- United States

- /

- Food

- /

- NasdaqGS:KHC

3 Top Dividend Stocks On The US Exchange

Reviewed by Simply Wall St

As major U.S. stock indexes approach record highs, buoyed by slowing wholesale inflation and a tempered tariff order from President Trump, investors are increasingly optimistic about the market's trajectory. In this environment, dividend stocks can offer a compelling blend of income and stability, making them an attractive option for those looking to capitalize on steady returns amidst fluctuating market conditions.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 5.24% | ★★★★★★ |

| Interpublic Group of Companies (NYSE:IPG) | 4.90% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.88% | ★★★★★★ |

| FMC (NYSE:FMC) | 6.32% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 5.22% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.55% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 5.93% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.20% | ★★★★★★ |

| First Interstate BancSystem (NasdaqGS:FIBK) | 5.76% | ★★★★★★ |

| Archer-Daniels-Midland (NYSE:ADM) | 4.46% | ★★★★★★ |

Click here to see the full list of 134 stocks from our Top US Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

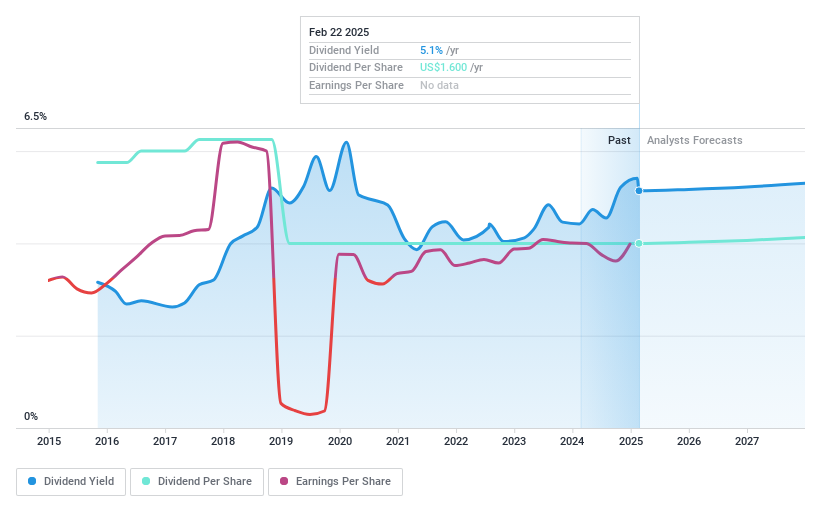

Kraft Heinz (NasdaqGS:KHC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Kraft Heinz Company, along with its subsidiaries, manufactures and markets food and beverage products both in North America and internationally, with a market cap of approximately $34.61 billion.

Operations: Kraft Heinz generates revenue from three main segments: North America ($19.54 billion), Emerging Markets Net Sales ($2.77 billion), and International Developed Markets ($3.54 billion).

Dividend Yield: 5.5%

Kraft Heinz offers a dividend yield of 5.47%, placing it in the top 25% of US dividend payers. However, its nine-year dividend history reveals volatility and past reductions, with payments covered by both earnings (70.6% payout ratio) and cash flows (64.1%). Recently, Kraft Heinz declared a quarterly dividend of US$0.40 per share and filed a shelf registration for various securities, indicating potential capital-raising activities that could impact future dividends or financial strategies.

- Navigate through the intricacies of Kraft Heinz with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Kraft Heinz's share price might be too pessimistic.

Coterra Energy (NYSE:CTRA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Coterra Energy Inc. is an independent oil and gas company focused on the development, exploration, and production of oil, natural gas, and natural gas liquids in the United States, with a market cap of approximately $20.30 billion.

Operations: Coterra Energy Inc. generates revenue of $5.50 billion from its activities in natural gas and oil development, exploitation, exploration, and production.

Dividend Yield: 3%

Coterra Energy's dividend yield of 3.04% is below the top 25% of US dividend payers, with a reasonable payout ratio (50%) indicating coverage by earnings and cash flows (55%). However, its dividend history has been volatile over the past decade. Recent debt financing includes US$1.5 billion in senior unsecured notes to fund acquisitions, which may influence future financial strategies and impact dividend reliability or growth prospects.

- Click here to discover the nuances of Coterra Energy with our detailed analytical dividend report.

- The analysis detailed in our Coterra Energy valuation report hints at an deflated share price compared to its estimated value.

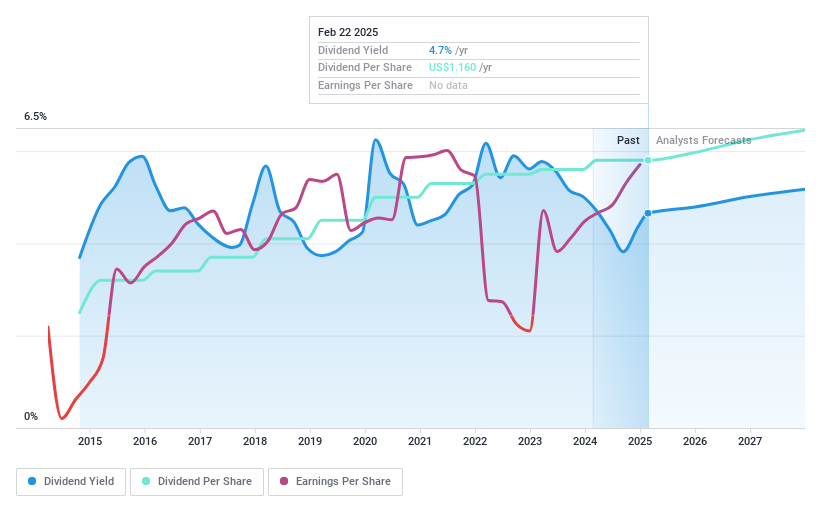

CareTrust REIT (NYSE:CTRE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CareTrust REIT, Inc. primarily focuses on acquiring, financing, developing, and owning real estate properties leased to third-party tenants in the healthcare sector, with a market cap of approximately $4.79 billion.

Operations: CareTrust REIT, Inc. generates revenue primarily from its investments in healthcare-related real estate assets, amounting to $296.29 million.

Dividend Yield: 4.4%

CareTrust REIT's recent earnings report showed significant growth, with net income for the year reaching US$125.08 million, up from US$53.74 million. Despite a dividend yield of 4.37%, slightly below top-tier payers, dividends have been stable over the past decade but are not well covered by earnings due to a high payout ratio (456.6%). Recent strategic moves include a US$1.2 billion credit facility renewal and substantial acquisitions totaling over $1.3 billion in annual investments, indicating robust expansion efforts.

- Click here and access our complete dividend analysis report to understand the dynamics of CareTrust REIT.

- Our expertly prepared valuation report CareTrust REIT implies its share price may be lower than expected.

Where To Now?

- Get an in-depth perspective on all 134 Top US Dividend Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kraft Heinz might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KHC

Kraft Heinz

Manufactures and markets food and beverage products in North America and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives