- United States

- /

- Capital Markets

- /

- NasdaqGS:CSWC

3 Undervalued Small Caps In United States With Insider Buying

Reviewed by Simply Wall St

Over the last 7 days, the market has dropped 1.4%, driven by a pullback of 4.3% in the Information Technology sector. Despite this recent dip, the market is up 21% over the past year and earnings are forecast to grow by 15% annually. In this environment, identifying undervalued small-cap stocks with insider buying can present unique opportunities for investors looking to capitalize on potential growth and value.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| PCB Bancorp | 11.2x | 2.8x | 42.35% | ★★★★★☆ |

| Thryv Holdings | NA | 0.7x | 24.56% | ★★★★★☆ |

| Chatham Lodging Trust | NA | 1.3x | 31.33% | ★★★★★☆ |

| Citizens & Northern | 13.0x | 2.9x | 42.79% | ★★★★☆☆ |

| Franklin Financial Services | 10.4x | 2.1x | 36.27% | ★★★★☆☆ |

| Leggett & Platt | NA | 0.4x | 1.64% | ★★★★☆☆ |

| German American Bancorp | 14.2x | 4.7x | 45.48% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Alta Equipment Group | NA | 0.1x | -80.00% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -92.09% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

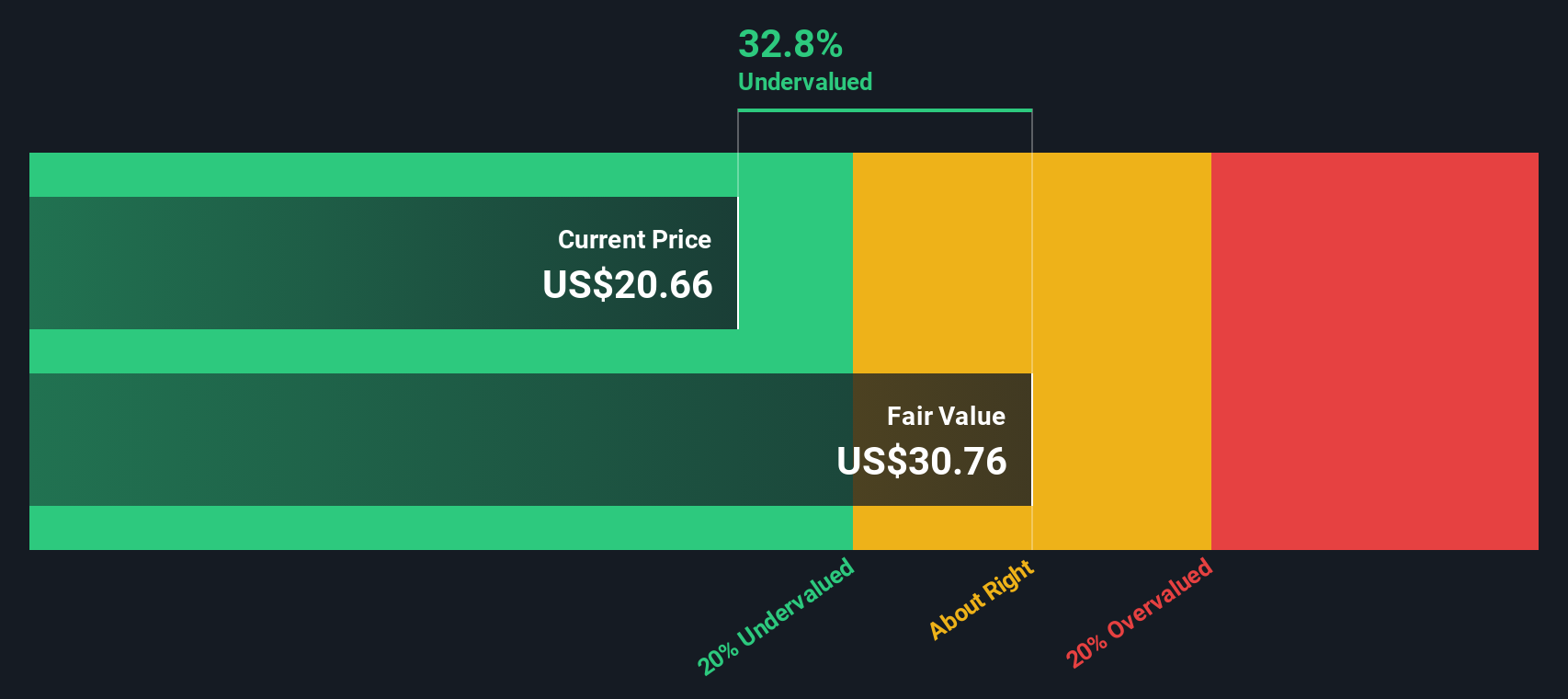

Capital Southwest (NasdaqGS:CSWC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Capital Southwest is a business development company that provides financing solutions to middle-market companies, with a market cap of approximately $0.55 billion.

Operations: Capital Southwest generates revenue primarily from investments, with recent figures reaching $189.13 million. The company's net income margin has shown variability, with the most recent period reflecting a margin of 38.92%. Operating expenses and non-operating expenses are significant cost components impacting the net income.

PE: 16.0x

Capital Southwest, a small cap stock, recently reported Q1 2024 revenue of US$51.35 million, up from US$40.36 million the previous year, though net income dropped to US$14.04 million from US$23.81 million. Despite not repurchasing any shares recently, insider confidence is evident with significant share purchases over the past year. The company declared a regular dividend of $0.58 per share and a supplemental dividend of $0.06 per share for Q3 2024, reflecting strong shareholder returns amidst steady earnings growth projections at 22% annually.

- Click here and access our complete valuation analysis report to understand the dynamics of Capital Southwest.

Explore historical data to track Capital Southwest's performance over time in our Past section.

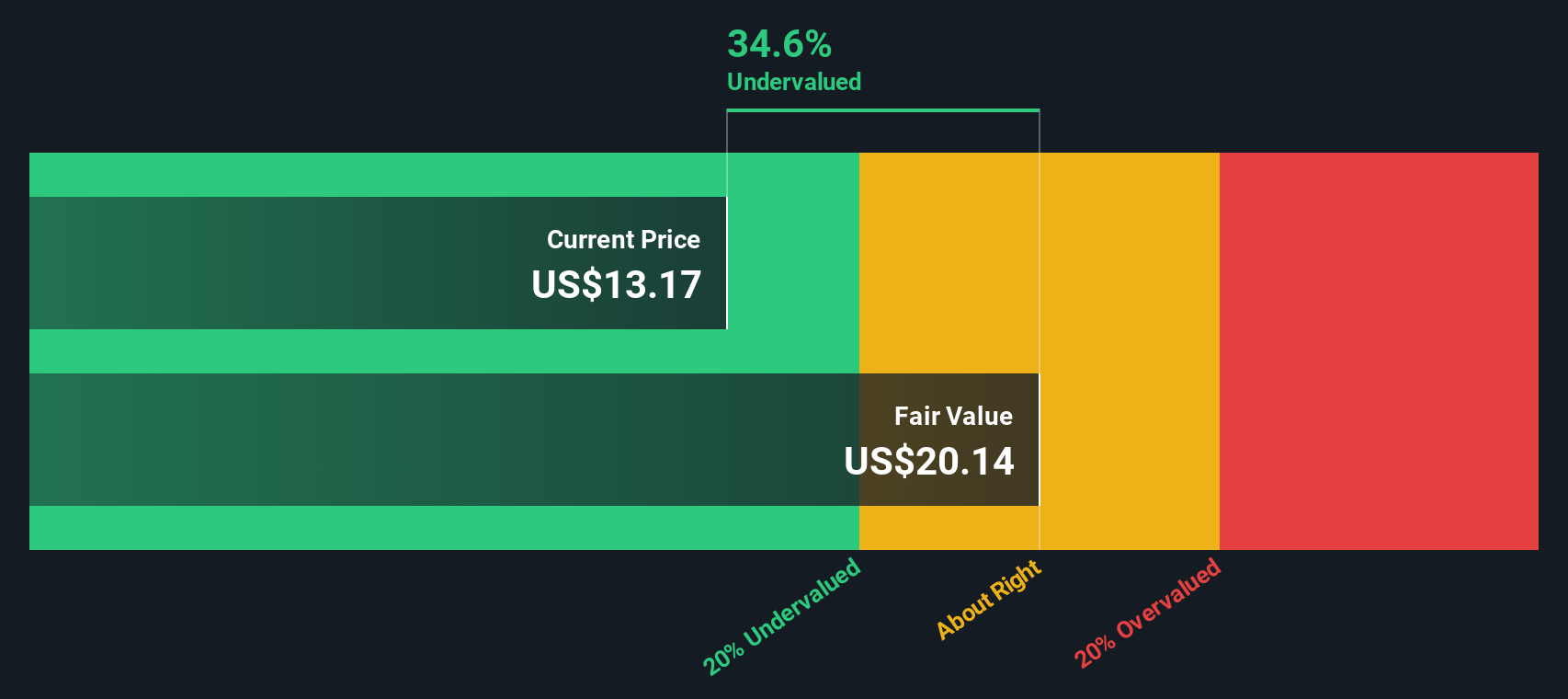

MaxLinear (NasdaqGS:MXL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: MaxLinear specializes in designing and manufacturing semiconductors, with a market cap of approximately $2.27 billion.

Operations: The primary revenue stream is derived from semiconductor sales, totaling $448.14 million in the latest period. The gross profit margin has shown variability, with the most recent figure at 53.99%. Operating expenses are significant, particularly in R&D and general & administrative costs, impacting net income margins which have been negative for several periods.

PE: -6.4x

MaxLinear, a small company in the semiconductor industry, has seen insider confidence with CEO Kishore Seendripu purchasing 108,303 shares valued at US$1.4 million recently. Despite a volatile share price over the past three months and earnings forecast to grow by 82.84% annually, MaxLinear faces challenges with high-risk funding sources and shareholder dilution over the past year. Their Panther III storage accelerator demonstrates significant cost-efficiency improvements in data storage systems, positioning them well for future growth amid rising AI-driven data demands.

- Take a closer look at MaxLinear's potential here in our valuation report.

Assess MaxLinear's past performance with our detailed historical performance reports.

Delek US Holdings (NYSE:DK)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Delek US Holdings operates in the energy sector with key segments in refining, logistics, and retail, and has a market capitalization of approximately $1.40 billion.

Operations: The company generates revenue primarily from its refining, retail, and logistics segments. As of the latest period, the refining segment leads in revenue generation with $14.98 billion. The gross profit margin has fluctuated over time, reaching up to 13.48% in Q2 2019 but recently recorded at 5.41% in Q2 2024.

PE: -12.4x

Delek US Holdings, a small-cap company in the energy sector, recently reported a net loss of US$37.2 million for Q2 2024, compared to a US$8.3 million loss the previous year. Despite this downturn, insider confidence is notable with recent share purchases between July and August 2024. The company projects Q3 crude throughput of 290,000-305,000 bpd and total throughput of 301,000-315,000 bpd. Additionally, Delek increased its quarterly dividend to US$0.255 per share effective August 19th.

Where To Now?

- Gain an insight into the universe of 57 Undervalued US Small Caps With Insider Buying by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSWC

Capital Southwest

A business development company specializing in credit and private equity and venture capital investments in middle market companies, mezzanine, later stage, mature, late venture, emerging growth, buyouts, industry consolidation, recapitalizations and growth capital investments.

Good value slight.