- United States

- /

- Oil and Gas

- /

- NYSE:CRK

Comstock Resources (CRK) Is Up 5.9% After Sharp Natural Gas Futures Rally and Surprise EIA Data – What's Changed

Reviewed by Sasha Jovanovic

- Over the past week, Comstock Resources surged after US natural gas futures rose sharply, driven by expectations of higher seasonal demand and bullish EIA storage data indicating a much smaller-than-expected inventory build.

- This development highlights how sensitive independent natural gas producers like Comstock Resources can be to even modest supply and demand shifts in natural gas markets.

- We'll now explore how this recent uptick in natural gas prices could influence Comstock's investment story and outlook.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Comstock Resources Investment Narrative Recap

To be a shareholder in Comstock Resources, you need confidence in both the resilience of US natural gas demand and the company’s concentrated bet on the Haynesville shale. The recent rally in natural gas prices has provided a significant short-term tailwind, but the company’s reliance on one region and commodity price swings remains its biggest vulnerability, while its ability to ramp up production and capitalize on strong prices will be the critical catalyst to watch in the coming quarters.

One relevant recent announcement is the upcoming Q3 2025 earnings release scheduled for early November, which now carries increased weight given the surge in natural gas prices. Investors will be watching closely for signs that stronger gas pricing has translated into improved revenue, net income, or future guidance, a crucial indicator for understanding the sustainability of Comstock’s recent gains and management’s response to operational and market risks.

By contrast, investors should also be mindful of risks related to Comstock's heavy geographic concentration in the Haynesville shale...

Read the full narrative on Comstock Resources (it's free!)

Comstock Resources' outlook anticipates $2.5 billion in revenue and $733.2 million in earnings by 2028. This projection assumes a 14.6% annual revenue growth rate and a $805.8 million increase in earnings from the current level of -$72.6 million.

Uncover how Comstock Resources' forecasts yield a $18.46 fair value, a 14% downside to its current price.

Exploring Other Perspectives

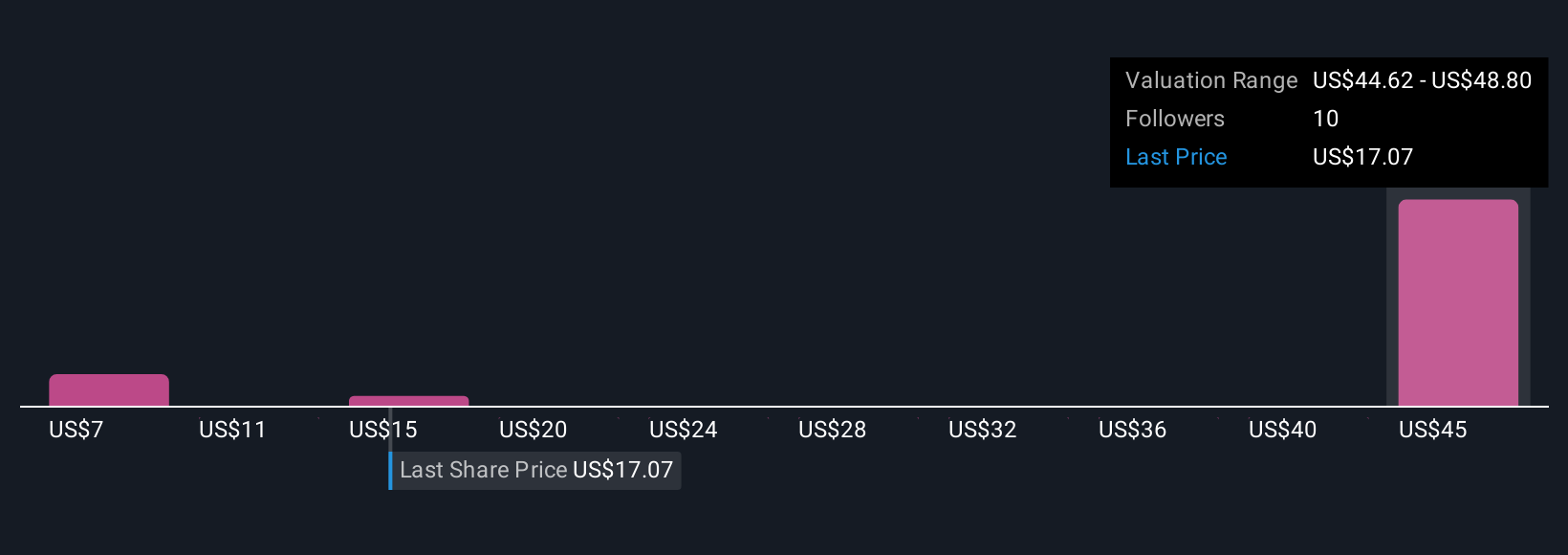

Simply Wall St Community members have published four fair value estimates for Comstock Resources, ranging widely from US$6.97 to US$33.42 per share. While these opinions vary, the company’s exposure to commodity price volatility remains a key consideration influencing expectations for future performance, see how your outlook compares to the rest and explore the different scenarios.

Explore 4 other fair value estimates on Comstock Resources - why the stock might be worth less than half the current price!

Build Your Own Comstock Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Comstock Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Comstock Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Comstock Resources' overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 34 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRK

Comstock Resources

An independent energy company, engages in the acquisition, exploration, development, and production of natural gas and oil properties in the United States.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives