- United States

- /

- Oil and Gas

- /

- NYSE:CRK

Comstock Resources (CRK): Evaluating Valuation After Q2 Revenue Surge and Strategic Asset Sales

Reviewed by Kshitija Bhandaru

Comstock Resources (CRK) saw its shares move after the company reported a 24% jump in revenue for Q2 2025, largely due to stronger natural gas prices, even as production declined. The update was accompanied by management’s focus on operational improvements and plans to divest non-core assets in an effort to improve the balance sheet.

See our latest analysis for Comstock Resources.

Comstock Resources’ share price has been on a rollercoaster, rallying with the surge in natural gas prices before retreating in recent weeks along with broader energy stocks as a result of renewed US-China trade tensions. Still, the company’s 65.98% total return over the past year suggests strong long-term momentum is firmly in place, despite short-term volatility.

If today’s energy sector volatility has you looking for standout performers, this could be the perfect time to discover fast growing stocks with high insider ownership

But with the stock now near analyst targets after a big rally, investors have to ask themselves: is Comstock Resources now undervalued, or is the market already factoring in all its future growth potential?

Most Popular Narrative: 4.1% Overvalued

With Comstock Resources closing at $19.22, just above the narrative's fair value of $18.46, analysts see room for caution rather than big upside. This reflects ongoing market uncertainty and sector headwinds. The current price aligns closely with the new consensus, making analyst assumptions even more crucial for the outlook.

"Bearish analysts cite persistent commodity headwinds, especially weak and oversupplied natural gas markets, as a major factor dampening upside potential. There is a sector-wide expectation that Henry Hub natural gas prices will remain challenged well into 2026 due to ongoing oversupply."

This price target has hidden layers. How did analysts settle on these specific expectations? The narrative relies on a series of bold financial projections and industry-wide market calls. Interested in the detailed assumptions behind this modest premium and what it says about Comstock’s risk-reward setup? You could be surprised by the numbers driving the new fair value.

Result: Fair Value of $18.46 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing reliance on the Haynesville and recent declines in production could challenge the optimistic outlook if market conditions or operational setbacks continue.

Find out about the key risks to this Comstock Resources narrative.

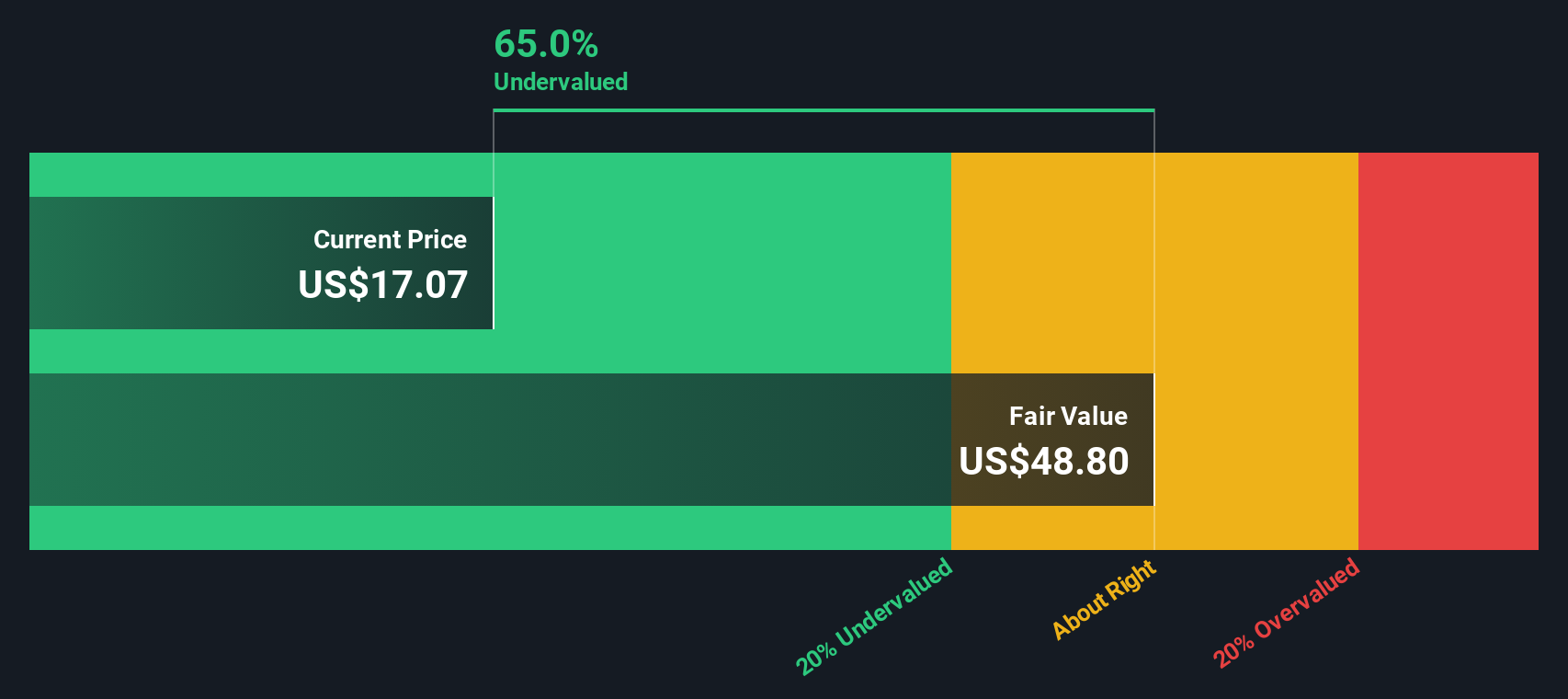

Another View: Discounted Cash Flow Model Suggests Undervaluation

Looking at Comstock Resources through the lens of our DCF model offers a different story. The SWS DCF model estimates a fair value of $23.78 per share, which is about 19% above current trading levels. This points to potential upside if long-term cash flows play out as projected. Could the market be missing latent value here, or is caution still warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Comstock Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Comstock Resources Narrative

If you’d rather analyze the outlook firsthand or want to test your own investment hypothesis, you can easily craft your own narrative in just a few minutes. Do it your way

A great starting point for your Comstock Resources research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Want to get ahead of the crowd? These tailored stock ideas could help you spot the next breakout performer before the market catches on.

- Secure steady income by targeting opportunities with strong yields. Use these 18 dividend stocks with yields > 3% to zero in on reliable dividend payers.

- Tap into tomorrow’s breakthroughs by checking out these 24 AI penny stocks, which features companies pushing the boundaries of artificial intelligence innovation.

- Capitalize on emerging finance trends and position your portfolio with these 79 cryptocurrency and blockchain stocks for exposure to game-changing crypto and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRK

Comstock Resources

An independent energy company, engages in the acquisition, exploration, development, and production of natural gas and oil properties in the United States.

Reasonable growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives