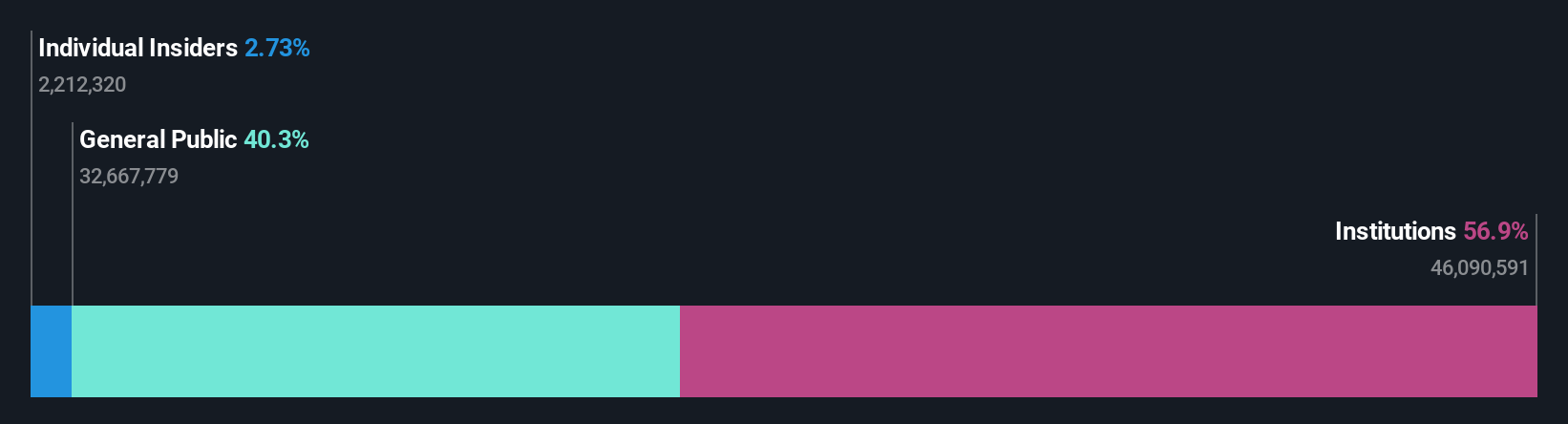

Overview: Delek US Holdings is an energy company primarily engaged in refining and logistics operations, with a market capitalization of approximately $1.43 billion.

Operations: The company generates revenue primarily from its refining segment, contributing $13.38 billion, and logistics operations adding $984.90 million. Over recent periods, the gross profit margin has shown fluctuations, with a notable decline to 3.97% by September 2024 compared to previous highs like 13.48% in June 2019. Operating expenses have consistently been a significant part of the cost structure, with general and administrative expenses being a substantial component within this category.

PE: -3.0x

Delek US Holdings, a smaller company in the energy sector, has been navigating financial challenges. Recent earnings showed a decline with third-quarter sales dropping to US$3.04 billion from US$4.63 billion last year and a net loss of US$76.8 million compared to previous profits. Despite these hurdles, insider confidence is evident as they continue share repurchases; recently completing 22.53% of their buyback plan since 2018 for US$505.2 million, signaling potential long-term value recognition amidst current volatility.

- Dive into the specifics of Delek US Holdings here with our thorough valuation report.

Gain insights into Delek US Holdings' past trends and performance with our Past report.

Taking Advantage

- Click through to start exploring the rest of the 38 Undervalued US Small Caps With Insider Buying now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DK

Delek US Holdings

Engages in the integrated downstream energy business in the United States.

Fair value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives